Washington Mutual was the United States' largest savings and loan association until its collapse in 2008.

The Commonwealth Bank of Australia (CBA), or CommBank, is an Australian multinational bank with businesses across New Zealand, Asia, the United States, and the United Kingdom. It provides a variety of financial services, including retail, business and institutional banking, funds management, superannuation, insurance, investment, and broking services. The Commonwealth Bank is the largest Australian listed company on the Australian Securities Exchange as of August 2015, with brands including Bankwest, Colonial First State Investments, ASB Bank, Commonwealth Securities (CommSec) and Commonwealth Insurance (CommInsure).

Comerica Bank is a subsidiary of Comerica Incorporated, a financial services company headquartered in Dallas, Texas, and strategically aligned by three business segments: The Commercial Bank, The Retail Bank and Wealth Management. Under the leadership of chairman, President and chief executive officer Curt Farmer, Comerica focuses on relationships, and helping people and businesses be successful.

Yorkshire Bank is a trading name used by Clydesdale Bank plc for its retail banking operations in England.

Bankwest is an Australian full-service bank based in Perth, Western Australia. It was sold in October 2008 to the Commonwealth Bank of Australia for A$2.1 billion and operates as a division of its parent company.

Truist Financial Corporation is an American bank holding company headquartered in Charlotte, North Carolina. The company was formed in December 2019 as the result of the merger of BB&T and SunTrust Banks. Its bank operates 2,781 branches in 15 states and Washington, D.C., and offers consumer and commercial banking, securities brokerage, asset management, mortgage, and insurance products and services. It is on the list of largest banks in the United States by assets; as of June 2021, it is the 10th largest bank with $509 billion in assets. As of January 2021, Truist Insurance Holdings is the seventh largest insurance broker in the world with $2.27 billion in annual revenue.

A mutual savings bank is a financial institution chartered by a central or regional government, without capital stock, owned by its members who subscribe to a common fund. From this fund, claims, loans, etc., are paid. Profits after deductions are shared among the members. The institution is intended to provide a safe place for individual members to save and to invest those savings in mortgages, loans, stocks, bonds and other securities and to share in any profits or losses that result.

The Winston-Salem Journal is an American, English language daily newspaper primarily serving Winston-Salem and Forsyth County, North Carolina. It also covers Northwestern North Carolina.

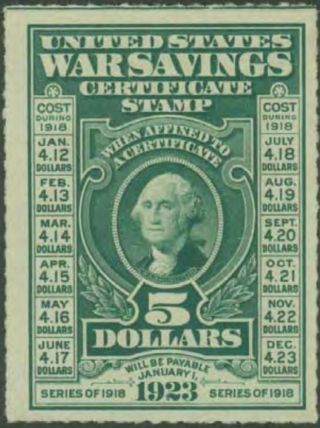

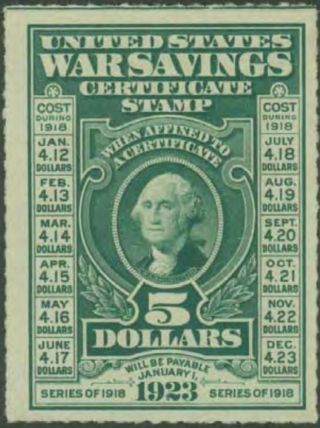

War savings stamps were issued by the United States Treasury Department to help fund participation in World War I and World War II. Although these stamps were distinct from the postal savings stamps issued by the United States Post Office Department, the Post Office nevertheless played a major role in promoting and distributing war savings stamps. In contrast to Liberty Bonds, which were purchased primarily by financial institutions, war savings stamps were principally aimed at common citizens. During World War I, 25-cent Thrift stamps were offered to allow individuals to accumulate enough over time to purchase the standard 5-dollar War Savings Certificate stamp. When the Treasury began issuing war savings stamps during World War II, the lowest denomination was a 10-cent stamp, enabling ordinary citizens to purchase them. In many cases, collections of war savings stamps could be redeemed for Treasury Certificates or War Bonds.

