Related Research Articles

Keynesian economics are the various macroeconomic theories and models of how aggregate demand strongly influences economic output and inflation. In the Keynesian view, aggregate demand does not necessarily equal the productive capacity of the economy. It is influenced by a host of factors that sometimes behave erratically and impact production, employment, and inflation.

Milton Friedman was an American economist and statistician who received the 1976 Nobel Memorial Prize in Economic Sciences for his research on consumption analysis, monetary history and theory and the complexity of stabilization policy. With George Stigler, Friedman was among the intellectual leaders of the Chicago school of economics, a neoclassical school of economic thought associated with the work of the faculty at the University of Chicago that rejected Keynesianism in favor of monetarism until the mid-1970s, when it turned to new classical macroeconomics heavily based on the concept of rational expectations. Several students, young professors and academics who were recruited or mentored by Friedman at Chicago went on to become leading economists, including Gary Becker, Robert Fogel, and Robert Lucas Jr.

Stagflation refers to an economic condition characterized by a simultaneous occurrence of high inflation, stagnant economic growth, and elevated unemployment. This phenomenon challenges traditional economic theories, which previously suggested that inflation and unemployment were inversely related, as depicted by the Phillips Curve. The term stagflation, a blend of "stagnation" and "inflation," was popularized by British politician Iain Macleod in the 1960s, during a period of economic distress in the United Kingdom. It gained broader recognition in the 1970s following a series of global economic shocks, particularly the 1973 oil crisis, which significantly disrupted supply chains and contributed to rising prices and slowing growth.

John Maynard Keynes, 1st Baron Keynes, was an English economist and philosopher whose ideas fundamentally changed the theory and practice of macroeconomics and the economic policies of governments. Originally trained in mathematics, he built on and greatly refined earlier work on the causes of business cycles. One of the most influential economists of the 20th century, he produced writings that are the basis for the school of thought known as Keynesian economics, and its various offshoots. His ideas, reformulated as New Keynesianism, are fundamental to mainstream macroeconomics. He is known as the "father of macroeconomics".

Monetarism is a school of thought in monetary economics that emphasizes the role of policy-makers in controlling the amount of money in circulation. It gained prominence in the 1970s but was mostly abandoned as a direct guidance to monetary policy during the following decade because of the rise of inflation targeting through movements of the official interest rate.

Henry Stuart Hazlitt was an American journalist, economist, and philosopher known for his advocacy of free markets and classical liberal principles. Over a career spanning more than seven decades, Hazlitt wrote extensively on business, economics, and public policy for prominent publications, including The Wall Street Journal, The Nation, The American Mercury, Newsweek, and The New York Times. He is best known for his 1946 book, Economics in One Lesson, a work grounded in the Austrian school of economics and the importance of individual liberty in economic decision-making.

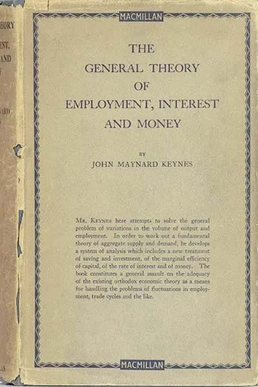

The General Theory of Employment, Interest and Money is a book by English economist John Maynard Keynes published in February 1936. It caused a profound shift in economic thought, giving macroeconomics a central place in economic theory and contributing much of its terminology – the "Keynesian Revolution". It had equally powerful consequences in economic policy, being interpreted as providing theoretical support for government spending in general, and for budgetary deficits, monetary intervention and counter-cyclical policies in particular. It is pervaded with an air of mistrust for the rationality of free-market decision-making.

The Failure of the "New Economics" subtitled An Analysis of The Keynesian Fallacies, (1959) is a book by Henry Hazlitt offering a detailed critique of John Maynard Keynes' work The General Theory of Employment, Interest and Money (1936).

The quantity theory of money is a hypothesis within monetary economics which states that the general price level of goods and services is directly proportional to the amount of money in circulation, and that the causality runs from money to prices. This implies that the theory potentially explains inflation. It originated in the 16th century and has been proclaimed the oldest surviving theory in economics.

Arthur Frank Burns was an American economist and diplomat who served as the 10th chairman of the Federal Reserve from 1970 to 1978. He previously chaired the Council of Economic Advisers under President Dwight D. Eisenhower from 1953 to 1956, and served as the first Counselor to the President under Richard Nixon from January to November 1969. He also taught and researched at Rutgers University, Columbia University, and the National Bureau of Economic Research.

Abraham "Abba" Ptachya Lerner was a Russian-born American-British economist.

