Americans for Tax Reform (ATR) is a politically conservative U.S. advocacy group whose stated goal is "a system in which taxes are simpler, flatter, more visible, and lower than they are today." According to ATR, "The government's power to control one's life derives from its power to tax. We believe that power should be minimized." The organization is known for its "Taxpayer Protection Pledge", which asks candidates for federal and state office to commit themselves in writing to oppose all tax increases. The founder and president of ATR is Grover Norquist, a conservative tax activist.

Proposition 13 is an amendment of the Constitution of California enacted during 1978, by means of the initiative process, to cap property taxes and limit property reassessments to when the property changes ownership, and to require a 2/3 majority for tax increases in the state legislature. The initiative was approved by California voters in a primary election on June 6, 1978, by a nearly two to one margin. It was upheld by the Supreme Court in 1992 in Nordlinger v. Hahn, 505 U.S. 1 (1992). Proposition 13 is embodied in Article XIII A of the Constitution of the State of California.

William Forrester Owens is an American former politician who served as the 40th Governor of Colorado, from 1999 to 2007. A member of the Republican Party, he was re-elected in 2002, amassing 62.6% of the vote, the largest Republican share of the vote in state history. As of 2024, he is the last Republican to serve as Governor of Colorado.

The Oregon tax revolt is a political movement in Oregon which advocates for lower taxes. This movement is part of a larger anti-tax movement in the western United States which began with the enactment of Proposition 13 in California. The tax revolt, carried out in large part by a series of citizens' initiatives and referendums, has reshaped the debate about taxes and public services in Oregon.

The National Taxpayers Union (NTU) is a fiscally conservative taxpayer advocacy organization and taxpayers union in the United States, founded in 1977 by James Dale Davidson. NTU says that it is the oldest taxpayer advocacy organization in the nation. It is closely affiliated with a non-profit foundation, the National Taxpayers Union Foundation (NTUF). The organization has ranked politicians on their perceived fiscal responsibility, in the eyes of the National Taxpayers Union.

Proposition 2½ is a Massachusetts statute that limits property tax assessments and, secondarily, automobile excise tax levies by Massachusetts municipalities. The name of the initiative refers to the 2.5% ceiling on total property taxes annually as well as the 2.5% limit on property tax increases. It was passed by ballot measure, specifically called an initiative petition within Massachusetts state law for any form of referendum voting, in 1980 and went into effect in 1982. The effort to enact the proposition was led by the anti-tax group Citizens for Limited Taxation. It is similar to other "tax revolt" measures passed around the same time in other parts of the United States. This particular proposition followed the movements of states such as California.

In 2021, the economy of the State of Colorado was 16th largest in the United States with a gross state product of $421 billion. Colorado's per capita personal income in 2019 was $61,157, putting Colorado 12th in the nation.

The Internal Revenue Service Restructuring and Reform Act of 1998, also known as Taxpayer Bill of Rights III, resulted from hearings held by the United States Congress in 1996 and 1997. The Act included numerous amendments to the Internal Revenue Code of 1986. The bill was passed in the Senate unanimously, and was seen as a major reform of the Internal Revenue Service.

The Office of the Taxpayer Advocate, also called the Taxpayer Advocate Service (TAS), is an office within the Internal Revenue Service (IRS) of the U.S. Department of the Treasury, reporting directly to the Commissioner of Internal Revenue. The office is under the supervision and direction of the National Taxpayer Advocate, who is appointed by the Secretary of Treasury.

Oregon ballot measure 48 was one of two unsuccessful ballot measures sponsored by the Taxpayers Association of Oregon (TAO) on the November 7, 2006 general election ballot. Measure 48 was an initiated constitutional amendment ballot measure. Oregon statute currently limits state appropriations to 8% of projected personal income in Oregon. If Governor declares emergency, legislature may exceed current statutory appropriations limit by 60% vote of each house. This measure would have added a constitutional provision limiting any increase in state spending from one biennium to next biennium to the percentage increase in state population, plus inflation, over previous two years. Certain exceptions to limit, including spending of: federal, donated funds; proceeds from selling certain bonds, real property; money to fund emergency funds; money to fund tax, "kicker," other refunds were included in the provisions of the measure. It also would have provided that spending limit may be exceeded by amount approved by two-thirds of each house of legislature and approved by majority of voters voting in general election.

