Vinod Khosla is an Indian-American businessman and venture capitalist. He is a co-founder of Sun Microsystems and the founder of Khosla Ventures. Khosla made his wealth from early venture capital investments in areas such as networking, software, and alternative energy technologies. He is considered one of the most successful and influential venture capitalists.

Y Combinator Management, LLC (YC) is an American technology startup accelerator launched in March 2005 which has been used to launch more than 4,000 companies. The accelerator program started in Boston and Mountain View, expanded to San Francisco in 2019, and was entirely online during the COVID-19 pandemic. Companies started via Y Combinator include Airbnb, Coinbase, Cruise, DoorDash, Dropbox, Instacart, Reddit, Stripe, and Twitch.

Social venture capital is a form of investment funding that is usually funded by a group of social venture capitalists or an impact investor to provide seed-funding investment, usually in a for-profit social enterprise, in return to achieve an outsized gain in financial return while delivering social impact to the world. There are various organizations, such as Venture Philanthropy (VP) companies and nonprofit organizations, that deploy a simple venture capital strategy model to fund nonprofit events, social enterprises, or activities that deliver a high social impact or a strong social causes for their existence. There are also regionally focused organizations that target a specific region of the world, to help build and support the local community in a social cause.

Index Ventures is a European venture capital firm with dual headquarters in San Francisco and London, investing in technology-enabled companies with a focus on e-commerce, fintech, mobility, gaming, infrastructure/AI, and security. Since its founding in 1996, the firm has invested in a number of companies and raised approximately $5.6 billion. Index Venture partners appear frequently on Forbes’ Midas List of the top tech investors in Europe and Israel.

Accel, formerly known as Accel Partners, is an American venture capital firm. Accel works with startups in seed, early and growth-stage investments. The company has offices in Palo Alto, California and San Francisco, California, with additional operating funds in London, India and China.

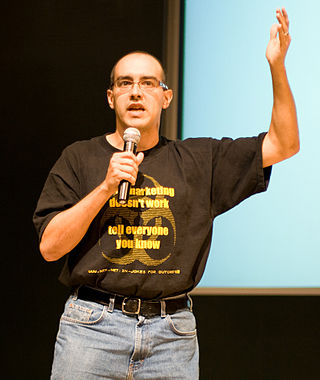

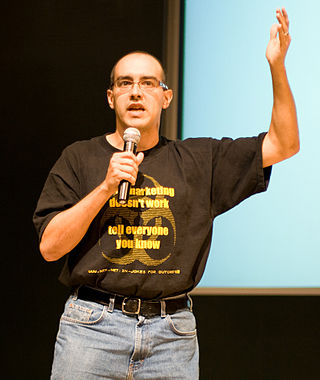

David "Dave" McClure is an entrepreneur and angel investor based in the San Francisco Bay Area, who founded the business accelerator 500 Startups ,and served as its CEO until his resignation in 2017. He founded Practical Venture Capital soon after, a new venture capital fund that would continue to work with companies he previously funded through 500 Startups.

500 Global is an early-stage venture fund and seed accelerator founded in 2010 by Dave McClure and Christine Tsai. The fund admitted a first "class" of twelve startups to its incubator office in Mountain View, California in February 2011. They expanded to a second class of 21 in June 2011 and a third class of 34 in October 2011.

Startup accelerators, also known as seed accelerators, are fixed-term, cohort-based programs, that include mentorship and educational components and culminate in a public pitch event or demo day. While traditional business incubators are often government-funded, generally take no equity, and rarely provide funding, accelerators can be either privately or publicly funded and cover a wide range of industries. Unlike business incubators, the application process for seed accelerators is open to anyone but highly competitive. There are specific accelerators, such as corporate accelerators, which are often subsidiaries or programs of larger corporations that act like seed accelerators.

