Related Research Articles

The Nasdaq Stock Market is an American stock exchange based in New York City. It is the most active stock trading venue in the U.S. by volume, and ranked second on the list of stock exchanges by market capitalization of shares traded, behind the New York Stock Exchange. The exchange platform is owned by Nasdaq, Inc., which also owns the Nasdaq Nordic stock market network and several U.S.-based stock and options exchanges. Although it trades stock of healthcare, financial, media, entertainment, retail, hospitality, and food businesses, it focuses more on technology stocks. The exchange is made up of both American and foreign firms, with China and Israel being the largest foreign sources.

The Standard and Poor's 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 of the largest companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices and includes approximately 80% of the total market capitalization of U.S. public companies, with an aggregate market cap of more than $43 trillion as of January 2024.

An exchange-traded fund (ETF) is a type of investment fund that is also an exchange-traded product, i.e., it is traded on stock exchanges. ETFs own financial assets such as stocks, bonds, currencies, debts, futures contracts, and/or commodities such as gold bars. Many ETFs provide some level of diversification compared to owning an individual stock.

The FTSE 250 Index, also called the FTSE 250, or, informally, the "Footsie 250", is a stock market index that measures the real strength of the economy of the United Kingdom and consists of the 101st to the 350th mid-cap blue chip companies listed on the London Stock Exchange.

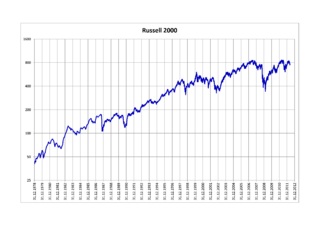

The Russell 2000 Index is a small-cap U.S. stock market index that makes up the smallest 2,000 stocks in the Russell Index. It was started by the Frank Russell Company in 1984. The index is maintained by FTSE Russell, a subsidiary of the London Stock Exchange Group (LSEG).

Russell indexes are a family of global stock market indices from FTSE Russell that allow investors to track the performance of distinct market segments worldwide. Many investors use mutual funds or exchange-traded funds based on the FTSE Russell Indexes as a way of gaining exposure to certain portions of the U.S. stock market. Additionally, many investment managers use the Russell Indexes as benchmarks to measure their own performance. Russell's index design has led to more assets benchmarked to its U.S. index family than all other U.S. equity indexes combined.

The Russell 1000 Index is a U.S. stock market index that tracks the highest-ranking 1,000 stocks in the Russell 3000 Index, which represent about 93% of the total market capitalization of that index.

The Russell 3000 Index is a capitalization-weighted stock market index that seeks to be a benchmark of the entire U.S. stock market. It measures the performance of the 3,000 largest publicly held companies incorporated in America as measured by total market capitalization, and represents approximately 97% of the American public equity market. The index was launched on January 1, 1984, and is maintained by FTSE Russell, a subsidiary of the London Stock Exchange Group. The ticker symbol on most systems is ^RUA.

The S&P Latin America 40 is a stock market index from Standard & Poor's. It tracks Latin American stocks.

The Standard and Poor's 100, or simply the S&P 100, is a stock market index of United States stocks maintained by Standard & Poor's.

The MSCI KLD 400 Social Index was launched in 1990 and is designed to help socially conscious investors weigh social and environmental factors in their investment choices. It was founded by KLD's Amy Domini as the Domini 400 Social Index.

The S&P MidCap 400 Index, more commonly known as the S&P 400, is a stock market index from S&P Dow Jones Indices.

The S&P SmallCap 600 Index is a stock market index established by S&P Global Ratings. It covers roughly the small-cap range of American stocks, using a capitalization-weighted index.

The Russell Top 200 Index measures the performance of the 200 largest companies in the Russell 1000 Index, with a weighted average market capitalization of $186 billion. The median capitalization is $48 billion; the smallest company in the index has an approximate capitalization of $14 billion.

The Russell Top 50 Index also known as the Russell Top 50 Mega Cap is a stock market index that measures the performance of the largest companies in the Russell 3000 Index. It includes approximately 50 of the largest securities based on a combination of their market cap and current index membership and represents approximately 40% of the total market capitalization of the Russell 3000.

The Russell 2500 Index measures the performance of the 2,500 smallest companies in the Russell 3000 Index, with a weighted average market capitalization of approximately $4.3 billion, median capitalization of $1.2 billion and market capitalization of the largest company of $18.7 billion.

The Russell Microcap Index measures the performance of the microcap segment of the U.S. equity market. It makes up less than 3% of the U.S. equity market. It includes 1,000 of the smallest securities in the Russell 2000 Index based on a combination of their market cap and current index membership and it also includes up to the next 1,000 stocks. As of 31 December 2016, the weighted average market capitalization for a company in the index was $535 million; the median market cap was $228 million. The market cap of the largest company in the index was $3.6 billion.

The Russell Small Cap Completeness Index measures the performance of the companies in the Russell 3000 Index excluding the companies in the S&P 500. As of 30 April 2021, the index contains 2,561 holdings. It provides a performance standard for active money managers seeking a liquid extended benchmark, and can be used for a passive investment strategy in the extended market. Weighted average market capitalization is approximately $15.4 billion.