Passive management is an investing strategy that tracks a market-weighted index or portfolio. Passive management is most common on the equity market, where index funds track a stock market index, but it is becoming more common in other investment types, including bonds, commodities and hedge funds.

Fischer Sheffey Black was an American economist, best known as one of the authors of the Black–Scholes equation.

Investment banking is an advisory-based financial service for institutional investors, corporations, governments, and similar clients. Traditionally associated with corporate finance, such a bank might assist in raising financial capital by underwriting or acting as the client's agent in the issuance of debt or equity securities. An investment bank may also assist companies involved in mergers and acquisitions (M&A) and provide ancillary services such as market making, trading of derivatives and equity securities, FICC services or research. Most investment banks maintain prime brokerage and asset management departments in conjunction with their investment research businesses. As an industry, it is broken up into the Bulge Bracket, Middle Market, and boutique market.

The Goldman Sachs Group, Inc. is an American multinational investment bank and financial services company. Founded in 1869, Goldman Sachs is headquartered in Lower Manhattan in New York City, with regional headquarters in many international financial centers. Goldman Sachs is the second-largest investment bank in the world by revenue and is ranked 55th on the Fortune 500 list of the largest United States corporations by total revenue. In the Forbes Global 2000 of 2024, Goldman Sachs ranked 23rd. It is considered a systemically important financial institution by the Financial Stability Board.

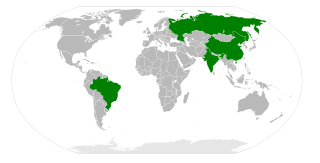

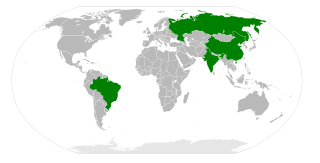

BRIC is a term describing the foreign investment strategies grouping acronym that stands for Brazil, Russia, India, and China. The separate BRICS organisation would go on to become a political and economic organization largely based on such grouping. The grouping has been rendered as "the BRICs", "the BRIC countries", "the BRIC economies", or alternatively as the "Big Four".

Investment management is the professional asset management of various securities, including shareholdings, bonds, and other assets, such as real estate, to meet specified investment goals for the benefit of investors. Investors may be institutions, such as insurance companies, pension funds, corporations, charities, educational establishments, or private investors, either directly via investment contracts/mandates or via collective investment schemes like mutual funds, exchange-traded funds, or Real estate investment trusts.

Prime brokerage is the generic term for a bundled package of services offered by investment banks, wealth management firms, and securities dealers to hedge funds which need the ability to borrow securities and cash in order to be able to invest on a netted basis and achieve an absolute return. The prime broker provides a centralized securities clearing facility for the hedge fund so the hedge fund's collateral requirements are netted across all deals handled by the prime broker. These two features are advantageous to their clients.

John Lawson Thornton is an American businessman and professor and director of the Global Leadership Program at Tsinghua University in Beijing. He is also chairman of Barrick Gold Corporation, chairman of RedBird Capital Partners and non-executive chairman of PineBridge Investments. Thornton stepped down as co-president of Goldman Sachs in 2003.

Commodities Corporation was a financial services company, based in Princeton, New Jersey, that traded actively across various commodities. The firm was noted as one of the leading commodity and futures trading firms. CC is credited for launching the careers of many notable hedge fund investors and for its influence on global macro investing.

Suzanne Nora Johnson is an American corporate lawyer and executive. Until 2007, she was vice chairman of Goldman Sachs, chair of the Global Markets Institute, head of the firm's Global Investment Research Division, and a member of the firm's management committee. She is the chair of Intuit since 2022.

The Greenspan put was a monetary policy response to financial crises that Alan Greenspan, former chair of the Federal Reserve, exercised beginning with the crash of 1987. Successful in addressing various crises, it became controversial as it led to periods of extreme speculation led by Wall Street investment banks overusing the put's repurchase agreements and creating successive asset price bubbles. The banks so overused Greenspan's tools that their compromised solvency in the 2007–2008 financial crisis required Fed chair Ben Bernanke to use direct quantitative easing. The term Yellen put was used to refer to Fed chair Janet Yellen's policy of perpetual monetary looseness.

Mark Joseph Carney is a Canadian economist and banker who served as the 8th governor of the Bank of Canada from 2008 to 2013 and the governor of the Bank of England from 2013 to 2020. He is chair, and head of impact investing at Brookfield Asset Management (BAM) since 2020, and was named chairman of Bloomberg Inc., parent company of Bloomberg L.P., in 2023. He was the chair of the Financial Stability Board from 2011 to 2018. Prior to his governorships, Carney worked at Goldman Sachs as well as the Department of Finance Canada. He also serves as the UN Special Envoy for Climate Action and Finance.

The Committee on Capital Markets Regulation is an independent and nonpartisan 501(c)(3) research organization financed by contributions from individuals, foundations, and corporations.

Paulson & Co., Inc. is a family office based in New York City. Previously, it was a hedge fund established by John Paulson in 1994. Specializing in "global mergers, event arbitrage, and credit strategies", the firm had a relatively low profile on Wall Street until its hugely successful bet against the subprime mortgage market in 2007. At one time the company had offices in London and Dublin.

AQR Capital Management is a global investment management firm based in Greenwich, Connecticut, United States. The firm, which was founded in 1998 by Cliff Asness, David Kabiller, John Liew, and Robert Krail, offers a variety of quantitatively driven alternative and traditional investment vehicles to both institutional clients and financial advisors. The firm is primarily owned by its founders and principals. AQR has additional offices in Boston, Chicago, Los Angeles, Bangalore, Hong Kong, London, Sydney, and Tokyo.

Clifford Scott Asness is an American hedge fund manager and the co-founder of AQR Capital Management. As of July 2024, Forbes estimated his net worth at US$2.0 billion.

Government Pension Investment Fund, or GPIF, is an incorporated administrative agency, established by the Japanese government. It is the largest pool of retirement savings in the world. Japan's GPIF is the largest public fund investor in Japan by assets and is a major proponent of the Stewardship Principles.

Robert Bruce Litterman is chairman of the Risk Committee and a founding partner of Kepos Capital in New York. Prior to Kepos Capital, Litterman spent 23 years at Goldman Sachs, where he was head of the Quantitative Resources Group in Goldman Sachs Asset Management for 11 years, starting in 1998. Prior to that position, Litterman headed the firm-wide risk department from 1994 to 1998, and prior to that he was the co-head of the model development group in the research department of Goldman Sachs' Fixed Income Division. Litterman received a Ph.D. in economics from the University of Minnesota in 1980.

Goldman Sachs, an investment bank, has been the subject of controversies. The company has been criticized for lack of ethical standards, working with dictatorial regimes, close relationships with the U.S. federal government via a "revolving door" of former employees, and driving up prices of commodities through futures speculation. It has also been criticized by its employees for 100-hour work weeks, high levels of employee dissatisfaction among first-year analysts, abusive treatment by superiors, a lack of mental health resources, and extremely high levels of stress in the workplace leading to physical discomfort.

Peter C. Oppenheimer is chief global equity strategist and head of Macro Research in Europe within Global Investment Research at Goldman Sachs. Oppenheimer joined Goldman Sachs in 2002 as European and global strategist and was named managing director in 2003 and partner in 2006. He regularly appears in news outlets such as Financial Times, CNBC, The Guardian, The Independent, Bloomberg, and Barron’s among others as a finance strategist and expert.