| Type | Private |

|---|---|

| Industry | Financial services |

| Founded | 2001 |

| Defunct | 2012 |

| Fate | Liquidation |

| Headquarters | Harare, Zimbabwe |

Key people | Peter Simhanga Chikumba Chairman Jeffrey Mzwimbi Executive Director |

| Products | Loans, Savings, Checking, Investments, Debit Cards, Credit Cards, Mortgages |

| Website | Homepage |

Royal Bank Zimbabwe, commonly referred to as Royal Bank, was a licensed commercial bank in that formerly operated in Zimbabwe. [1] It operated between 2001 and 2012, when it was shutdown by its Board due to accumulated losses, liquidity challenges and high level of non-performing loans. [2]

Royal Bank was a small privately owned financial institution and financial services provider in Zimbabwe. As of June 2010 [update] , the shareholder's equity in the bank was estimated at US$12.5 million, the minimum capital requirement for a commercial bank in Zimbabwe. [3]

The bank was founded in 2001. In 2004, the Reserve Bank of Zimbabwe (RBZ), the national banking regulator, closed the bank down, together with Barbican Bank and Trust Banking Corporation. The assets of the three shuttered banks, were merged, to form Zimbabwe Allied Banking Group (ZABG).

In September 2010, the RBZ reversed its decision and reissued the commercial banking licences of the three banks that had been closed. Royal Bank reopened in February 2011, after six years of enforced closure. [4] ZABG also retained its banking licence. As of December 2010 [update] , the number of licensed commercial banks in Zimbabwe, was nineteen. [5]

In March 2012, Zimbabwean media reported that Commercial Bank of Africa Group, a Kenyan financial services conglomerate, had agreed to acquire a 62% stake in Royal Bank of Zimbabwe. [6] [7] However, both parties failed to finalise on the deal within the allowed regulatory time frame thus the deal lapsed. [2]

On July 27, 2012, the board of directors of Royal Bank Zimbabwe resolved to surrender the institution's banking licence to the Reserve Bank of Zimbabwe and shut down its business in the country. This followed the determination by the Reserve Bank of Zimbabwe that Royal Bank was no longer in a "safe and sound financial condition". The board of directors' resolution was due to under capitalization of the bank, accumulated of losses, liquidity challenges and high level of non-performing loans. [2] The central bank is in the process of liquidating Royal bank and reimbursing depositor funds. [8]

As of June 2012 [update] , Royal Bank maintained a network of branches at the following locations: [9]

Manicaland is a province in eastern Zimbabwe. After Harare Province, it is the country's second-most populous province, with a population of 2.037 million, as of the 2022 census. After Harare and Bulawayo provinces, it is Zimbabwe's third-most densely populated province. Manicaland was one of five original provinces established in Southern Rhodesia in the early colonial period. The province endowed with country's major tourist attractions, the likes of Mutarazi Falls, Nyanga National Park and Zimbabwe's top three highest peaks. The province is divided into ten administrative subdivisions of seven rural districts and three towns/councils, including the provincial capital, Mutare. The name Manicaland is derived from one of the province's largest ethnic groups, the Manyika, who originate from the area north of the Manicaland province and as well as western Mozambique, who speak a distinct language called ChiManyika in Shona.

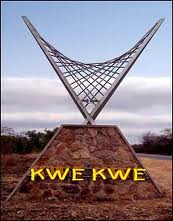

Kwekwe, originally known as Que Que, is a city in the Midlands province of central Zimbabwe. The city has a population of 119,863 within the city limits, as of the 2022 census, making it the 7th-largest city in Zimbabwe and the second-most populous city in the Midlands, behind Gweru.

The following lists events that happened during 2000 in Zimbabwe.

The Republic of Zimbabwe is broken down into 10 administrative provinces, which are divided into 59 districts and 1,200 wards.

Kadoma, originally known as Gatooma, is a town in Zimbabwe.

Trust Banking Corporation (TBC), commonly referred to as Trust Bank, is a commercial bank in Zimbabwe. It is one of the commercial banks in the country, licensed by the Reserve Bank of Zimbabwe, the national banking regulator.

Standard Chartered Zimbabwe is a commercial bank in Zimbabwe and a wholly owned subsidiary of Standard Chartered. It is licensed by the Reserve Bank of Zimbabwe, the central bank and national banking regulator.

Ecobank Zimbabwe Limited (EZL), is a commercial bank in Zimbabwe. It is one of the commercial banks licensed by the Reserve Bank of Zimbabwe and a subsidiary of Togo-based Ecobank.

Allied Bank, was a commercial bank in Zimbabwe that closed in 2015. The bank regulator cancelled its license on 8 January 2015 after determining that the bank was "no longer in a safe and sound condition, grossly undercapitalised and facing chronic liquidity challenges"

The Kwekwe-Gokwe Highway or the R84-7 Highway is an all-weather bitumen macadam highway in Zimbabwe running from Kwekwe to Gokwe passing through Zhombe. As a trunk road it is officially designated as the P11 Highway.

The A5 Highway is a national road in Zimbabwe. It joins the cities of Harare and Bulawayo, and is hence known as the Harare-Bulawayo Highway. It is one of the two routes that form the R2 Route, which connects Harare with the Plumtree Border with Botswana.

R5 Highway is a 270.8 kilometres (168.3 mi) regional road corridor running from Harare to Mutare. It is also known as the A3 Highway. It is part of the Beira–Lobito Highway.