Constituent companies

This section needs to be updated.(October 2024) |

As of 20 January 2022 [update] , the constituent stocks of the S&P Latin America 40 are: [2]

The S&P Latin America 40 is a stock market index from Standard & Poor's. It tracks Latin American stocks.

The S&P Latin America 40 is one of seven headline indices making up S&P Global 1200 and includes highly liquid securities from economic sectors of Mexican and South American equity markets. Companies from Brazil, Chile, Colombia, Mexico and Peru are represented in this index. Representing approximately 70% of each country's market capitalization, this index provides coverage of the large cap, liquid constituents of each key country in Latin America.

The S&P Latin America 40 is maintained by the S&P Index Committee, whose members include Standard and Poor's economists and index analysts. The goal of the Index Committee is to ensure that the S&P Latin America 40 remains an accurate measure of Latin American markets, reflecting the risk and return characteristics of the broader universe on an ongoing basis. As of 2010, S&P Latin America 40 consisted of forty companies with a market capitalization of US$450.07 billion.

This section needs to be updated.(October 2024) |

As of 20 January 2022 [update] , the constituent stocks of the S&P Latin America 40 are: [2]

As of 15 October 2024 [update] , the country coverage is the following: [3]

| Country | No. of companies | Country weight |

|---|---|---|

| Brazil | 17 | 62.6% |

| Mexico | 10 | 24.2% |

| Chile | 9 | 6.5% |

| Peru | 2 | 5% |

| Colombia | 3 | 1.7% |

| Total | 41 | 100.0% |

The Standard and Poor's 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 of the largest companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices and includes approximately 80% of the total market capitalization of U.S. public companies, with an aggregate market cap of more than $43 trillion as of January 2024.

The Mexican Stock Exchange, commonly known as Mexican Bolsa, Mexbol, or BMV, is one of two stock exchanges in Mexico, the other being BIVA - Bolsa Institucional de Valores. It is the second largest stock exchange in Latin America, only after São Paulo based B3 in Brasil. It is also the fifth largest stock exchange in the Americas. The exchange platform is owned by BMV Group, which also owns the derivative exchange MexDer and the custody agency Indeval.

An emerging market is a market that has some characteristics of a developed market, but does not fully meet its standards. This includes markets that may become developed markets in the future or were in the past. The term "frontier market" is used for developing countries with smaller, riskier, or more illiquid capital markets than "emerging". As of 2006, the economies of China and India are considered to be the largest emerging markets. According to The Economist, many people find the term outdated, but no new term has gained traction. Emerging market hedge fund capital reached a record new level in the first quarter of 2011 of $121 billion. Emerging market economies’ share of global PPP-adjusted GDP has risen from 27 percent in 1960 to around 53 percent by 2013. The ten largest emerging economies by nominal GDP are 4 of the 9 BRICS countries along with Mexico, South Korea, Indonesia, Turkey, Saudi Arabia, and Poland. The inclusion of South Korea, Poland, and sometimes Taiwan are questionable given they are no longer considered emerging markets by the IMF and World Bank If we ignore those three, the top ten would include Argentina and Thailand.

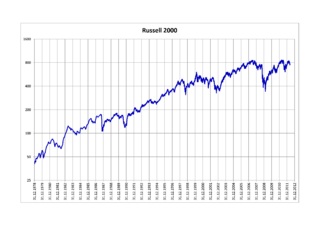

The Russell 2000 Index is a small-cap U.S. stock market index that makes up the smallest 2,000 stocks in the Russell Index. It was started by the Frank Russell Company in 1984. The index is maintained by FTSE Russell, a subsidiary of the London Stock Exchange Group (LSEG).

NIFTY 500 is India’s first broad-based stock market index of the Indian stock market. It contains top 500 listed companies on the NSE. The NIFTY 500 index represents about 96.1% of free float market capitalization and about 96.5% of the total turnover on the National Stock Exchange (NSE).

The S&P Global 1200 Index is a free-float weighted stock market index of global equities from Standard & Poor's. The index was launched on Sep 30, 1999 and covers 31 countries and approximately 70 percent of global stock market capitalization. It is composed of seven regional indices:

The Standard and Poor's 100, or simply the S&P 100, is a stock market index of United States stocks maintained by Standard & Poor's.

