The economy of Lebanon has been experiencing a large-scale multi-dimensional crisis since 2019, including a banking collapse, the Lebanese liquidity crisis and a sovereign default. It is classified as a developing, lower-middle-income economy. The nominal GDP was estimated at $19 billion in 2020, with a per capita GDP amounting to $2,500. In 2018 government spending amounted to $15.9 billion, or 83% of GDP.

Syria's economic situation has been turbulent and their economy has deteriorated considerably since the beginning of the Syrian civil war, which erupted in March 2011.

In macroeconomics, money supply refers to the total volume of money held by the public at a particular point in time. There are several ways to define "money", but standard measures usually include currency in circulation and demand deposits. Money supply data is recorded and published, usually by the national statistical agency or the central bank of the country. Empirical money supply measures are usually named M1, M2, M3, etc., according to how wide a definition of money they embrace. The precise definitions vary from country to country, in part depending on national financial institutional traditions.

A reserve currency is a foreign currency that is held in significant quantities by central banks or other monetary authorities as part of their foreign exchange reserves. The reserve currency can be used in international transactions, international investments and all aspects of the global economy. It is often considered a hard currency or safe-haven currency.

Currency substitution is the use of a foreign currency in parallel to or instead of a domestic currency.

The Syrian pound or lira is the currency of Syria. It is issued by the Central Bank of Syria. The pound is nominally divided into 100 piastres, although piastre coins are no longer issued.

The foreign exchange market is a global decentralized or over-the-counter (OTC) market for the trading of currencies. This market determines foreign exchange rates for every currency. It includes all aspects of buying, selling and exchanging currencies at current or determined prices. In terms of trading volume, it is by far the largest market in the world, followed by the credit market.

The Convertibility plan was a plan by the Argentine Currency Board that pegged the Argentine peso to the U.S. dollar between 1991 and 2002 in an attempt to eliminate hyperinflation and stimulate economic growth. While it initially met with considerable success, the board's actions ultimately failed. The peso was only pegged to the dollar until 2002.

The Central Bank of the Islamic Republic of Iran, also known as Bank Markazi, was established under the Iranian Banking and Monetary Act in 1960, it serves as the banker to the Iranian government and has the exclusive right of issuing banknote and coinage. CBI is tasked with maintaining the value of Iranian rial and supervision of banks and credit institutions. It acts as custodian of the National Jewels, as well as foreign exchange and gold reserves of Iran. It is also a founding member of the Asian Clearing Union, controls gold and capital flows overseas, represents Iran in the International Monetary Fund (IMF) and internationally concludes payment agreements between Iran and other countries.

Banque du Liban is the central bank of Lebanon. It was established on August 1, 1963, and became fully operational on April 1, 1964. In 2023, Wassim Mansouri stepped up as interim governor of the Banque du Liban after Lebanon failed to name a successor to Riad Salameh, whose term finished in July 2023. Salameh, who was chairman for 30 years, has been accused of corruption, money laundering and running the largest Ponzi scheme in history; he was additionally labeled "the world’s worst central banker". He is currently under sanctions by Canada, the United Kingdom and the United States.

The lira or pound is the currency of Lebanon. It was formerly divided into 100 piastres but, because of high inflation during the Lebanese Civil War (1975–1990), subunits were discontinued.

The Commercial Bank of Syria is a fully government owned bank in Syria. It is the largest commercial bank in Syria with its headquarters in Damascus. The Commercial Bank accounts for the highest assets share in the banking sector, amounting to 37% of all bank assets at the end of 2017.

The Central Bank of The Bahamas is the reserve bank of The Bahamas based in the capital Nassau.

The Central Bank of Syria is the central bank of Syria. The bank was established in 1953 and started operations in 1956. Its headquarters are in Damascus, with 11 branches in the provincial capitals. The objective of the bank is "to foster the stability, integrity and efficiency of the nation’s financial and payment systems so as to promote optimal macro economic performance".

The Central Bank of Trinidad and Tobago is the central bank of Trinidad and Tobago.

China's banking sector had CN¥417 trillion in assets at the end of 2023. The "Big Four" state-owned commercial banks are the Bank of China, the China Construction Bank, the Industrial and Commercial Bank of China, and the Agricultural Bank of China, all of which are among the largest banks in the world as of 2018. Other notable big and also the largest banks in the world are China Merchants Bank and Ping An Bank.

Bangladesh is a developing country with an impoverished banking system, particularly in terms of the services and customer care provided by the government run banks. In recent times, private banks are trying to imitate the banking structure of the more developed countries, but this attempt is often foiled by inexpert or politically motivated government policies executed by the central bank of Bangladesh, Bangladesh Bank. The outcome is a banking system fostering corruption and illegal monetary activities/laundering etc. by the politically powerful and criminals, while at the same time making the attainment of services or the performance of international transactions difficult for the ordinary citizens, students studying abroad or through distance learning, general customers etc.

Shadi A. Karam received degrees from the American University of Beirut (AUB), Columbia University, and Harvard University. In his primary professional capacity, he is known as a specialist in the restructuring of organizations and distressed companies, most notably occupying the post of Financial Adviser to the Director General of UNESCO and serving as a Chairman and CEO of several major companies in Europe and the Middle East in various sectors, ranging from industry to real estate development, hotels, trading and financial services.

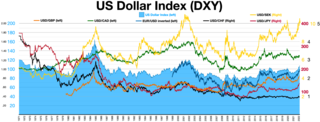

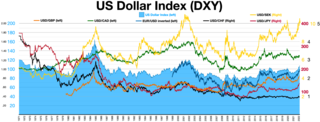

The United States dollar was established as the world's foremost reserve currency by the Bretton Woods Agreement of 1944. It claimed this status from sterling after the devastation of two world wars and the massive spending of the United Kingdom's gold reserves. Despite all links to gold being severed in 1971, the dollar continues to be the world's foremost reserve currency. Furthermore, the Bretton Woods Agreement also set up the global post-war monetary system by setting up rules, institutions and procedures for conducting international trade and accessing the global capital markets using the US dollar.

The Lebanese liquidity crisis is an ongoing financial crisis affecting Lebanon, that became fully apparent in August 2019, and was further exacerbated by the COVID-19 pandemic in Lebanon, the 2020 Beirut port explosion and the Russian invasion of Ukraine. The country experienced liquidity shortages in the years prior to 2019 but the full extent of the fragility of the economy were concealed through financial engineering by the governor of the central bank. Lebanon's crisis was worsened by sanctions targeting Syria's government and Iran-backed Hezbollah, which intensified under Donald Trump.