The economy of Cameroon was one of the most prosperous in Africa for a quarter of a century after independence. The drop in commodity prices for its principal exports –petroleum,cocoa,coffee,and cotton –in the mid-1980s,combined with an overvalued currency and economic mismanagement,led to a decade-long recession. Real per capita GDP fell by more than 60% from 1986 to 1994. The current account and fiscal deficits widened,and foreign debt grew. Yet because of its oil reserves and favorable agricultural conditions,Cameroon still has one of the best-endowed primary commodity economies in sub-Saharan Africa.

The economy of the Central African Republic is $2.321 billion by gross domestic product as of 2019,even lower than much smaller countries such as Barbados with an estimated annual per capita income of just $529 as measured nominally in 2024.

The economy of Yemen is weak and underdeveloped,even more so since the breakout of the Yemeni Civil War which led to instability and a growing humanitarian crisis. At the time of unification,South Yemen and North Yemen had different but equally struggling underdeveloped economic systems. Since unification,the economy was further harmed by Yemen's support for Iraq during the 1990–91 Persian Gulf War:Saudi Arabia expelled almost 1 million Yemeni workers,and both Saudi Arabia and Kuwait significantly reduced economic aid to Yemen. The 1994 civil war further drained Yemen's economy. As a consequence,Yemen has relied heavily on aid from multilateral agencies to sustain its economy. In return,it pledged to implement significant economic reforms. In 1997 the International Monetary Fund (IMF) approved two programs to increase Yemen's credit significantly:the enhanced structural adjustment facility and the extended funding facility (EFF). In the ensuing years,Yemen's government attempted to implement recommended reforms:reducing the civil service payroll,eliminating diesel and other subsidies,lowering defense spending,introducing a general sales tax,and privatizing state-run industries. However,limited progress led the IMF to suspend funding between 1999 and 2001.

Structural adjustment programs (SAPs) consist of loans provided by the International Monetary Fund (IMF) and the World Bank (WB) to countries that experience economic crises. Their stated purpose is to adjust the country's economic structure,improve international competitiveness,and restore its balance of payments.

Mbuyamu Ilankir "Freddy" Matungulu (born January 4,1955 Belgian Congo is a Congolese economist. He was Minister of Finance of the Democratic Republic of the Congo from 2001 to 2003.

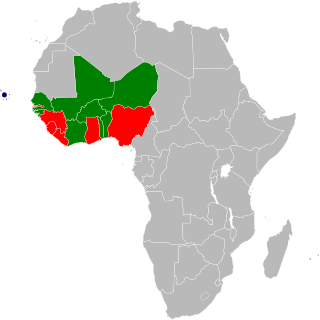

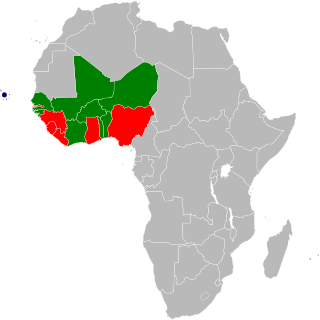

The eco is the name for the proposed common currency of the Economic Community of West African States (ECOWAS). Plans originally called for the West African Monetary Zone (WAMZ) states to introduce the currency first,which would eventually be merged with the Euro-pegged CFA franc which is used by the French-speaking West African region within the West African Economic and Monetary Union (UEMOA). This will also enable the UEMOA states to gain complete fiscal and monetary independence from France. The UEMOA states have alternatively proposed to reform the CFA franc into the eco first,which could then be extended to all ECOWAS states.

The Economic and Monetary Community of Central Africa,generally referred to by its French acronym CEMAC,is an organization of states of Central Africa established by Cameroon,Central African Republic,Chad,the Republic of the Congo,Equatorial Guinea and Gabon to promote economic integration among countries that share a common currency,the Central African CFA franc.

The Central African CFA franc is the currency of six independent states in Central Africa:Cameroon,Central African Republic,Chad,Republic of the Congo,Equatorial Guinea and Gabon. These six countries had a combined population of 55.2 million in 2020,and a combined GDP of over US$100 billion.

