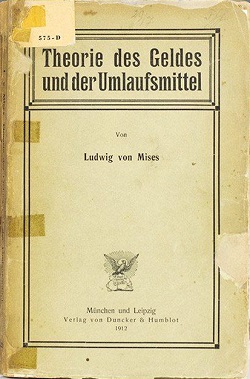

First German edition | |

| Author | Ludwig von Mises |

|---|---|

| Original title | Theorie des Geldes und der Umlaufsmittel |

| Language | German |

| Subject | Economics |

| Genre | Non-fiction |

Publication date | 1912 |

| Publication place | Germany |

The Theory of Money and Credit is a 1912 economics book written by Ludwig von Mises, originally published in German as Theorie des Geldes und der Umlaufsmittel. It features the earliest statement of Mises's business cycle theory. The book also includes the first exposition of Mises's regression theorem, which aimed to explain the purchasing power of money using the subjective marginal utility theory of value, [1] an accomplishment which has been argued to have reunited the microeconomic and macroeconomic spheres. [2] The book also details Mises's views on the origins of money, on the gold standard, on the forms and functions of money, and on the role of the State and of the banking system with regard to money.

Contents

The Theory of Money and Credit is one of the foundational works of the Misesian branch of the Austrian School of economic thought. Murray Rothbard considered The Theory of Money and Credit to be one of the four major works of Mises's career, alongside Socialism (1922), Human Action (1949), and Theory and History (1957). [3]