Charles Humphrey Keating Jr. was an American sportsman, lawyer, real estate developer, banker, financier, conservative activist, and convicted felon best known for his role in the savings and loan scandal of the late 1980s.

Full-reserve banking is a system of banking where banks do not lend demand deposits and instead only lend from time deposits. It differs from fractional-reserve banking, in which banks may lend funds on deposit, while fully reserved banks would be required to keep the full amount of each customer's demand deposits in cash, available for immediate withdrawal.

Bank fraud is the use of potentially illegal means to obtain money, assets, or other property owned or held by a financial institution, or to obtain money from depositors by fraudulently posing as a bank or other financial institution. In many instances, bank fraud is a criminal offence.

Lehman Brothers Inc. was an American global financial services firm founded in 1850. Before filing for bankruptcy in 2008, Lehman was the fourth-largest investment bank in the United States, with about 25,000 employees worldwide. It was doing business in investment banking, equity, fixed-income and derivatives sales and trading, research, investment management, private equity, and private banking. Lehman was operational for 158 years from its founding in 1850 until 2008.

The savings and loan crisis of the 1980s and 1990s was the failure of 32% of savings and loan associations (S&Ls) in the United States from 1986 to 1995. An S&L or "thrift" is a financial institution that accepts savings deposits and makes mortgage, car and other personal loans to individual members.

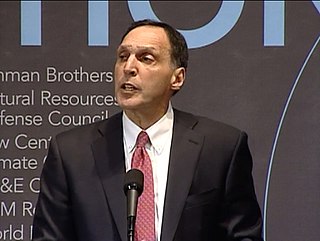

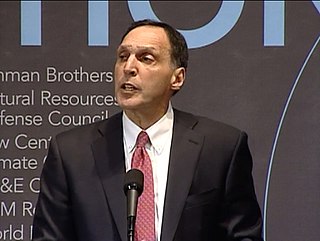

Richard Severin Fuld Jr. is an American banker best known as the final chairman and chief executive officer of investment bank Lehman Brothers. Fuld held this position from 1 April 1994 after the firm's spinoff from American Express until 15 September 2008. Lehman Brothers filed for bankruptcy protection under Chapter 11 on September 15, 2008, and subsequently announced the sale of major operations to parties including Barclays Bank and Nomura Securities.

A financial crisis is any of a broad variety of situations in which some financial assets suddenly lose a large part of their nominal value. In the 19th and early 20th centuries, many financial crises were associated with banking panics, and many recessions coincided with these panics. Other situations that are often called financial crises include stock market crashes and the bursting of other financial bubbles, currency crises, and sovereign defaults. Financial crises directly result in a loss of paper wealth but do not necessarily result in significant changes in the real economy.

Lewis William Seidman was an American economist, financial commentator, and former head of the U.S. Federal Deposit Insurance Corporation, best known for his role in helping work to correct the Savings and Loan Crisis in the American financial sector from 1988 to 1991 as head of the Resolution Trust Corporation. He also worked as an economic adviser during three separate administrations of United States presidents: Gerald Ford, Ronald Reagan, and George H. W. Bush. He was lauded by both Republicans and Democrats for his work in cleaning up the frauds of the Savings and Loan disaster, but was pushed out of American government by the George H.W. Bush administration for disclosing the full extent of the crisis to the United States Congress and taxpayers.

The Federal Deposit Insurance Corporation Improvement Act of 1991, passed during the savings and loan crisis in the United States, strengthened the power of the Federal Deposit Insurance Corporation.

The American subprime mortgage crisis was a multinational financial crisis that occurred between 2007 and 2010 that contributed to the 2007–2008 global financial crisis. The crisis led to a severe economic recession, with millions losing their jobs and many businesses going bankrupt. The U.S. government intervened with a series of measures to stabilize the financial system, including the Troubled Asset Relief Program (TARP) and the American Recovery and Reinvestment Act (ARRA).

The subprime mortgage crisis impact timeline lists dates relevant to the creation of a United States housing bubble and the 2005 housing bubble burst and the subprime mortgage crisis which developed during 2007 and 2008. It includes United States enactment of government laws and regulations, as well as public and private actions which affected the housing industry and related banking and investment activity. It also notes details of important incidents in the United States, such as bankruptcies and takeovers, and information and statistics about relevant trends. For more information on reverberations of this crisis throughout the global financial system see 2007–2008 financial crisis.

The bankruptcy of Lehman Brothers, also known as the Crash of '08 and the Lehman Shock on September 15, 2008, was the climax of the subprime mortgage crisis. After the financial services firm was notified of a pending credit downgrade due to its heavy position in subprime mortgages, the Federal Reserve summoned several banks to negotiate financing for its reorganization. These discussions failed, and Lehman filed a Chapter 11 petition that remains the largest bankruptcy filing in U.S. history, involving more than US$600 billion in assets.

The government interventions during the subprime mortgage crisis were a response to the 2007–2009 subprime mortgage crisis and resulted in a variety of government bailouts that were implemented to stabilize the financial system during late 2007 and early 2008.

Government policies and the subprime mortgage crisis covers the United States government policies and its impact on the subprime mortgage crisis of 2007-2009. The U.S. subprime mortgage crisis was a set of events and conditions that led to the 2007–2008 financial crisis and subsequent recession. It was characterized by a rise in subprime mortgage delinquencies and foreclosures, and the resulting decline of securities backed by said mortgages. Several major financial institutions collapsed in September 2008, with significant disruption in the flow of credit to businesses and consumers and the onset of a severe global recession.

James M. Fail was an American financial executive who served as chairman of Stone Holdings, Inc. and Bluebonnet Savings Bank. A native of Mobile, Alabama, he attended Murphy High School and served for three years in the U.S. Navy. After graduating from the University of Alabama in 1949, he began his career as a securities salesman for Merrill Lynch. In the following decades, Fail and his holding companies have owned and operated a variety of investment, mortgage, banking, savings and loan, and insurance businesses throughout the U.S.

Mark Thomas Williams is an academic, financial author and risk management expert. He is a faculty member in the Finance Department at Boston University Questrom School of Business where he teaches courses in banking, capital markets and FinTech. In 2018, he was awarded the James E. Freeman Lecturer in Management Chair.

Control fraud occurs when a trusted person in a high position of responsibility in a company, corporation, or state subverts the organization and engages in extensive fraud for personal gain. The term "control fraud" was coined by William K. Black to refer both to the acts of fraud and to the individuals who commit them.

The 2007–2008 financial crisis, or the global financial crisis (GFC), was the most severe worldwide economic crisis since the Great Depression. Predatory lending in the form of subprime mortgages targeting low-income homebuyers, excessive risk-taking by global financial institutions, a continuous buildup of toxic assets within banks, and the bursting of the United States housing bubble culminated in a "perfect storm", which led to the Great Recession.

Barclays plc is a British multinational universal bank, headquartered in London, England. Barclays operates as two divisions, Barclays UK and Barclays International, supported by a service company, Barclays Execution Services.