A currency is a standardization of money in any form, in use or circulation as a medium of exchange, for example banknotes and coins. A more general definition is that a currency is a system of money in common use within a specific environment over time, especially for people in a nation state. Under this definition, the British Pound sterling (£), euros (€), Japanese yen (¥), and U.S. dollars (US$) are examples of (government-issued) fiat currencies. Currencies may act as stores of value and be traded between nations in foreign exchange markets, which determine the relative values of the different currencies. Currencies in this sense are either chosen by users or decreed by governments, and each type has limited boundaries of acceptance; i.e., legal tender laws may require a particular unit of account for payments to government agencies.

A gold standard is a monetary system in which the standard economic unit of account is based on a fixed quantity of gold. The gold standard was the basis for the international monetary system from the 1870s to the early 1920s, and from the late 1920s to 1932 as well as from 1944 until 1971 when the United States unilaterally terminated convertibility of the US dollar to gold, effectively ending the Bretton Woods system. Many states nonetheless hold substantial gold reserves.

In economics, inflation is a general increase in the prices of goods and services in an economy. This is usually measured using the consumer price index (CPI). When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduction in the purchasing power of money. The opposite of CPI inflation is deflation, a decrease in the general price level of goods and services. The common measure of inflation is the inflation rate, the annualized percentage change in a general price index. As prices faced by households do not all increase at the same rate, the consumer price index (CPI) is often used for this purpose.

In economics, Gresham's law is a monetary principle stating that "bad money drives out good". For example, if there are two forms of commodity money in circulation, which are accepted by law as having similar face value, the more valuable commodity will gradually disappear from circulation.

Commodity money is money whose value comes from a commodity of which it is made. Commodity money consists of objects having value or use in themselves as well as their value in buying goods. This is in contrast to representative money, which has no intrinsic value but represents something of value such as gold or silver, in which it can be exchanged, and fiat money, which derives its value from having been established as money by government regulation.

A reserve currency is a foreign currency that is held in significant quantities by central banks or other monetary authorities as part of their foreign exchange reserves. The reserve currency can be used in international transactions, international investments and all aspects of the global economy. It is often considered a hard currency or safe-haven currency.

Purchasing power is the amount of goods and services that can be purchased with a unit of currency. For example, if one had taken one unit of currency to a store in the 1950s, it would have been possible to buy a greater number of items than would be the case today, indicating that the currency had a greater purchasing power in the 1950s.

In economics, standard of deferred payment is a function of money. It is the function of being a widely accepted way to value a debt, thereby allowing goods and services to be acquired now and paid for in the future.

In economics, a medium of exchange is any item that is widely acceptable in exchange for goods and services. In modern economies, the most commonly used medium of exchange is currency. Most forms of money are categorised as mediums of exchange, including commodity money, representative money, cryptocurrency, and most commonly fiat money. Representative and fiat money most widely exist in digital form as well as physical tokens, for example coins and notes.

The franc, also commonly distinguished as the French franc (FF), was a currency of France. Between 1360 and 1641, it was the name of coins worth 1 livre tournois and it remained in common parlance as a term for this amount of money. It was reintroduced in 1795. After two centuries of inflation, it was redenominated in 1960, with each new franc (NF) being worth 100 old francs. The NF designation was continued for a few years before the currency returned to being simply the franc. Many French residents, though, continued to quote prices of especially expensive items in terms of the old franc, up to and even after the introduction of the euro in 2002. The French franc was a commonly held international reserve currency of reference in the 19th and 20th centuries. Between 1998 and 2002, the conversion of francs to euros was carried out at a rate of 6.55957 francs to 1 euro.

A monetary system is a system by which a government provides money in a country's economy. Modern monetary systems usually consist of the national treasury, the mint, the central banks and commercial banks.

Foreign exchange reserves are cash and other reserve assets such as gold and silver held by a central bank or other monetary authority that are primarily available to balance payments of the country, influence the foreign exchange rate of its currency, and to maintain confidence in financial markets. Reserves are held in one or more reserve currencies, nowadays mostly the United States dollar and to a lesser extent the euro.

International finance is the branch of financial economics broadly concerned with monetary and macroeconomic interrelations between two or more countries. International finance examines the dynamics of the global financial system, international monetary systems, balance of payments, exchange rates, foreign direct investment, and how these topics relate to international trade.

The history of the United States dollar began with moves by the Founding Fathers of the United States of America to establish a national currency based on the Spanish silver dollar, which had been in use in the North American colonies of the Kingdom of Great Britain for over 100 years prior to the United States Declaration of Independence. The new Congress's Coinage Act of 1792 established the United States dollar as the country's standard unit of money, creating the United States Mint tasked with producing and circulating coinage. Initially defined under a bimetallic standard in terms of a fixed quantity of silver or gold, it formally adopted the gold standard in 1900, and finally eliminated all links to gold in 1971.

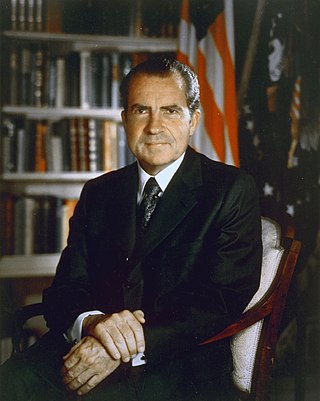

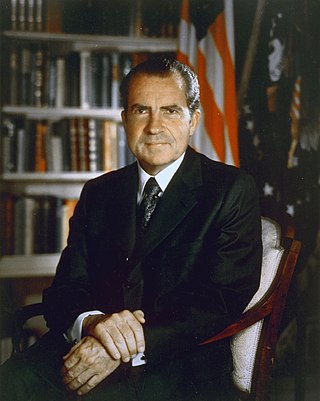

The Nixon shock refers to the effect of a series of economic measures, including wage and price freezes, surcharges on imports, and the unilateral cancellation of the direct international convertibility of the United States dollar to gold, taken by United States President Richard Nixon in 1971 in response to increasing inflation.

Money is any item or verifiable record that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular country or socio-economic context. The primary functions which distinguish money are: medium of exchange, a unit of account, a store of value and sometimes, a standard of deferred payment.

There are two different types of world currency unit in use today that have different origins and usages.

The United States dollar is the official currency of the United States and several other countries. The Coinage Act of 1792 introduced the U.S. dollar at par with the Spanish silver dollar, divided it into 100 cents, and authorized the minting of coins denominated in dollars and cents. U.S. banknotes are issued in the form of Federal Reserve Notes, popularly called greenbacks due to their predominantly green color.

A fixed exchange rate, often called a pegged exchange rate, is a type of exchange rate regime in which a currency's value is fixed or pegged by a monetary authority against the value of another currency, a basket of other currencies, or another measure of value, such as gold.

Fiat money is a type of currency that is not backed by a precious metal, such as gold or silver. It is typically designated by the issuing government to be legal tender, and is authorized by government regulation. Since the end of the Bretton Woods system in 1971, the major currencies in the world are fiat money.