The permanent income hypothesis (PIH) is a model in the field of economics to explain the formation of consumption patterns. It suggests consumption patterns are formed from future expectations and consumption smoothing. The theory was developed by Milton Friedman and published in his A Theory of the Consumption Function, published in 1957 and subsequently formalized by Robert Hall in a rational expectations model. Originally applied to consumption and income, the process of future expectations is thought to influence other phenomena. In its simplest form, the hypothesis states changes in permanent income, rather than changes in temporary income, are what drive changes in consumption.

New classical macroeconomics, sometimes simply called new classical economics, is a school of thought in macroeconomics that builds its analysis entirely on a neoclassical framework. Specifically, it emphasizes the importance of rigorous foundations based on microeconomics, especially rational expectations.

The following outline is provided as an overview of and topical guide to economics:

Steven Pressman is an American economist. He is a former Professor of Economics and Finance at Monmouth University in West Long Branch, New Jersey. He has taught at the University of New Hampshire and Trinity College in Hartford, Connecticut.

Following the global 2007–2008 financial crisis, there was a worldwide resurgence of interest in Keynesian economics among prominent economists and policy makers. This included discussions and implementation of economic policies in accordance with the recommendations made by John Maynard Keynes in response to the Great Depression of the 1930s, most especially fiscal stimulus and expansionary monetary policy.

The Keynesian Revolution was a fundamental reworking of economic theory concerning the factors determining employment levels in the overall economy. The revolution was set against the then orthodox economic framework, namely neoclassical economics.

Macroeconomic theory has its origins in the study of business cycles and monetary theory. In general, early theorists believed monetary factors could not affect real factors such as real output. John Maynard Keynes attacked some of these "classical" theories and produced a general theory that described the whole economy in terms of aggregates rather than individual, microeconomic parts. Attempting to explain unemployment and recessions, he noticed the tendency for people and businesses to hoard cash and avoid investment during a recession. He argued that this invalidated the assumptions of classical economists who thought that markets always clear, leaving no surplus of goods and no willing labor left idle.

The post-war displacement of Keynesianism was a series of events which from mostly unobserved beginnings in the late 1940s, had by the early 1980s led to the replacement of Keynesian economics as the leading theoretical influence on economic life in the developed world. Similarly, the allied discipline known as development economics was largely displaced as the guiding influence on economic policies adopted by developing nations.

Throughout modern history, a variety of perspectives on capitalism have evolved based on different schools of thought.

References

- ↑ "This House Believes that We Are All Feminists Now". The Oxford Student. 2013-03-04. Retrieved 2023-01-23.

- ↑ Walters, Suzanna Danuta (2018-10-04). "We Are All Feminists Now". Ms. Magazine. Retrieved 2023-01-23.

- ↑ Carl B. Turner (1969) An analysis of Soviet views on John Maynard Keynes, Duke Univ Press, p52

- ↑ "We Are All Keynesians Now". Time . December 31, 1965. Archived from the original on October 23, 2008. Retrieved 2008-12-16.

- ↑ Gerstle, Gary, The Rise and Fall of the Neoliberal Order: America and the World in the Free Market Era (New York: Oxford University Press, 2022), p. 46. Hazlitt, Henry. "The Policy is Inflation". Newsweek, July 5, 1954. Reprinted in Doolittle, Marc, ed., Business Tides: The Newsweek Era of Henry Hazlitt , p. 353. Retrieved April 2, 2023.

- ↑ "Letter: Friedman & Keynes". Time . February 4, 1966. Retrieved 2021-02-14.

- ↑ Jeffrey Kluger (October 22, 2012). "Viewpoint: The Problem with the "We Are All…" Trope". Time . Retrieved 11 February 2015.

- ↑ John Meachan (February 6, 2009). "We Are All Socialists Now". newsweek.com. Retrieved 11 February 2015.

- ↑ Pearlstein, Steven (November 26, 2008). "Keynes on Steroids". The Washington Post. Retrieved 2008-12-16.

- ↑ "Nixon Reportedly Says He Is Now a Keynesian". The New York Times, Reuters. January 7, 1971. Retrieved 2021-02-14.

- ↑ Tempest, Matthew (10 June 2002). "Mandelson: we are all Thatcherites now". The Guardian . London.

- ↑ "We are all Keynesians now". The Boston Globe . November 25, 2008. Retrieved 2008-12-16.

- ↑ Fox, Justin (October 23, 2008). "The Comeback Keynes". Time . Archived from the original on October 26, 2008. Retrieved 2008-12-16.