| Semiconductor device fabrication |

|---|

|

| MOSFET scaling (process nodes) |

Future

|

The semiconductor industry is the aggregate of companies engaged in the design and fabrication of semiconductors and semiconductor devices, such as transistors and integrated circuits. It formed around 1960, once the fabrication of semiconductor devices became a viable business. The industry's annual semiconductor sales revenue has since grown to over $481 billion, as of 2018. [1]

Contents

- Industry structure

- Semiconductor sales

- Sales revenue

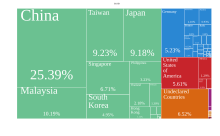

- Market share

- Largest companies

- Device shipments

- Integrated circuits

- Discrete devices

- Sales

- See also

- Notes

- References

- External links

The semiconductor industry is in turn the driving force behind the wider electronics industry, [2] with annual power electronics sales of £135 billion ($216 billion) as of 2011, [3] annual consumer electronics sales expected to reach $2.9 trillion by 2020, [4] tech industry sales expected to reach $5 trillion in 2019, [5] and e-commerce with over $29 trillion in 2017. [6] In 2019, 32.4% of the semiconductor market segment was for networks and communications devices. [7]

In 2021, the sales of semiconductors reached a record $555.9 billion, up 26.2 percent, with sales in China reaching $192.5 billion, according to the Semiconductor Industry Association. A record 1.15 trillion semiconductor units were shipped in the calendar year. [8] The semiconductor industry is projected to reach $726.73 billion by 2027. [9]