The EURO STOXX 50 is a stock index of Eurozone stocks designed by STOXX, an index provider owned by Deutsche Börse Group. The index is composed of 50 stocks from 11 countries in the Eurozone.

A capitalization-weightedindex, also called a market-value-weighted index is a stock market index whose components are weighted according to the total market value of their outstanding shares. Every day an individual stock's price changes and thereby changes a stock index's value. The impact that individual stock's price change has on the index is proportional to the company's overall market value, in a capitalization-weighted index. In other types of indices, different ratios are used.

The Santiago Stock Exchange (SSE), founded on November 27, 1893, is Chile's dominant stock exchange, and the third largest stock exchange in Latin America, behind Brazil's BM&F Bovespa, and the Bolsa Mexicana de Valores in Mexico. On December 5, 2014, the Santiago Stock Exchange announced it was joining the United Nations Sustainable Stock Exchanges (SSE) initiative, becoming the 17th Partner Exchange of the initiative.

The Dow Jones Global Titans 50 index is a float-adjusted index of 50 of the largest and best known blue chip companies traded on the New York Stock Exchange, American Stock Exchange, Nasdaq, Euronext, London Stock Exchange, and Tokyo Stock Exchange. The index represents the biggest and most liquid stocks traded in individual countries. It was created by Dow Jones Indexes to reflect the globalization of international blue chip securities in the wake of mergers and the creation of megacorporations.

Fundamentally based indexes or fundamental indexes, also called fundamentally weighted indexes, are indexes in which stocks are weighted according to factors related to their fundamentals such as earnings, dividends and assets, commonly used when performing corporate valuations. This fundamental weight may be calculated statically, or it may be adjusted by the security's fundamental to market capitalization ratio to further neutralize the price factor between different securities. Indexes that use a composite of several fundamental factors attempt to average out sector biases that may arise from relying on a single fundamental factor. A key belief behind the fundamental index methodology is that underlying corporate accounting/valuation figures are more accurate estimators of a company's intrinsic value, rather than the listed market value of the company, i.e. that one should buy and sell companies in line with their accounting figures rather than according to their current market prices. In this sense fundamental indexing is linked to so-called fundamental analysis.

The S&P/ASX 300, or simply, ASX 300, is a stock market index of Australian stocks listed on the Australian Securities Exchange (ASX). The index is market-capitalisation weighted, meaning each company included is in proportion to the indexes total market value, and float-adjusted, meaning the index only considers shares available to public investors.

A frontier market is a term for a type of developing country's market economy which is more developed than a least developed country's, but too small, risky, or illiquid to be generally classified as an emerging market economy. The term is an economic term which was coined by International Finance Corporation’s Farida Khambata in 1992. The term is commonly used to describe the equity markets of the smaller and less accessible, but still "investable" countries of the developing world. The frontier, or pre-emerging equity markets are typically pursued by investors seeking high, long-run return potential as well as low correlations with other markets. Some frontier market countries were emerging markets in the past, but have regressed to frontier status.

The FTSE Global Equity Index Series is a series of stock market indices provided by FTSE Group. It was launched in September 2003, and provides coverage of over 17,000 stocks in 48 countries, covering 98% of the world's investable market capitalization.

The S&P MidCap 400 Index, more commonly known as the S&P 400, is a stock market index from S&P Dow Jones Indices.

The S&P SmallCap 600 Index is a stock market index established by S&P Global Ratings. It covers roughly the small-cap range of American stocks, using a capitalization-weighted index.

In finance, a stock index, or stock market index, is an index that measures the performance of a stock market, or of a subset of a stock market. It helps investors compare current stock price levels with past prices to calculate market performance.

The Mercado Integrado Latinoamericano, more commonly known as MILA, is a program that integrates the stock exchange markets of Chile, Colombia, Mexico, and Peru. The three founding members are the Lima Stock Exchange, the Santiago Stock Exchange, and the Colombia Stock Exchange. The integration aims to develop the capital market through the integration of the four countries, to give investors a greater supply of securities, issuers and also larger sources of funding.