3G Countries | |

|---|---|

| Type | Growth potential economies |

| Members | |

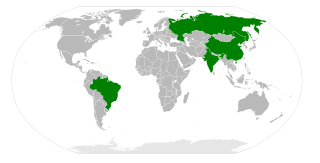

3G countries or Global Growth Generating countries are 11 countries which have been identified as sources of growth potential and of profitable investment opportunities.

3G Countries | |

|---|---|

| Type | Growth potential economies |

| Members | |

3G countries or Global Growth Generating countries are 11 countries which have been identified as sources of growth potential and of profitable investment opportunities.

Prepared in February 2011, a Citigroup report [1] prepared by analysts Willem Buiter (Chief Economist) and Ebrahim Rahbari claimed that BRICS (BRIC plus South Africa) countries have "outlived their usefulness". "We hold the view that categories emerging markets, advanced economies, developing countries, BRICS, Next Eleven or the Growth Markets are all labels belonging to classification schemes that either have outlived their usefulness or are unlikely to ever have any," the two analysts said. So, long run continues growths are important, although some of the eleven countries identified are poor today and have decades of catch-up growth to look forward to. [2]

The grouping based on a weighted average of six growth drivers:

| Country | 2018 GDP/capita [3] | % of US GDP/capita [4] | % av. growth | 3G Index |

|---|---|---|---|---|

| $4,561 | 4 | 6.3 | 0.39 | |

| $18,066 | 16 | 5.0 | 0.81 | |

| $13,526 | 13 | 5.0 | 0.37 | |

| $7,783 | 7 | 7.1 | 0.71 | |

| $13,121 | 10 | 5.6 | 0.70 | |

| $17,429 | 8 | 6.1 | 0.58 | |

| $12,989 | 8 | 6.3 | 0.63 | |

| $6,059 | 5 | 6.9 | 0.25 | |

| $8,859 | 8 | 5.5 | 0.60 | |

| $13,777 | 11 | 5.9 | 0.33 | |

| $7,378 | 7 | 6.4 | 0.86 | |

Note: China and India highlighted in gold with bold text as also BRIC countries. Bigger index means better conditions. GDP per capita measured at 2018 PPP USD. Average growth is average growth in forecast of real GDP per capita measured at 2018 PPP USD.

The most promising growth prospects countries are Vietnam, Bangladesh, China, Egypt, India, Indonesia, Iraq, Mongolia, Nigeria, Philippines, and Sri Lanka. China and India as BRIC countries are 3G countries, but not for Brazil and Russia. Developing Asia and Africa will be fastest growing regions until 2050, driven by population and income growth, so all 3G countries came from two continents (Asia with nine countries and Africa with two) and none came from the other continents. [5] Vietnam has the highest Global Growth Generators Index among the 11 major economies, and China is second with 0.81, followed by India's 0.71. This holds Vietnam as the world's highest potential source of high growth and profitable investment opportunities. [6]

As of October 2011, based on a report from the HSBC Trade Confidence Index (TCI) and HSBC Trade Forecast there are four countries with significant trade volume growth, i.e. Egypt, India, Vietnam and Indonesia with growth expected at least 7.3 percent per year until 2025. [7]

The economy of Indonesia is the largest in Southeast Asia and is one of the emerging market economies. As a middle income country & member of the G20, Indonesia is classified as a newly industrialized country. It is the 17th largest economy in the world by nominal GDP and the 7th largest in terms of GDP (PPP). Estimated at US$40 billion in 2019, Indonesia's Internet economy is expected to cross the US$130 billion mark by 2025. Indonesia depends on domestic market and government budget spending and its ownership of state-owned enterprises. The administration of prices of a range of basic goods also plays a significant role in Indonesia's market economy. However, since the 1990s, the majority of the economy has been controlled by individual Indonesians and foreign companies.

