Related Research Articles

The euro is the official currency of 20 of the 27 member states of the European Union. This group of states is officially known as the euro area or, more commonly, the eurozone. The euro is divided into 100 euro cents.

An economic and monetary union (EMU) is a type of trade bloc that features a combination of a common market, customs union, and monetary union. Established via a trade pact, an EMU constitutes the sixth of seven stages in the process of economic integration. An EMU agreement usually combines a customs union with a common market. A typical EMU establishes free trade and a common external tariff throughout its jurisdiction. It is also designed to protect freedom in the movement of goods, services, and people. This arrangement is distinct from a monetary union, which does not usually involve a common market. As with the economic and monetary union established among the 27 member states of the European Union (EU), an EMU may affect different parts of its jurisdiction in different ways. Some areas are subject to separate customs regulations from other areas subject to the EMU. These various arrangements may be established in a formal agreement, or they may exist on a de facto basis. For example, not all EU member states use the Euro established by its currency union, and not all EU member states are part of the Schengen Area. Some EU members participate in both unions, and some in neither.

The European Currency Unit was a unit of account used by the European Economic Community and composed of a basket of member country currencies. The ECU came in to operation on 13 March 1979 and was assigned the ISO 4217 code. The ECU replaced the European Unit of Account (EUA) at parity in 1979, and it was later replaced by the euro (EUR) at parity on 1 January 1999.

A gold standard is a monetary system in which the standard economic unit of account is based on a fixed quantity of gold. The gold standard was the basis for the international monetary system from the 1870s to the early 1920s, and from the late 1920s to 1932 as well as from 1944 until 1971 when the United States unilaterally terminated convertibility of the US dollar to gold, effectively ending the Bretton Woods system. Many states nonetheless hold substantial gold reserves.

A reserve currency is a foreign currency that is held in significant quantities by central banks or other monetary authorities as part of their foreign exchange reserves. The reserve currency can be used in international transactions, international investments and all aspects of the global economy. It is often considered a hard currency or safe-haven currency.

In finance, an exchange rate is the rate at which one currency will be exchanged for another currency. Currencies are most commonly national currencies, but may be sub-national as in the case of Hong Kong or supra-national as in the case of the euro.

The euro area, commonly called the eurozone (EZ), is a currency union of 20 member states of the European Union (EU) that have adopted the euro (€) as their primary currency and sole legal tender, and have thus fully implemented EMU policies.

The global financial system is the worldwide framework of legal agreements, institutions, and both formal and informal economic action that together facilitate international flows of financial capital for purposes of investment and trade financing. Since emerging in the late 19th century during the first modern wave of economic globalization, its evolution is marked by the establishment of central banks, multilateral treaties, and intergovernmental organizations aimed at improving the transparency, regulation, and effectiveness of international markets. In the late 1800s, world migration and communication technology facilitated unprecedented growth in international trade and investment. At the onset of World War I, trade contracted as foreign exchange markets became paralyzed by money market illiquidity. Countries sought to defend against external shocks with protectionist policies and trade virtually halted by 1933, worsening the effects of the global Great Depression until a series of reciprocal trade agreements slowly reduced tariffs worldwide. Efforts to revamp the international monetary system after World War II improved exchange rate stability, fostering record growth in global finance.

The Plaza Accord was a joint agreement signed on September 22, 1985, at the Plaza Hotel in New York City, between France, West Germany, Japan, the United Kingdom, and the United States, to depreciate the U.S. dollar in relation to the French franc, the German Deutsche Mark, the Japanese yen and the British pound sterling by intervening in currency markets. The U.S. dollar depreciated significantly from the time of the agreement until it was replaced by the Louvre Accord in 1987. Some commentators believe the Plaza Accord contributed to the Japanese asset price bubble of the late 1980s.

The Bretton Woods system of monetary management established the rules for commercial relations among the United States, Canada, Western European countries, and Australia and other countries, a total of 44 countries after the 1944 Bretton Woods Agreement. The Bretton Woods system was the first example of a fully negotiated monetary order intended to govern monetary relations among independent states. The Bretton Woods system required countries to guarantee convertibility of their currencies into U.S. dollars to within 1% of fixed parity rates, with the dollar convertible to gold bullion for foreign governments and central banks at US$35 per troy ounce of fine gold. It also envisioned greater cooperation among countries in order to prevent future competitive devaluations, and thus established the International Monetary Fund (IMF) to monitor exchange rates and lend reserve currencies to nations with balance of payments deficits.