A Christmas club is a special-purpose savings account, first offered by various banks and credit unions in the United States beginning in early 20th century, including the Great Depression, under which bank customers deposit a set amount of money each week into a savings account, and receive the money back at the end of the year for Christmas shopping.

Tamil Nadu is the second richest state economy in India. It is also the most industrialised state in the country. The state is 48.40% urbanised, accounting for around 9.26% of the urban population in the country, while the state as a whole accounted for 5.96% of India's total population in the 2011 census. Services contributes to 54% to the gross domestic product of the state, followed by manufacturing at 33% and agriculture at 13%. Government is the major investor in the state, with 52% of total investments, followed by private Indian investors at 29.9% and foreign private investors at 14.9%. It has been ranked as the most economically free state in India by the Economic Freedom Rankings for the States of India.

School Street is a short but significant street in the center of Boston, Massachusetts. It is so named for being the site of the first public school in the United States. The school operated at various addresses on the street from 1704 to 1844.

F.N.B. Corporation is a diversified financial services corporation based in Pittsburgh, Pennsylvania, and the holding company for its largest subsidiary, First National Bank. As of December 31, 2022, FNB has total assets of nearly $44 billion. FNB's market coverage spans several major metropolitan areas including: Pittsburgh, Pennsylvania; Baltimore, Maryland; Cleveland, Ohio; Washington, D.C.; Charlotte, Raleigh, Durham and the Piedmont Triad in North Carolina; and Charleston, South Carolina with approximately 350 offices. The company has more than 4,100 employees.

First Bancorp is a bank holding company headquartered in Southern Pines, North Carolina. It operates as First Bank in North and South Carolina. In North Carolina, the company has 94 branches, assets totaling $4.3 billion and deposits of $3.4 billion as of early 2017. First Bancorp has 103 branches, $9.6 billion in assets, and $7.2 billion in deposits.

Wachovia was a diversified financial services company based in Charlotte, North Carolina. Before its acquisition by Wells Fargo and Company in 2008, Wachovia was the fourth-largest bank holding company in the United States, based on total assets. Wachovia provided a broad range of banking, asset management, wealth management, and corporate and investment banking products and services. At its height, it was one of the largest providers of financial services in the United States, operating financial centers in 21 states and Washington, D.C., with locations from Connecticut to Florida and west to California. Wachovia provided global services through more than 40 offices around the world.

Eastern Bank is a bank based in Boston, Massachusetts. Before de-mutualizing in 2020, it was the oldest and largest mutual bank in the United States and the largest community bank in Massachusetts. With 95 branches, Eastern had a 3.2% market share in Massachusetts in 2016. It was founded in 1818 in Salem, and then moved to Lynn, Massachusetts. The company began an aggressive expansion campaign near the end of the 1990s and moved its headquarters to Boston's Financial District. In 2020, Eastern Bank announced plans to de-mutualize and become a publicly traded corporation.

BNC Bank was a bank based in High Point, North Carolina, United States. In 2014 its parent company BNC Bancorp had $4.05 billion in assets, 38 branches in North Carolina and 13 in South Carolina. Its latest acquisition gave BNC $6.8 billion in assets and 87 branches, 48 in North Carolina, 29 in South Carolina nine in Virginia, and one in Haiti.

SFB are a type of niche banks in India. Banks with a small finance bank (SFB) license can provide basic banking service of acceptance of deposits and lending. The aim behind these is to provide financial inclusion to sections of the economy not being served by other banks, such as small business units, small and marginal farmers, micro and small industries and unorganised sector entities.

Institution for Savings in Newburyport and Its Vicinity is a bank based in Newburyport, Massachusetts. It has 15 branches, all of which are in Essex County, Massachusetts. It is a mutual organization.

IDFC First Bank is an Indian private sector bank formed by the merger of the banking arm of Infrastructure Development Finance Company and Capital First, an Indian non-bank financial institution.