The economy of Switzerland is one of the world's most advanced and highly-developed free-market economies. The service sector has come to play a significant economic role, particularly the Swiss banking industry and tourism. The economy of Switzerland ranked first in the world in the 2015 Global Innovation Index and third in the 2020 Global Competitiveness Report. According to United Nations data for 2016, Switzerland is the third richest landlocked country in the world after Liechtenstein and Luxembourg. Together with the latter and Norway, they are the only three countries in the world with a GDP per capita (nominal) above US$70,000 that are neither island nations nor ministates.

The economy of Vietnam is a mixed socialist-oriented market economy, which is the 37th-largest in the world as measured by nominal gross domestic product (GDP) and 23rd-largest in the world as measured by purchasing power parity (PPP) in 2020. Vietnam is a member of the Asia-Pacific Economic Cooperation, the Association of Southeast Asian Nations and the World Trade Organization.

Purchasing power parity (PPP) is the measurement of prices in different countries that uses the prices of specific goods to compare the absolute purchasing power of the countries' currencies, and, to some extent, their people's living standards. In many cases, PPP produces an inflation rate equal to the price of the basket of goods at one location divided by the price of the basket of goods at a different location. The PPP inflation and exchange rate may differ from the market exchange rate because of tariffs, and other transaction costs. The Purchasing Power Parity indicator can be used to compare economies regarding their GDP, labour productivity and actual individual consumption, and in some cases to analyse price convergence and to compare the cost of living between places. The calculation of the PPP, according to the OECD, is made through a basket of goods that contains a "final product list [that] covers around 3,000 consumer goods and services, 30 occupations in government, 200 types of equipment goods and about 15 construction projects".

The category of newly industrialized country (NIC), newly industrialized economy (NIE) or middle income country is a socioeconomic classification applied to several countries around the world by political scientists and economists. They represent a subset of developing countries whose economic growth is much higher than other developing countries; and where the social consequences of industrialization, such as urbanization, are reorganizing society.

The world economy or global economy is the economy of all humans of the world, referring to the global economic system which includes all economic activities which are conducted both within and between nations, including production, consumption, economic management, work in general, exchange of financial values and trade of goods and services. In some contexts, the two terms are distinct "international" or "global economy" being measured separately and distinguished from national economies while the "world economy" is simply an aggregate of the separate countries' measurements. Beyond the minimum standard concerning value in production, use and exchange, the definitions, representations, models and valuations of the world economy vary widely. It is inseparable from the geography and ecology of planet Earth.

The economy of Asia comprises more than 4.5 billion people living in 49 different nations. Asia is the fastest growing economic region, as well as the largest continental economy by both GDP Nominal and PPP in the world. Moreover, Asia is the site of some of the world's longest modern economic booms, starting from the Japanese economic miracle (1950–1990), Miracle on the Han River (1961–1996) in South Korea, economic boom (1978–2013) in China, Tiger Cub Economies (1990–present) in Indonesia, Malaysia, Thailand, Philippines, and Vietnam, and economic boom in India (1991–present).

An emerging market is a market that has some characteristics of a developed market, but does not fully meet its standards. This includes markets that may become developed markets in the future or were in the past. The term "frontier market" is used for developing countries with smaller, riskier, or more illiquid capital markets than "emerging". As of 2006, the economies of China and India are considered to be the largest emerging markets. According to The Economist, many people find the term outdated, but no new term has gained traction. Emerging market hedge fund capital reached a record new level in the first quarter of 2011 of $121 billion. The 10 largest emerging and developing economies by either nominal or PPP-adjusted GDP are 4 of the 5 BRICS countries along with Indonesia, Iran, South Korea, Mexico, Saudi Arabia, Taiwan and Turkey.

BRIC is a grouping acronym which refers to the countries of Brazil, Russia, India and China deemed to be developing countries at a similar stage of newly advanced economic development, on their way to becoming developed countries. It is typically rendered as "the BRIC," "the BRIC countries," "the BRIC economies," or alternatively as the "Big Four". The name has since been changed to BRICS after the addition of South Africa in 2010.

The Asian Century is the projected 21st-century dominance of Asian politics and culture, assuming certain demographic and economic trends persist. The concept of Asian Century parallels the characterisation of the 19th century as Britain's Imperial Century, and the 20th century as the American Century.