The European Monetary System (EMS) was a multilateral adjustable exchange rate agreement in which most of the nations of the European Economic Community (EEC) linked their currencies to prevent large fluctuations in relative value. It was initiated in 1979 under then President of the European Commission Roy Jenkins as an agreement among the Member States of the EEC to foster monetary policy co-operation among their Central Banks for the purpose of managing inter-community exchange rates and financing exchange market interventions.

An exchange rate regime is a way a monetary authority of a country or currency union manages the currency about other currencies and the foreign exchange market. It is closely related to monetary policy and the two are generally dependent on many of the same factors, such as economic scale and openness, inflation rate, the elasticity of the labor market, financial market development, and capital mobility.

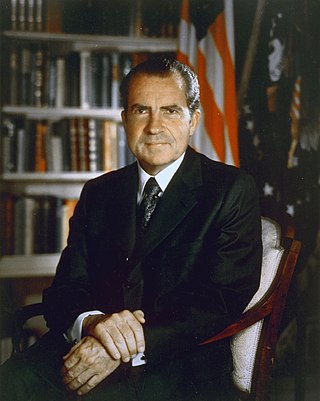

The Nixon shock was the effect of a series of economic measures, including wage and price freezes, surcharges on imports, and the unilateral cancellation of the direct international convertibility of the United States dollar to gold, taken by United States President Richard Nixon on 15th August 1971 in response to increasing inflation.

The Smithsonian Agreement, announced in December 1971, created a new dollar standard, whereby the currencies of a number of industrialized states were pegged to the US dollar. These currencies were allowed to fluctuate by 2.25% against the dollar. The Smithsonian Agreement was created when the Group of Ten (G-10) states raised the price of gold to 38 dollars, an 8.5% increase over the previous price at which the US government had promised to redeem dollars for gold. In effect, the changing gold price devalued the dollar by 7.9%.

Denmark uses the krone as its currency and does not use the euro, having negotiated the right to opt out from participation under the Maastricht Treaty of 1992. In 2000, the government held a referendum on introducing the euro, which was defeated with 53.2% voting no and 46.8% voting yes. The Danish krone is part of the ERM II mechanism, so its exchange rate is tied to within 2.25% of the euro.

A fixed exchange rate, often called a pegged exchange rate, is a type of exchange rate regime in which a currency's value is fixed or pegged by a monetary authority against the value of another currency, a basket of other currencies, or another measure of value, such as gold.

The international status and usage of the euro has grown since its launch in 1999. When the euro formally replaced 12 currencies on 1 January 2002, it inherited their use in territories such as Montenegro and replaced minor currencies tied to pre-euro currencies, such as in Monaco. Four small states have been given a formal right to use the euro, and to mint their own coins, but all other usage outside the eurozone has been unofficial. With or without an agreement, these countries, unlike those in the eurozone, do not participate in the European Central Bank or the Eurogroup.

The European Monetary Cooperation Fund (EMCF) was a fund established in April 1973 by members of the European Economic Community (EEC) to ensure concerted action for a proper functioning of the Community exchange system. The EMCF was located in Luxembourg. The decision-making body, the Board of Governors, was composed of the governors from the EEC countries' central banks. In contrast to what its name indicates, the fund did not hold any paid-in capital.

The second Werner-Schaus Government was the government of Luxembourg between 6 February 1969 and 15 June 1974. Throughout the ministry, the Deputy Prime Minister was Eugène Schaus, replacing Henry Cravatte, who had been Deputy Prime Minister in the Werner-Cravatte Government.

The economic and monetary union (EMU) of the European Union is a group of policies aimed at converging the economies of member states of the European Union at three stages.

References

- ↑ Delivorias, Angelos (March 2015). "A history of European monetary integration" (PDF). European Parliamentary Research Service. p. 3. Retrieved 23 November 2024.

- ↑ Werner, Pierre (8 October 1970). "Report to the Council and the Commission on the realisation by stages of Economic and Monetary Union in the Community" (PDF). Council Commission of the European Communities. p. 43. Retrieved 23 November 2024.

- 1 2 European Parliament: The historical development of monetary integration, accessed 2010-06-01.

- ↑ "Euro area". European Commission - European Commission. Retrieved 22 September 2019.

- ↑ The European Monetary System, accessed 2010-06-01.

- 1 2 3 Reputation and Credibility in the European Monetary System Axel A. Weber, Richard Baldwin and Maurice Obstfeld, 1991, Economic Policy journal

- ↑ Eichengreen, Barry (2019). Globalizing Capital: A History of the International Monetary System (3rd ed.). Princeton University Press. pp. 146–149. doi:10.2307/j.ctvd58rxg. ISBN 978-0-691-19390-8. JSTOR j.ctvd58rxg. S2CID 240840930.