Related Research Articles

A commodity market is a market that trades in the primary economic sector rather than manufactured products, such as cocoa, fruit and sugar. Hard commodities are mined, such as gold and oil. Futures contracts are the oldest way of investing in commodities. Futures are secured by physical assets. Commodity markets can include physical trading and derivatives trading using spot prices, forwards, futures, and options on futures. Farmers have used a simple form of derivative trading in the commodity market for centuries for price risk management.

In finance, a futures contract is a standardized legal agreement to buy or sell something at a predetermined price at a specified time in the future, between parties not known to each other. The asset transacted is usually a commodity or financial instrument. The predetermined price the parties agree to buy and sell the asset for is known as the forward price. The specified time in the future—which is when delivery and payment occur—is known as the delivery date. Because it is a function of an underlying asset, a futures contract is a derivative product.

A futures exchange or futures market is a central financial exchange where people can trade standardized futures contracts defined by the exchange. Futures contracts are derivatives contracts to buy or sell specific quantities of a commodity or financial instrument at a specified price with delivery set at a specified time in the future. Futures exchanges provide physical or electronic trading venues, details of standardized contracts, market and price data, clearing houses, exchange self-regulations, margin mechanisms, settlement procedures, delivery times, delivery procedures and other services to foster trading in futures contracts. Futures exchanges can be organized as non-profit member-owned organizations or as for-profit organizations. Futures exchanges can be integrated under the same brand name or organization with other types of exchanges, such as stock markets, options markets, and bond markets. Non-profit member-owned futures exchanges benefit their members, who earn commissions and revenue acting as brokers or market makers. For-profit futures exchanges earn most of their revenue from trading and clearing fees.

The Chicago Mercantile Exchange (CME) is a global derivatives marketplace based in Chicago and located at 20 S. Wacker Drive. The CME was founded in 1898 as the Chicago Butter and Egg Board, an agricultural commodities exchange. Originally, the exchange was a non-profit organization. The Merc demutualized in November 2000, went public in December 2002, and merged with the Chicago Board of Trade in July 2007 to become a designated contract market of the CME Group Inc., which operates both markets. The chairman and chief executive officer of CME Group is Terrence A. Duffy, Bryan Durkin is president. On August 18, 2008, shareholders approved a merger with the New York Mercantile Exchange (NYMEX) and COMEX. CME, CBOT, NYMEX, and COMEX are now markets owned by CME Group. After the merger, the value of the CME quadrupled in a two-year span, with a market cap of over $25 billion.

The New York Mercantile Exchange (NYMEX) is a commodity futures exchange owned and operated by CME Group of Chicago. NYMEX is located at One North End Avenue in Brookfield Place in the Battery Park City section of Manhattan, New York City.

Tokyo Commodity Exchange, also known as TOCOM, is Japan's largest and one of Asia's most prominent commodity futures exchanges. TOCOM operates electronic markets for precious metals, oil, rubber and soft commodities. It offers futures and options contracts for precious metals ; energy ; natural rubber and agricultural products.

Yokohama Commodity Exchange (Y-COM) was a futures exchange based in Yokohama, Japan which operated from 1998 to 2006.

Osaka Mercantile Exchange (OME) was a futures exchange based in Osaka, Japan that merged with the Nagoya-based Central Japan Commodity Exchange in 2007.

Fukuoka Futures Exchange (FFE) was a futures exchange founded 1893, based in Fukuoka, Japan. It was absorbed by Kansai Commodities Exchange, based in Ôsaka, and no longer exists. Trading was conducted at six specified session times through the day. At each session, a price was established for each contract month in each commodity. Daily price movement limits apply, including open position limits for members and customers. There were no position limits for hedging.

IOM soybeans is an industrial designation for soybeans from the U.S. states of Indiana, Ohio, and Michigan. Beans grown in those states have a high protein content that is valued by processors, in particular in Japan. IOM soybeans are traded on the following Japanese commodity exchanges:

Zhengzhou Commodity Exchange, established in 1990, is a futures exchange in Zhengzhou, one of the four futures exchanges in China. The ZCE is under the vertical management of China Securities Regulatory Commission (CSRC).

