Related Research Articles

Econometrics is an application of statistical methods to economic data in order to give empirical content to economic relationships. More precisely, it is "the quantitative analysis of actual economic phenomena based on the concurrent development of theory and observation, related by appropriate methods of inference." An introductory economics textbook describes econometrics as allowing economists "to sift through mountains of data to extract simple relationships." Jan Tinbergen is one of the two founding fathers of econometrics. The other, Ragnar Frisch, also coined the term in the sense in which it is used today.

Game theory is the study of mathematical models of strategic interactions. It has applications in many fields of social science, and is used extensively in economics, logic, systems science and computer science. Initially, game theory addressed two-person zero-sum games, in which a participant's gains or losses are exactly balanced by the losses and gains of the other participant. In the 1950s, it was extended to the study of non zero-sum games, and was eventually applied to a wide range of behavioral relations. It is now an umbrella term for the science of rational decision making in humans, animals, and computers.

James Tobin was an American economist who served on the Council of Economic Advisers and consulted with the Board of Governors of the Federal Reserve System, and taught at Harvard and Yale Universities. He contributed to the development of key ideas in the Keynesian economics of his generation and advocated government intervention in particular to stabilize output and avoid recessions. His academic work included pioneering contributions to the study of investment, monetary and fiscal policy and financial markets. He also proposed an econometric model for censored dependent variables, the well-known tobit model.

Neoclassical economics is an approach to economics in which the production, consumption, and valuation (pricing) of goods and services are observed as driven by the supply and demand model. According to this line of thought, the value of a good or service is determined through a hypothetical maximization of utility by income-constrained individuals and of profits by firms facing production costs and employing available information and factors of production. This approach has often been justified by appealing to rational choice theory.

The prisoner's dilemma is a game theory thought experiment involving two rational agents, each of whom can either cooperate for mutual benefit or betray their partner ("defect") for individual gain. The dilemma arises from the fact that while defecting is rational for each agent, cooperation yields a higher payoff for each. The puzzle was designed by Merrill Flood and Melvin Dresher in 1950 during their work at the RAND Corporation. They invited economist Armen Alchian and mathematician John Williams to play a hundred rounds of the game, observing that Alchian and Williams often chose to cooperate. When asked about the results, John Nash remarked that rational behavior in the iterated version of the game can differ from that in a single-round version. This insight anticipated a key result in game theory: cooperation can emerge in repeated interactions, even in situations where it is not rational in a one-off interaction.

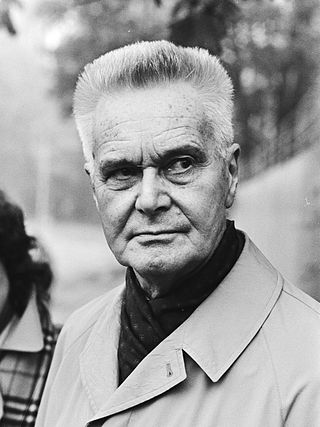

Jan Tinbergen was a Dutch economist who was awarded the first Nobel Memorial Prize in Economic Sciences in 1969, which he shared with Ragnar Frisch for having developed and applied dynamic models for the analysis of economic processes. He is widely considered to be one of the most influential economists of the 20th century and one of the founding fathers of econometrics.

Sir John Richard Nicholas Stone was an eminent British economist. He was educated at Gonville and Caius College and King's College at the University of Cambridge. In 1984, he was awarded the Nobel Memorial Prize in Economic Sciences for developing an accounting model that could be used to track economic activities on a national and, later, an international scale.

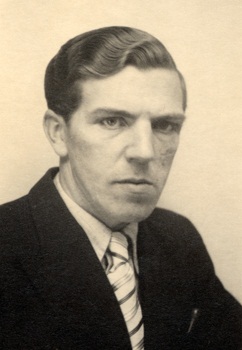

Trygve Magnus Haavelmo, born in Skedsmo, Norway, was an economist whose research interests centered on econometrics. He received the Nobel Memorial Prize in Economic Sciences in 1989.

Philosophy and economics studies topics such as public economics, behavioural economics, rationality, justice, history of economic thought, rational choice, the appraisal of economic outcomes, institutions and processes, the status of highly idealized economic models, the ontology of economic phenomena and the possibilities of acquiring knowledge of them.

Wesley Clair Mitchell was an American economist known for his empirical work on business cycles and for guiding the National Bureau of Economic Research in its first decades.

Economic methodology is the study of methods, especially the scientific method, in relation to economics, including principles underlying economic reasoning. In contemporary English, 'methodology' may reference theoretical or systematic aspects of a method. Philosophy and economics also takes up methodology at the intersection of the two subjects.

Applied economics is the application of economic theory and econometrics in specific settings. As one of the two sets of fields of economics, it is typically characterized by the application of the core, i.e. economic theory and econometrics to address practical issues in a range of fields including demographic economics, labour economics, business economics, industrial organization, agricultural economics, development economics, education economics, engineering economics, financial economics, health economics, monetary economics, public economics, and economic history. From the perspective of economic development, the purpose of applied economics is to enhance the quality of business practices and national policy making.