Jerusalem Venture Partners (JVP) is an international venture capital firm founded in 1993. The fund specializes in investments in startup companies, focusing on digital media, enterprise software, semiconductors, data storage and cyber security, having raised close to $1.4 billion USD across nine funds. JVP is headquartered in Margalit Startup City Jerusalem with offices in Be'er Sheva, New York City and Paris.

Unitus Seed Fund (now Unitus Ventures) is a venture fund based in Bangalore and Seattle that supports early-stage tech startups with India scale and global potential. It funds early-stage Indian technology startups, primarily in the healthcare, education and financial sectors. As an impact investment fund, its focus is on startups that serve low and middle-income consumers.

Baseline Ventures is a venture capital investment firm that focuses on seed and growth-stage investments in technology companies. The company was the first seed investor in Instagram, an early investor of Twitter and has been called "one of Silicon Valley's most successful — and smallest — investment firms" by Forbes. It is headquartered in San Francisco, California. They also do commercial representation of some athletes.

Barcelona Ventures is a seed accelerator and resource platform for European startups to get a foothold in Silicon Valley to connect with investors and expand into the US market. Barcelona Ventures provides mentoring programs, helps coordinate with US legal counsel, immigration services, access to investors, and a Silicon Valley network.

TiE Silicon Valley is the largest and founding chapter of the TiE brand, a non-profit organization dedicated to fostering entrepreneurship. The chapter provides technology entrepreneurs with mentoring services, networking opportunities, startup-related education, funding, and incubating.

Sapphire Ventures is a venture capital firm with offices in Menlo Park, San Francisco, Austin, and London. The firm is considered one of the world's premier venture capital firms.

Conquest, an initiative by students at the Center for Entrepreneurial Leadership at BITS Pilani, Pilani Campus is India's first Student-Run Startup Accelerator. Their program includes online mentoring to the ten most exciting startups from across the country over six weeks, connecting them with field experts. Following this, the startups undergo a ten-day mentorship program in Bangalore. The program ends with the Grand Finale where these startups pitch before India's biggest investment firms and media houses.

MACH37 is an American startup accelerator that was established in 2013 as a division of the Virginia-based Center for Innovative Technology (CIT) with funding from the Commonwealth of Virginia. In 2017 CIT partnered with VentureScope, a strategic innovation consultancy and venture firm, to revamp MACH37's operating model and curriculum. Following a successful partnership between CIT and VentureScope, MACH37 became fully owned and operated by VentureScope in 2020. MACH37 focuses primarily on honing and strengthening startups' product-market fit through extensive customer discovery and market research, expanding emerging companies' professional networks, fostering founder wellbeing, and providing emerging companies in the cybersecurity industry with access to investment capital and an immediate customer base. In an October 2020 article Forbes named MACH37 'the Granddaddy' of top cyber accelerators giving a nod to the fact that MACH37 was one of the first accelerators in the world dedicated to cyber and cyber adjacent technologies, and it has lasted far longer than many of its peer accelerators while strengthening over time. The name 'MACH37' is a reference to the escape velocity of Earth's atmosphere. VentureScope applies Lean Startup methodology at MACH37 as an efficient and successful approach to assist startups to rapidly adapt their search for a successful business model and test their hypotheses about customer needs and market demands.

Whatfix is a SaaS based digital adoption platform that provides organizations with a no-code editor to create in-app guidance and self-help support on any application that looks 100% native. The platform enables companies to create interactive walkthroughs, product tours, user onboarding checklists, smart tips, field validation, self-help wikis, hotspots, and more. Its advanced product analytics empower organizations with the data to understand how users are engaging with their applications and software products.

Entrepreneurs Roundtable Accelerator is an American seed accelerator launched in January 2011.

Fusion LA is a venture capital firm and an accelerator for Israeli startups in the United States. It was founded in 2017 and is headquartered in Santa Monica, California, United States.

AlphaLab is an American technology startup accelerator based in Pittsburgh, Pennsylvania. It was founded in 2008 by Jim Jen. AlphaLab has two subsidiaries, AlphaLab Gear and AlphaLab Health, catering to companies in the hardware and medical fields, respectively.