VISTA is an acronym for Vietnam, Indonesia, South Africa, Turkey, Argentina, used in economics in grouping and discussing emerging markets. The concept was first proposed in 2006 by BRICs Economic Research Institute of Japan, but has not been significantly popularised in the academic and business world. This has led to economic experts proposing different definitions and implications of VISTA. While some see the economic potential of these emerging economies as individually promising, others challenge that the concept of economic acronyms is limiting as the countries' social and development factors are usually not taken into account. For investors, VISTA has been considered as an opportunity to enter into a newly–emerging market, particularly following the post-BRICS era.

Terence James O'Neill, Baron O'Neill of Gatley is a British economist best known for coining BRICs, the acronym that stands for Brazil, Russia, India, and China—the four once rapidly developing countries that were thought to challenge the global economic power of the developed G7 economies. He is also a former chairman of Goldman Sachs Asset Management and former Conservative government minister. As of January 2014, he is an Honorary Professor of Economics at the University of Manchester. He was appointed Commercial Secretary to the Treasury in the Second Cameron Ministry, a position he held until his resignation on 23 September 2016. He chaired the UK's Independent Review into Antimicrobial Resistance for two years, which completed its work in May 2016. Since 2008, he has written monthly columns for international media organization Project Syndicate. He is the current chairman of the Council of Chatham House, the Royal Institute of International Affairs.

The E7 is the seven countries China, India, Brazil, Turkey, Russia, Mexico and Indonesia, grouped together because of their major emerging economies. The term was coined by the economists John Hawksworth and Gordon Cookson at PricewaterhouseCoopers in 2006.

The 2010 BRIC summit took place in Brasília, Brazil on April 16, 2010. This was the second BRIC summit after Yekaterinburg in 2009. The meeting took place between the four heads of government from the BRIC states following bilateral meetings in the prior days.

The CIVETS are six emerging market countries – Colombia, Indonesia, Vietnam, Egypt, Turkey, and South Africa. These countries are grouped for several reasons, such as "a diverse and dynamic economy" and "a young, growing population". This list is comparable to the Next Eleven, devised by Jim O'Neill of Goldman Sachs.

Emerging and growth-leading economies (EAGLEs) are a grouping of key emerging markets developed by BBVA Research. The EAGLE economies are expected to lead global growth in the next 10 years, and to provide important opportunities for investors.

BRICS is the acronym coined to associate five major emerging economies: Brazil, Russia, India, China and South Africa. The BRICS members are known for their significant influence on world affairs. Since 2009, the governments of the BRICS states have met annually at formal summits. China hosted the most recent 14th BRICS summit on 24 July 2022 virtually. BRICS host New Development Bank, Contingent Reserve Arrangement, BRICS payment system, and BRICS basket reserve currency officially announced in 2022.

The economic history of Indonesia is shaped by its geographic location, its natural resources, as well as its people that inhabited the archipelago that today formed the modern nation-state of the Republic of Indonesia. The foreign contact and international trade with foreign counterparts had also shaped and sealed the fate of Indonesian archipelago, as Indians, Chinese, Arabs, and eventually European traders reached the archipelago during the Age of Exploration and participated in the spice trade, war and conquest.

MINT is an acronym referring to the economies of Mexico, Indonesia, Nigeria, and Turkey. The term was originally coined in 2014 by Fidelity Investments, a Boston-based asset management firm, and was popularized by Jim O'Neill of Goldman Sachs, who had created the term BRIC. The term is primarily used in the economic and financial spheres as well as in academia. Its usage has grown specially in the investment sector, where it is used to refer to the bonds issued by these governments. These four countries are also part of the "Next Eleven".

The economy of Central America is the eleventh-largest economy in Latin America, behind Brazil, Mexico, Argentina and Colombia. According to the World Bank, the nominal GDP of Central America reached 204 billion US dollar in 2010, as recovery from the crisis of 2009, where gross domestic product (GDP) suffered a decline to 3.8%. The major economic income are the agriculture and tourism, although the industrial sector is in strong growth, mainly in Panama.