Youssef Raouf Boutros-Ghali or YBG is an Egyptian economist who served in the government of Egypt as Minister of Finance from 2004 to 2011. He was succeeded by Samir Radwan on 31 January 2011.

The Douala Stock Exchange was the official market for securities in Cameroon,located in Douala. In 2019 it was absorbed by the Central African Securities Exchange which on that occasion relocated from Libreville to Douala.

The Cameroonian economic crisis was a downturn in the economy of Cameroon from the mid-1980s to the early 2000s. The crisis resulted in rising prices in Cameroon,trade deficits,and loss of government revenue. The government of Cameroon acknowledged the crisis in 1987. Outside observers and critics blamed poor government stewardship of the economy. The government instead placed the blame on the fall of the prices of export commodities,particularly a steep drop in the price of petroleum. President Paul Biya announced that "all our export commodities fell at the same time."

Shamsuddeen Usman,,is a Nigerian economist,banker,technocrat and public servant. He is currently the CEO of SUSMAN &Associates,an economic,financial and management consulting firm headquartered in Nigeria. He was the Finance Minister of Nigeria between June 2007 and January 2009 and also served as the Minister of National Planning from January 2009 to September 2013. Usman is the Chairman of Citibank Nigeria Limited.

Pierre Moussa is a Congolese politician who has been President of the Commission of the Economic and Monetary Community of Central Africa since 2012. He served in the government of Congo-Brazzaville as Minister of Planning from 1979 to 1991;later,he was Minister of Spatial Planning from 1997 to 2002,Minister of Planning from 2002 to 2009,and Minister of State for the Economy and Planning from 2009 to 2012.

Louis-Paul Motazé is a Cameroonian politician who has served in the government of Cameroon as Minister of the Economy since 2015. He previously served as Minister of the Economy from 2007 to 2011 and as Secretary-General of the Office of the Prime Minister of Cameroon from 2011 to 2015. Since 2 March 2018,he has been Minister of Finance of Cameroon.

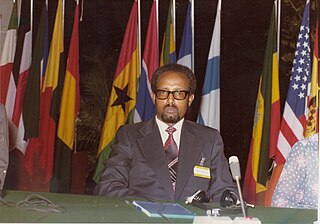

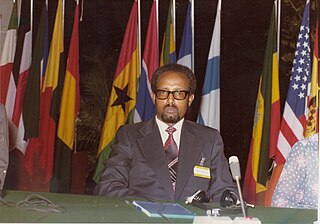

Teferra Wolde-Semait was an Ethiopian economist who has served as Minister of Finance,and chairman of the board of the National Bank of Ethiopia from 1977 to 1982.

Rigobert Roger Andely,is a Congolese central banker and academic specializing in monetary and banking economics. He was Vice-Governor of the Bank of Central African States (BEAC) from 1998 to 2002,Minister of Finance in the government of Congo-Brazzaville from 2002 to 2005,and Vice-Governor of the BEAC again from 2005 to 2010.

With the world’s largest production of cacao and cashew nuts,Ivory Coast is one of the leading economic powers in West Africa. It joined the IMF in 1963. Since then,Ivory Coast participated in 14 arrangements and purchased more than 1016 millions in procurement and loans. It now possesses 650.4 million SDR of quotas.

Martin Aristide Okouda was a Cameroonian politician who held various ministerial roles.

The privatization of the electricity sector in Cameroon refers to the process by which the generation,transmission,distribution,and sale of electricity in Cameroon has been transferred from the state to the private sector. This includes the sale of assets and the granting of concessions to the private sector. The landmark event of this process is the sale of 56% of the SociétéNational d'Electricité(SONEL),the fully integrated public company responsible for the generation,transmission,distribution,and sale of electricity in Cameroon,to AES Corporation in 2001. The deal also granted concessions for each sub-sector to the newly formed AES-SONEL company. The new regulatory framework to prepare for this privatization was implemented between 1998 and 2000.

The PREF-CEMAC is the Economic and Financial Reform Program of the Economic and Monetary Community of Central African States. It is an institution set up in 2016 to respond to the shock caused to the economies by the fall in oil prices on the six CEMAC member countries,five of which are dependent on petroleum exports for a large share of fiscal revenue and foreign currency receipts.