Related Research Articles

NYSE American, formerly known as the American Stock Exchange (AMEX), and more recently as NYSE MKT, is an American stock exchange situated in New York City. AMEX was previously a mutual organization, owned by its members. Until 1953, it was known as the New York Curb Exchange.

The Standard and Poor's 500, or simply the S&P 500, is a stock market index tracking the performance of 500 large companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices. As of December 31, 2020, more than $5.4 trillion was invested in assets tied to the performance of the index.

An exchange-traded fund (ETF) is a type of investment fund and exchange-traded product, i.e. they are traded on stock exchanges. ETFs are similar in many ways to mutual funds, except that ETFs are bought and sold from other owners throughout the day on stock exchanges whereas mutual funds are bought and sold from the issuer based on their price at day's end. An ETF holds assets such as stocks, bonds, currencies, futures contracts, and/or commodities such as gold bars, and generally operates with an arbitrage mechanism designed to keep it trading close to its net asset value, although deviations can occasionally occur. Most ETFs are index funds: that is, they hold the same securities in the same proportions as a certain stock market index or bond market index. The most popular ETFs in the U.S. replicate the S&P 500 Index, the total market index, the NASDAQ-100 index, the price of gold, the "growth" stocks in the Russell 1000 Index, or the index of the largest technology companies. With the exception of non-transparent actively managed ETFs, in most cases, the list of stocks that each ETF owns, as well as their weightings, is posted daily on the website of the issuer. The largest ETFs have annual fees of 0.03% of the amount invested, or even lower, although specialty ETFs can have annual fees well in excess of 1% of the amount invested. These fees are paid to the ETF issuer out of dividends received from the underlying holdings or from selling assets.

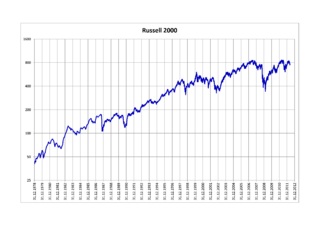

The Russell 2000 Index is a small-cap stock market index that makes up the smallest 2,000 stocks in the Russell 3000 Index. It was started by the Frank Russell Company in 1984. The index is maintained by FTSE Russell, a subsidiary of the London Stock Exchange Group (LSEG).

Russell indexes are a family of global stock market indices from FTSE Russell that allow investors to track the performance of distinct market segments worldwide. Many investors use mutual funds or exchange-traded funds based on the FTSE Russell Indexes as a way of gaining exposure to certain portions of the U.S. stock market. Additionally, many investment managers use the Russell Indexes as benchmarks to measure their own performance. Russell's index design has led to more assets benchmarked to its U.S. index family than all other U.S. equity indexes combined.

The Russell 1000 Index is a stock market index that tracks the highest-ranking 1,000 stocks in the Russell 3000 Index, which represent about 93% of the total market capitalization of that index. As of 31 December 2021, the stocks of the Russell 1000 Index had a weighted average market capitalization of $608.1 billion and a median market capitalization of $15.1 billion. As of 8 May 2020, components ranged in market capitalization from $1.8 billion to $1.4 trillion. The index, which was launched on January 1, 1984, is maintained by FTSE Russell, a subsidiary of the London Stock Exchange Group.

The Russell 3000 Index is a capitalization-weighted stock market index that seeks to be a benchmark of the entire U.S stock market. It measures the performance of the 3,000 largest publicly held companies incorporated in America as measured by total market capitalization, and represents approximately 97% of the American public equity market. The index was launched on January 1, 1984, and is maintained by FTSE Russell, a subsidiary of the London Stock Exchange Group. The ticker symbol on most systems is ^RUA.

Invesco Ltd. is an American independent investment management company that is headquartered in Atlanta, Georgia, with additional branch offices in 20 countries. Its common stock is a constituent of the S&P 500 and trades on the New York stock exchange. Invesco operates under the Invesco, Trimark, Invesco Perpetual, WL Ross & Co and Powershares brand names.

The Russell Midcap Index measures performance of the 800 smallest companies in the Russell 1000 Index. As of 30 June 2019, the stocks of the Russell Midcap Index have a weighted average market capitalization of approximately $17.0 billion, median capitalization of $8.4 billion, and market capitalization of the largest company $49 billion. The index, which was launched on November 1, 1991, is maintained by FTSE Russell, a subsidiary of the London Stock Exchange Group.

iShares S&P 100 Index Fund is an exchange-traded fund of US stocks. The fund tracks the S&P 100 index.

An inverse exchange-traded fund is an exchange-traded fund (ETF), traded on a public stock market, which is designed to perform as the inverse of whatever index or benchmark it is designed to track. These funds work by using short selling, trading derivatives such as futures contracts, and other leveraged investment techniques.

The S&P SmallCap 600 Index is a stock market index established by Standard & Poor's. It covers roughly the small-cap range of American stocks, using a capitalization-weighted index.

The Russell Top 200 Index measures the performance of the 200 largest companies in the Russell 1000 Index, with a weighted average market capitalization of $186 billion. The median capitalization is $48 billion; the smallest company in the index has an approximate capitalization of $14 billion.

The Russell 2500 Index measures the performance of the 2,500 smallest companies in the Russell 3000 Index, with a weighted average market capitalization of approximately $4.3 billion, median capitalization of $1.2 billion and market capitalization of the largest company of $18.7 billion.

The Russell Microcap Index measures the performance of the microcap segment of the U.S. equity market. It makes up less than 3% of the U.S. equity market. It includes 1,000 of the smallest securities in the Russell 2000 Index based on a combination of their market cap and current index membership and it also includes up to the next 1,000 stocks. As of 31 December 2016, the weighted average market capitalization for a company in the index was $535 million; the median market cap was $228 million. The market cap of the largest company in the index was $3.6 billion.

The Russell Small Cap Completeness Index measures the performance of the companies in the Russell 3000 Index excluding the companies in the S&P 500. As of 30 April 2021, the index contains 2,561 holdings. It provides a performance standard for active money managers seeking a liquid extended benchmark, and can be used for a passive investment strategy in the extended market. Weighted average market capitalization is approximately $15.4 billion.

Invesco PowerShares is an American boutique investment management firm based near Chicago which manages a family of exchange-traded funds or ETFs. The company has been part of Invesco, which markets the PowerShares product, since 2006.

WisdomTree Investments, Inc. is a New York-based exchange-traded fund (ETF) and exchange-traded product (ETP) sponsor and asset manager. WisdomTree launched its first ETFs in June 2006, and became one of the major ETF providers in the United States. WisdomTree sponsors different ETFs that span asset classes and countries worldwide. Categories include: U.S. and International Equity, Currency, Fixed Income and Alternatives.

The SPDR S&P 500 trust is an exchange-traded fund which trades on the NYSE Arca under the symbol. SPDR is an acronym for the Standard & Poor's Depositary Receipts, the former name of the ETF. It is designed to track the S&P 500 stock market index. This fund is the largest and oldest ETF in the world. SPDR is a trademark of Standard and Poor's Financial Services LLC, a subsidiary of S&P Global. The ETF's CUSIP is 78462F103 and its ISIN is US78462F1030. The fund has a net expense ratio of 0.0945%. The value of one share of the ETF is worth approximately 1/10 of the cash S&P 500's current level. On December 1, 2021, the 30-Day average daily volume range for the past 5 years was 82.45 million shares, making it the ETF with the largest trading volume. The sponsor is SPDR Services LLC, a wholly owned subsidiary of American Stock Exchange LLC. Dividends are distributed quarterly, and are based on the accumulated stock dividends held in trust, less any expenses of the trust. The trust seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of the S&P 500 index.