The Dalian Commodity Exchange (DCE) is a Chinese futures exchange based in Dalian, Liaoning province, China. It is a non-profit, self-regulating and membership legal entity established on February 28, 1993.

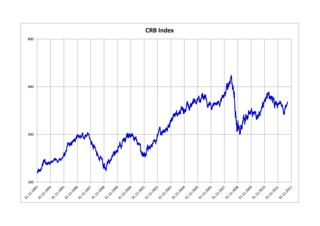

The Refinitiv/CoreCommodity CRB Index is a commodity futures price index. It was first calculated by Commodity Research Bureau, Inc. in 1957 and made its inaugural appearance in the 1958 CRB Commodity Year Book.

A benchmark crude or marker crude is a crude oil that serves as a reference price for buyers and sellers of crude oil. There are three primary benchmarks, West Texas Intermediate (WTI), Brent Blend, and Dubai Crude. Other well-known blends include the OPEC Reference Basket used by OPEC, Tapis Crude which is traded in Singapore, Bonny Light used in Nigeria, Urals oil used in Russia and Mexico's Isthmus. Energy Intelligence Group publishes a handbook which identified 195 major crude streams or blends in its 2011 edition.

Multi Commodity Exchange of India Ltd (MCX) is an independent Indian government owned commodity exchange based in India. It was established in 2003 by the Government of India and is currently based in Mumbai. It is India's largest commodity derivatives exchange. The average daily turnover of commodity futures contracts increased by 26% to ₹32,424 crore during FY2019-20, as against ₹25,648 crore in FY2018-19. The total turnover of commodity futures traded on the Exchange stood at ₹83.98 lakh crore in FY2019-20. MCX offers options trading in gold and futures trading in non-ferrous metals, bullion, energy, and a number of agricultural commodities.

Pakistan Mercantile Exchange Limited is Pakistan's first futures commodity market having its registered Head office in Karachi, Sindh. It is the only company in Pakistan to provide a centralized and regulated place for commodity futures trading and is regulated by Securities and Exchange Commission of Pakistan (SECP). It has started full trading activities on 11 May 2007.

Iran Mercantile Exchange (IME) is a commodities exchange located in Tehran, Iran.

Live cattle is a type of futures contract that can be used to hedge and to speculate on fed cattle prices. Cattle producers, feedlot operators, and merchant exporters can hedge future selling prices for cattle through trading live cattle futures, and such trading is a common part of a producer's price risk management program. Conversely, meat packers, and merchant importers can hedge future buying prices for cattle. Producers and buyers of live cattle can also enter into production and marketing contracts for delivering live cattle in cash or spot markets that include futures prices as part of a reference price formula. Businesses that purchase beef as an input could also hedge beef price risk by purchasing live cattle futures contracts.

LME Copper stands for a group of spot, forward, and futures contracts, trading on the London Metal Exchange (LME), for delivery of Copper, that can be used for price hedging, physical delivery of sales or purchases, investment, and speculation.

Osaka Dojima Commodity Exchange (ODE) is a futures exchange based in Osaka, Japan. It started as the Osaka Grain Exchange in 1952. In 1993 it merged with the Osaka Sugar Exchange and the Kobe Grain Exchange, taking the name Kansai Agricultural Commodities Exchange. The exchange merged with the Kobe Raw Silk Exchange in 1997, becoming the Kansai Commodities Exchange (KEX), and with the Fukuoka Commodities Exchange in 2006. In February 2013 it took over the rice exchange from the Tokyo Grain Exchange and took its current name.

References

- ↑ "TOCOM Monthly Update - July 2015 - Message from Tadashi Ezaki". July 2015.

- ↑ "Central Japan Commodity Exchange web site". Archived from the original on 2005-11-02.