Public finance is the study of the role of the government in the economy. It is the branch of economics that assesses the government revenue and government expenditure of the public authorities and the adjustment of one or the other to achieve desirable effects and avoid undesirable ones. The purview of public finance is considered to be threefold, consisting of governmental effects on:

- The efficient allocation of available resources;

- The distribution of income among citizens; and

- The stability of the economy.

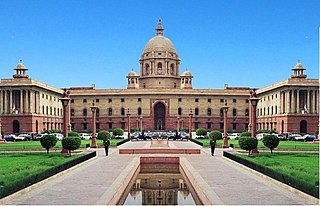

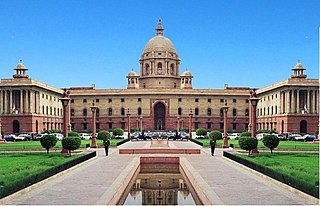

The Government of India, often abbreviated as GoI, is the union government created by the constitution of India as the legislative, executive and judicial authority of the union of twenty eight states and eight union territories of a constitutionally democratic republic. The seat of the Government is located in New Delhi, the capital of India.

Indian law is enforced by a number of agencies. Like many federal nations, the constitution of India delegates the maintenance of law and order primarily to the states and territories.

The law of India refers to the system of law across the Indian nation. India maintains a hybrid legal system with a mixture of civil, common law and customary, Islamic ethics, or religious law within the legal framework inherited from the colonial era and various legislation first introduced by the British are still in effect in modified forms today. Since the drafting of the Indian Constitution, Indian laws also adhere to the United Nations guidelines on human rights law and the environmental law.

Tax evasion is the illegal evasion of taxes by individuals, corporations, and trusts. Tax evasion often entails taxpayers deliberately misrepresenting the true state of their affairs to the tax authorities to reduce their tax liability, and it includes dishonest tax reporting, such as declaring less income, profits or gains than the amounts actually earned, or overstating deductions.

Income tax in India is governed by Entry 82 of the Union List of the Seventh Schedule to the Constitution of India, empowering the central government to tax non-agricultural income; agricultural income is defined in Section 10(1) of the Income-tax Act, 1961. Income-tax law consists of the 1961 act, Income Tax Rules 1962, Notifications and Circulars issued by the Central Board of Direct Taxes (CBDT), annual Finance Acts, and judicial pronouncements by the Supreme and high courts.

The Indian Revenue Service, often abbreviated as IRS, is the administrative revenue civil service under Group A of the Central Civil Services of the executive branch of the Government of India. It functions under the Department of Revenue of the Ministry of Finance and is under the administrative direction of the Revenue Secretary and the ministerial command of the Minister of Finance. The IRS is primarily responsible for collecting and administering direct and indirect taxes accruing to the Government of India.

Taxes in India are levied by the Central Government and the state governments. Some minor taxes are also levied by the local authorities such as the Municipality.

The Ministry of Law and Justice in the Government of India is a cabinet ministry which deals with the management of the legal affairs, legislative activities and administration of justice in India through its three departments namely the Legislative Department and the Department of Legal Affairs and Department of Justice respectively. The Department of Legal Affairs is concerned with advising the various Ministries of the Central Government while the Legislative Department is concerned with drafting of principal legislation for the Central Government. The ministry is headed by a cabinet rank minister appointed by the President of India on the recommendation of the Prime Minister of India. The first Law and Justice minister of independent India was Dr. B. R. Ambedkar, who served in the Prime Minister Jawaharlal Nehru's cabinet during 1947–51. Ravi Shankar Prasad is the current Minister of Law and Justice.

The Ministry of Finance is a ministry within the Government of India concerned with the economy of India, serving as the Indian Treasury Department. In particular, it concerns itself with taxation, financial legislation, financial institutions, capital markets, centre and state finances, and the Union Budget.

The Internal Revenue Service (IRS) is the revenue service of the United States federal government responsible for collecting taxes and administering the Internal Revenue Code, the main body of federal statutory tax law. It is part of the Department of the Treasury and led by the Commissioner of Internal Revenue, who is appointed to a five-year term by the President of the United States. The duties of the IRS include providing tax assistance to taxpayers; pursuing and resolving instances of erroneous or fraudulent tax filings; and overseeing various benefits programs, including the Affordable Care Act.

The Economic Intelligence Council is the apex forum overseeing government agencies responsible for economic intelligence and combating economic offences in India. The Council is also the apex of 18 regional economic intelligence committees, and is part of the Union Ministry of Finance. It was formed in 1990.

The Central Economic Intelligence Bureau (CEIB) is an Indian intelligence agency responsible for gathering information and monitoring the economic and financial sectors for economic offences and warfare.

The Directorate General of Income Tax Investigation is the law enforcement agency under the Ministry of Finance responsible for investigating violations of India's tax laws, including fraud, evasion and money laundering. The controlling authority is the Investigation Division of the Central Board of Direct Taxes.

The Investigation Division of the CBDT, abbreviated as Inv-CBDT, is the revenue enforcement agency of the Central Board of Direct Taxes, Government of India. It functions under the Department of Revenue in the Union Ministry of Finance and is concerned with the collection and administration of, as well as enforcement and prosecution of cases related to, the various direct taxes accruing to the Union Government.

The Income Tax Air Intelligence Unit is a law enforcement agency, under the Ministry of Finance responsible for handling tax evasion and cross-border illegal trade in India in airports in consultation with the Central Board of Indirect Taxes and Customs and the CISF. It functions under the Zonal Deputy Director (Intelligence) Income Tax. The agency functions under the rules prescribed by its parent organisation to handle any intimidation in course of their new duty of checking and gathering intelligence on tax evasion in airports. Their mandate will soon be extended to Ports. The Election Commission of India has congratulated this agency on their path breaking efforts to fight tax evasion among politicians.

The Income Tax Department is a government agency undertaking direct tax collection of the Government of India. It functions under the Department of Revenue of the Ministry of Finance. Income Tax Department is headed by the apex body Central Board of Direct Taxes (CBDT). Main responsibility of IT Department is to enforce various direct tax laws, most important among these being the Income-tax Act, 1961, to collect revenue for Government of India. It also enforces other economic laws like the Benami Transactions (Prohibition) Act, 1988 and the Black Money Act, 2015.

The Indian Revenue Service , often abbreviated to I.R.S. (C&I.T.), or simply IRS C&IT, is the administrative revenue service of the Government of India. A Central Service, it functions under the Department of Revenue of the Ministry of Finance and is under the administrative direction of the Revenue Secretary and the ministerial command of the Minister of Finance. The IRS is primarily responsible for collecting and administering indirect taxes accruing to the Government of India. It is one of the largest civil service amongst the organised civil services in the Indian government and serves the nation through discharging sovereign functions of collection of revenue for development, security and governance.

The Indian Revenue Service , often abbreviated as IRS (IT), is the administrative revenue service of the Government of India. A Central Service, it functions under the Department of Revenue of the Ministry of Finance and is under the administrative direction of the Revenue Secretary and the ministerial command of the Minister of Finance. The IRS is primarily responsible for collecting and administering direct taxes accruing to the Government of India.