Dale Weldeau Jorgenson was an American economist who served as the Samuel W. Morris University Professor at Harvard University. An influential econometric scholar, he was famed for his work on the relationship between productivity and economic growth, the economics of climate change, and the intersection between economics and statistics. Described as a "master" of his field, he received the John Bates Clark Medal in 1971, and was described as a worthy contender for the Nobel Memorial Prize in Economic Sciences.

Complexity economics is the application of complexity science to the problems of economics. It relaxes several common assumptions in economics, including general equilibrium theory. While it does not reject the existence of an equilibrium, it features an non-equilibrium approach and sees such equilibria as a special case and as an emergent property resulting from complex interactions between economic agents. The complexity science approach has also been applied to computational economics.

Mary Susanna Morgan FBA FRDAAS, is an economist, philosopher, historian, and the Albert O. Hirschman Professor of the History and Philosophy of Economics in the London School of Economics. She was Department Chair of Economic History between 2002 and 2005. In 2002, she was elected a Fellow of the British Academy.

Mathematical economics is the application of mathematical methods to represent theories and analyze problems in economics. Often, these applied methods are beyond simple geometry, and may include differential and integral calculus, difference and differential equations, matrix algebra, mathematical programming, or other computational methods. Proponents of this approach claim that it allows the formulation of theoretical relationships with rigor, generality, and simplicity.

The methodology of econometrics is the study of the range of differing approaches to undertaking econometric analysis.

Disequilibrium macroeconomics is a tradition of research centered on the role of deviation from equilibrium in economics. This approach is also known as non-Walrasian theory, equilibrium with rationing, the non-market clearing approach, and non-tâtonnement theory. Early work in the area was done by Don Patinkin, Robert W. Clower, and Axel Leijonhufvud. Their work was formalized into general disequilibrium models, which were very influential in the 1970s. American economists had mostly abandoned these models by the late 1970s, but French economists continued work in the tradition and developed fixprice models. Other approaches that focus on the dynamic processes and interactions in economic systems that are constantly changing and do not necessarily settle into a stable state are discussed as non-equilibrium economics.

The sociologyof quantification is the investigation of quantification as a sociological phenomenon in its own right.

Models as Mediators: Perspectives on Natural and Social Science is a multi-author book edited by Mary S. Morgan and Margaret Morrison and published in 1999 by Cambridge University Press.

References

- 1 2 3 4 5 6 Sugden, R. (20 May 2013). "Mary S. Morgan's The world in the model: how economists work and think. Cambridge University Press, 2012, 435 pp". Erasmus Journal for Philosophy and Economics. 6 (1): 108–114. doi: 10.23941/ejpe.v6i1.121 . ISSN 1876-9098.

- 1 2 3 4 5 6 7 8 9 Halsmayer, V. (September 2014). "Mary Morgan, The World in the Model: How Economists Work and Think". Journal of the History of Economic Thought. 36 (3): 380–382. doi:10.1017/S105383721400039X.

- 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 Morgan, M. S. (17 September 2012). The World in the Model: How Economists Work and Think. Cambridge University Press. ISBN 978-1-107-00297-5.

- 1 2 3 4 5 6 7 8 Claveau, F. (March 2015). "The World in the Model: How Economists Work and Think, Mary S. Morgan. Cambridge University Press, 2012, xvii + 421 pages". Economics & Philosophy. 31 (1): 161–168. doi:10.1017/S0266267114000443.

- ↑ Hughes, R. I. G. (1997). "Models and Representation". Philosophy of Science. 64 ((Proceedings)): S325 –S336. doi:10.1086/392611.

- 1 2 3 4 5 6 7 Desmarais-Tremblay, M. (4 May 2018). "The world in the model. How economists work and think" (PDF). The European Journal of the History of Economic Thought. 25 (3). Routledge: 493–498. doi:10.1080/09672567.2018.1486577. ISSN 0967-2567.

- 1 2 3 4 5 Callahan, G. (1 June 2016). "Morgan, Mary S. 2012., The World in the Model: How Economists Work and Think. Cambridge; New York: Cambridge University Press. 2012. xvii + 421 Pages. $44.99". The Review of Austrian Economics. 29 (2): 227–231. doi:10.1007/s11138-015-0303-2. ISSN 1573-7128.

- ↑ Rapoport, A. (1962). "The Use and Misuse of Game Theory". Scientific American. 207 (6). Scientific American, a division of Nature America, Inc.: 108–119. Bibcode:1962SciAm.207f.108R. doi:10.1038/scientificamerican1262-108. ISSN 0036-8733. PMID 13973104.

- ↑ Cartwright, N. (1 January 2009). "If No Capacities Then No Credible Worlds. But Can Models Reveal Capacities?". Erkenntnis. 70 (1): 45–58. doi:10.1007/s10670-008-9136-8. ISSN 1572-8420.

- ↑ The European Society for the History of Economic Thought - ESHET , retrieved 7 December 2024