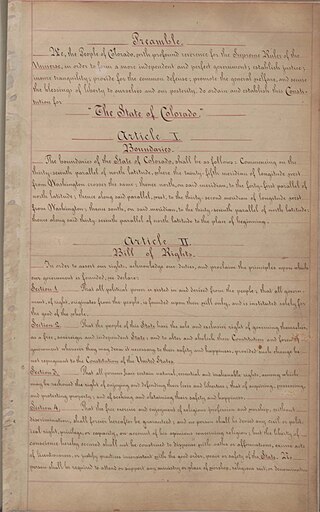

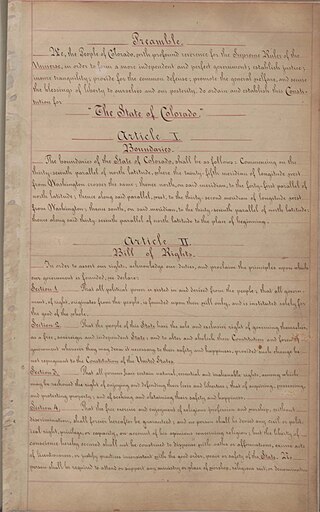

The Constitution of the State of Colorado is the foundation of the laws and government of the U.S. state of Colorado. The Colorado State Constitution was drafted on March 14, 1876; approved by Colorado voters on July 1, 1876; and took effect upon the statehood of Colorado on August 1, 1876. As of 2020, the constitution has been amended at least 166 times. The Constitution of Colorado derives its authority from the sovereignty of the people. As such, the people of Colorado reserved specific powers in governing Colorado directly; in addition to providing for voting for Governor, state legislators, and judges, the people of Colorado have reserved initiative of laws and referendum of laws enacted by the legislature to themselves, provided for recall of office holders, and limit tax increases beyond set amounts without explicit voter approval, and must explicitly approve any change to the constitution, often with a 55% majority. The Colorado state constitution is one of the longest in the United States.

Douglas Edward Bruce is an American conservative activist, attorney, convicted felon, and former legislator who served as a member of the Colorado House of Representatives from 2008 to 2009.

Under United States tax law, certain performing artists are eligible to deduct the expenses incurred in the course of their employment as performing artists. The deduction itself is provided by IRC § 62(a)(2)(B), while qualifications of a Qualified Performing Artist ("QPA") are provided by IRC § 62(b).

A tax-free savings account is an account available in Canada that provides tax benefits for saving. Investment income, including capital gains and dividends, earned in a TFSA is not taxed in most cases, even when withdrawn. Contributions to a TFSA are not deductible for income tax purposes, unlike contributions to a registered retirement savings plan (RRSP).

The politics of Colorado, United States, are that of a blue state. Once considered a swing state that used to be Republican-leaning, Colorado has been trending Democratic since the early part of the 21st century due to the organization of the state Democratic Party, changing demographics, and a rising number of the large unaffiliated bloc of voters leaning Democratic. The growing shift of the state's Republican Party towards social and religious conservatism along with shifting further to the right has also been cited as reasons for the changing voting patterns of Colorado.

Initiative 126 or the Savings Account for Education Initiative appeared on the ballot as Amendment 59. The measure would have created a savings account in the state education fund funded by 10 percent of the monies deposited into the fund, including revenue that would otherwise be rebated under the Taxpayer Bill of Rights rules.

The Independence Institute (II) is a libertarian think tank based in Denver, Colorado. The group's stated mission "is to empower individuals and to educate citizens, legislators and opinion makers about public policies that enhance personal and economic freedom."

The alternative minimum tax (AMT) is a tax imposed by the United States federal government in addition to the regular income tax for certain individuals, estates, and trusts. As of tax year 2018, the AMT raises about $5.2 billion, or 0.4% of all federal income tax revenue, affecting 0.1% of taxpayers, mostly in the upper income ranges.

The premium tax credit (PTC) is a mechanism established by the Affordable Care Act (ACA) through which the United States federal government partially subsidizes the cost of private health insurance for certain lower- and middle-income individuals and families. The PTC is a refundable tax credit, and may be applied directly to the cost of insurance premiums.

The state and local tax deduction is a United States federal itemized deduction that allows taxpayers to deduct certain taxes paid to state and local governments from their adjusted gross income.