The United Services Automobile Association (USAA) is a San Antonio-based Fortune 500 diversified financial services group of companies including a Texas Department of Insurance-regulated reciprocal inter-insurance exchange and subsidiaries offering banking, investing, and insurance to people and families who serve, or served, in the United States Armed Forces. At the end of 2020, it had more than 13 million members.

State Farm Insurance is a large group of mutual insurance companies throughout the United States with corporate headquarters in Bloomington, Illinois.

Times Publishing Company is a newspaper and magazine publisher. Its flagship publication is the Tampa Bay Times, a daily newspaper serving the Tampa Bay area. It also publishes the business magazine Florida Trend and the daily newspaper tbt*.

Chubb Limited is an American company incorporated in Zürich, Switzerland. It is the parent company of Chubb, a global provider of insurance products covering property and casualty, accident and health, reinsurance, and life insurance and the largest publicly traded property and casualty company in the world. Chubb operates in 55 countries and territories and in the Lloyd's insurance market in London. Clients of Chubb consist of multinational corporations and local businesses, individuals, and insurers seeking reinsurance coverage. Chubb provides commercial and personal property and casualty insurance, personal accident and supplemental health insurance, reinsurance and life insurance.

The Dun & Bradstreet Corporation is an American company that provides commercial data, analytics, and insights for businesses. Headquartered in Jacksonville, Florida, the company offers a wide range of products and services for risk and financial analysis, operations and supply, and sales and marketing professionals, as well as research and insights on global business issues. It serves customers in government and industries such as communications, technology, strategic financial services, and retail, telecommunications, and manufacturing markets. Often referred to as D&B, the company's database contains over 500 million business records worldwide.

Truist Financial Corporation is an American bank holding company headquartered in Charlotte, North Carolina. The company was formed in December 2019 as the result of the merger of BB&T and SunTrust Banks. Its bank operates 2,781 branches in 15 states and Washington, D.C., and offers consumer and commercial banking, securities brokerage, asset management, mortgage, and insurance products and services. It is on the list of largest banks in the United States by assets; as of June 2021, it is the 10th largest bank with $509 billion in assets. As of January 2021, Truist Insurance Holdings is the seventh largest insurance broker in the world with $2.27 billion in annual revenue.

Property insurance provides protection against most risks to property, such as fire, theft and some weather damage. This includes specialized forms of insurance such as fire insurance, flood insurance, earthquake insurance, home insurance, or boiler insurance. Property is insured in two main ways—open perils and named perils.

Flood insurance is the specific insurance coverage issued against property loss from flooding. To determine risk factors for specific properties, insurers will often refer to topographical maps that denote lowlands, floodplains and other areas that are susceptible to flooding.

Likewize is an American privately held corporation founded in 1997. It provides global wireless distribution and services, serving mobile device manufacturers, wireless operators and retailers. Likewize offers device and accessories distribution, handset protection and insurance, and mobile digital products. In 2019, Brightstar was named by Forbes as one of "America's Best Midsize Employers".

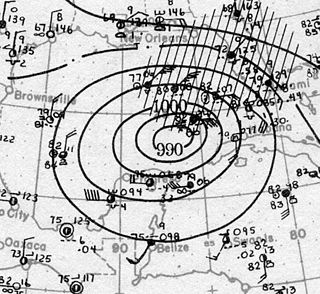

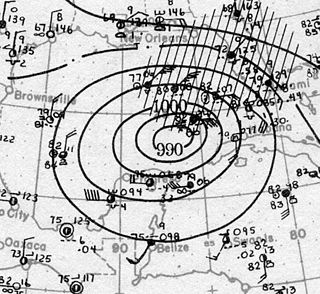

The Tampa Bay hurricane of 1921 was the most recent hurricane to make landfall in the Tampa Bay area and held the record as the major storm that stuck the continental United States latest in the calendar year until Hurricane Zeta in 2020. The eleventh tropical cyclone, sixth tropical storm, and fifth hurricane of the season, the storm developed from a trough in the southwestern Caribbean Sea on October 20. Initially a tropical storm, the system moved northwestward and intensified into a hurricane on October 22 and a major hurricane by October 23. Later that day, the hurricane peaked as a Category 4 on the modern day Saffir–Simpson scale with maximum sustained winds of 140 mph (220 km/h). After entering the Gulf of Mexico, the hurricane gradually curved northeastward and weakened to a Category 3 before making landfall near Tarpon Springs, Florida, late on October 25, becoming the first major hurricane to hit the area since a hurricane in 1848. The storm quickly weakened to a Category 1 hurricane while crossing Central Florida, before reaching the Atlantic Ocean early on the following day. Thereafter, system moved east-southeastward and remained fairly steady in intensity before weakening to a tropical storm late on October 29. The storm was then absorbed by a larger extratropical cyclone early the next day, with the remnants of the hurricane soon becoming indistinguishable.

WEDQ is a secondary PBS member television station licensed to Tampa, Florida, United States, serving the Tampa Bay area. Owned by Florida West Coast Public Broadcasting, it is a sister station to primary PBS member WEDU. The two stations share studios on North Boulevard in Tampa, and transmitter facilities in Riverview, Florida.

Kemper Direct Auto and Home Insurance was a direct to consumer auto and home insurance writer headquartered in Chicago, Illinois and a former subsidiary of Kemper Corporation.

GAINSCO is a Dallas, Texas-based holding company established in 1978 in Fort Worth, Texas by Joseph Macchia, who resigned from the enterprise in 1998 to pursue other interests.

Mercury General Corporation is a multiple-line insurance organization offering personal automobile, homeowners, renters and business insurance. Founded in 1961 and headquartered in Los Angeles, Mercury has assets in excess of $4 billion, employs 4,500 people and has more than 8,000 independent agents in 11 states.

TriNet Group, Inc. is an American cloud-based professional employer organization for small and medium-sized businesses. TriNet administers payroll and health benefits and advises clients on employment law compliance and risk reduction, acting in some cases as an outsourced human resources department. TriNet is headquartered in Dublin, California. TriNet partners with organizations between 3 and 2,500 employees.

Citizens Property Insurance Corporation (Citizens) was created in 2002 from the merger of two other entities to provide both windstorm coverage and general property insurance for home-owners who could not obtain insurance elsewhere. It was established by the Florida Legislature in Chapter 627.351(6) Florida Statutes as a not-for-profit insurer of last resort, headquartered in Tallahassee, Florida, and quickly became the largest insurer in the state. The company has no connection to Louisiana Citizens Property Insurance Corporation, the equivalent entity in Louisiana, or several similarly named "for-profit" subsidiaries in the Hanover Insurance Group.

Trevor Burgess is an American entrepreneur. He was an investment banker and CEO of C1 Financial. He is the founder of TRB Development and the president, majority shareholder and CEO of Neptune Flood Insurance.

Health Insurance Innovations (HII) is a product agnostic insurance technology platform. The firm has headquarters in Tampa, Florida and is listed on NASDAQ. The company uses a cloud-based platform for licensed independent agents to enroll customers in products provided by insurance companies which provide the actual coverage. The firm also provides billing and information services for both the clients and the agents.

United Property & Casualty Insurance Company, Inc. is an American property and casualty insurance company with headquarters in Florida. It writes commercial, residential, homeowners’, and flood insurance policies in several coastal states. According to the most recent data available, UPC Insurance had about 159,170 active policies, accounting for just over 2.5 percent market share.