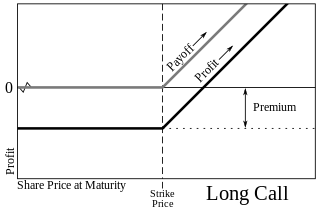

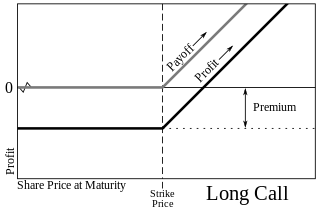

In finance, a call option, often simply labeled a "call", is a contract between the buyer and the seller of the call option to exchange a security at a set price. The buyer of the call option has the right, but not the obligation, to buy an agreed quantity of a particular commodity or financial instrument from the seller of the option at or before a certain time for a certain price. This effectively gives the owner a long position in the given asset. The seller is obliged to sell the commodity or financial instrument to the buyer if the buyer so decides. This effectively gives the seller a short position in the given asset. The buyer pays a fee for this right. The term "call" comes from the fact that the owner has the right to "call the stock away" from the seller.

In finance, a put or put option is a derivative instrument in financial markets that gives the holder the right to sell an asset, at a specified price, by a specified date to the writer of the put. The purchase of a put option is interpreted as a negative sentiment about the future value of the underlying stock. The term "put" comes from the fact that the owner has the right to "put up for sale" the stock or index.

In finance, a straddle strategy involves two transactions in options on the same underlying, with opposite positions. One holds long risk, the other short. As a result, it involves the purchase or sale of particular option derivatives that allow the holder to profit based on how much the price of the underlying security moves, regardless of the direction of price movement.

In finance, moneyness is the relative position of the current price of an underlying asset with respect to the strike price of a derivative, most commonly a call option or a put option. Moneyness is firstly a three-fold classification:

In finance, risk reversal can refer to a measure of the volatility skew or to a trading strategy.

In finance, a butterfly is a limited risk, non-directional options strategy that is designed to have a high probability of earning a limited profit when the future volatility of the underlying asset is expected to be lower or higher than that asset's current implied volatility.

In options trading, a box spread is a combination of positions that has a certain payoff, considered to be simply "delta neutral interest rate position". For example, a bull spread constructed from calls combined with a bear spread constructed from puts has a constant payoff of the difference in exercise prices assuming that the underlying stock does not go ex-dividend before the expiration of the options. If the underlying asset has a dividend of X, then the settled value of the box will be 10 + x. Under the no-arbitrage assumption, the net premium paid out to acquire this position should be equal to the present value of the payoff.

In finance, a calendar spread is a spread trade involving the simultaneous purchase of futures or options expiring on a particular date and the sale of the same instrument expiring on another date. These individual purchases, known as the legs of the spread, vary only in expiration date; they are based on the same underlying market and strike price.

The iron condor is an options trading strategy utilizing two vertical spreads – a put spread and a call spread with the same expiration and four different strikes. A long iron condor is essentially selling both sides of the underlying instrument by simultaneously shorting the same number of calls and puts, then covering each position with the purchase of further out of the money call(s) and put(s) respectively. The converse produces a short iron condor.

In options trading, a bull spread is a bullish, vertical spread options strategy that is designed to profit from a moderate rise in the price of the underlying security.

In finance an iron butterfly, also known as the ironfly, is the name of an advanced, neutral-outlook, options trading strategy that involves buying and holding four different options at three different strike prices. It is a limited-risk, limited-profit trading strategy that is structured for a larger probability of earning smaller limited profit when the underlying stock is perceived to have a low volatility.

Option strategies are the simultaneous, and often mixed, buying or selling of one or more options that differ in one or more of the options' variables. Call options, simply known as Calls, give the buyer a right to buy a particular stock at that option's strike price. Opposite to that are Put options, simply known as Puts, which give the buyer the right to sell a particular stock at the option's strike price. This is often done to gain exposure to a specific type of opportunity or risk while eliminating other risks as part of a trading strategy. A very straightforward strategy might simply be the buying or selling of a single option; however, option strategies often refer to a combination of simultaneous buying and or selling of options.

The backspread is the converse strategy to the ratio spread and is also known as reverse ratio spread. Using calls, a bullish strategy known as the call backspread can be constructed and with puts, a strategy known as the put backspread can be constructed.

Options arbitrage is a trading strategy using arbitrage in the options market to earn small profits with very little or zero risk.

In finance, an option is a contract which conveys to its owner, the holder, the right, but not the obligation, to buy or sell a specific quantity of an underlying asset or instrument at a specified strike price on or before a specified date, depending on the style of the option. Options are typically acquired by purchase, as a form of compensation, or as part of a complex financial transaction. Thus, they are also a form of asset and have a valuation that may depend on a complex relationship between underlying asset price, time until expiration, market volatility, the risk-free rate of interest, and the strike price of the option. Options may be traded between private parties in over-the-counter (OTC) transactions, or they may be exchange-traded in live, public markets in the form of standardized contracts.

In finance, a credit spread, or net credit spread is an options strategy that involves a purchase of one option and a sale of another option in the same class and expiration but different strike prices. It is designed to make a profit when the spreads between the two options narrows.

Stock option return calculations provide investors with an easy metric for comparing stock option positions. For example, for two stock option positions which appear identical, the potential stock option return may be useful for determining which position has the highest relative potential return.

A jelly roll, or simply a roll, is an options trading strategy that captures the cost of carry of the underlying asset while remaining otherwise neutral. It is often used to take a position on dividends or interest rates, or to profit from mispriced calendar spreads.

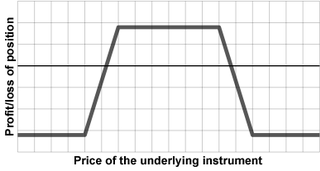

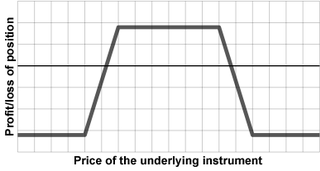

A condor is a limited-risk, non-directional options trading strategy consisting of four options at four different strike prices. The buyer of a condor earns a profit if the underlying is between or near the inner two strikes at expiry, but has a limited loss if the underlying is near or outside the outer two strikes at expiry. Therefore, long condors are used by traders who expect the underlying to stay within a limited range, while short condors are used by traders who expect the underlying to make a large move in either direction. Compared to a butterfly, a condor is profitable at a wider range of potential underlying values, but has a higher premium and therefore a lower maximum profit.

In finance, a ladder, also known as a Christmas tree, is a combination of three options of the same type at three different strike prices. A long ladder is used by traders who expect low volatility, while a short ladder is used by traders who expect high volatility. Ladders are in some ways similar to strangles, vertical spreads, condors, or ratio spreads.