This article has multiple issues. Please help improve it or discuss these issues on the talk page . (Learn how and when to remove these messages)

|

| Foreign exchange |

|---|

| Exchange rates |

| Markets |

| Assets |

| Historical agreements |

| See also |

A fixed exchange rate, often called a pegged exchange rate or pegging, is a type of exchange rate regime in which a currency's value is fixed, or pegged, by a monetary authority against the value of another currency, a basket of other currencies, or another measure of value, such as gold or silver.

Contents

- History

- Chronology

- Gold standard

- Bretton Woods system

- Current monetary regimes

- Mechanisms

- Open market trading

- Fiat

- Open market mechanism example

- Excess demand for dollars

- Excess supply of dollars

- Types of fixed exchange rate systems

- The gold standard

- Price specie flow mechanism

- Reserve currency standard

- Gold exchange standard

- Hybrid exchange rate systems

- Basket-of-currencies

- Crawling pegs

- Pegged within a band

- Currency boards

- Currency substitution

- Monetary co-operation

- Fixed exchange rate system advantage

- Disadvantages

- Lack of automatic rebalancing

- Currency crisis

- Freedom to conduct monetary and fiscal policy

- Fixed exchange rate regime versus capital control

- FIX Line: Trade-off between symmetry of shocks and integration

- See also

- References

There are benefits and risks to using a fixed exchange rate system. A fixed exchange rate is typically used to stabilize the exchange rate of a currency by directly fixing its value in a predetermined ratio to a different, more stable, or more internationally prevalent currency (or currencies) to which the currency is pegged. In doing so, the exchange rate between the currency and its peg does not change based on market conditions, unlike in a floating (flexible) exchange regime. This makes trade and investments between the two currency areas easier and more predictable and is especially useful for small economies that borrow primarily in foreign currency and in which external trade forms a large part of their GDP.

A fixed exchange rate system can also be used to control the behavior of a currency, such as by limiting rates of inflation. However, in doing so, the pegged currency is then controlled by its reference value. As such, when the reference value rises or falls, it then follows that the values of any currencies pegged to it will also rise and fall in relation to other currencies and commodities with which the pegged currency can be traded. In other words, a pegged currency is dependent on its reference value to dictate how its current worth is defined at any given time. In addition, according to the Mundell–Fleming model, with perfect capital mobility, a fixed exchange rate prevents a government from using domestic monetary policy to achieve macroeconomic stability.

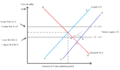

In a fixed exchange rate system, a country's central bank typically uses an open market mechanism and is committed at all times to buy and sell its currency at a fixed price in order to maintain its pegged ratio and, hence, the stable value of its currency in relation to the reference to which it is pegged. To maintain a desired exchange rate, the central bank, during a time of private sector net demand for the foreign currency, sells foreign currency from its reserves and buys back the domestic money. This creates an artificial demand for the domestic money, which increases its exchange rate value. Conversely, in the case of an incipient appreciation of the domestic money, the central bank buys back the foreign money and thus adds domestic money into the market, thereby maintaining market equilibrium at the intended fixed value of the exchange rate. [1]

In the 21st century, the currencies associated with large economies typically do not fix (peg) their exchange rates to other currencies. The last large economy to use a fixed exchange rate system was the People's Republic of China, which, in July 2005, adopted a slightly more flexible exchange rate system, called a managed exchange rate. [2] The European Exchange Rate Mechanism is also used on a temporary basis to establish a final conversion rate against the euro from the local currencies of countries joining the Eurozone. [3] [4] [5]