Columbia Business School (CBS) is the business school of Columbia University, a private research university in New York City. Established in 1916, Columbia Business School is one of six Ivy League business schools and is one of the oldest business schools in the world.

A real estate investment trust is a company that owns, and in most cases operates, income-producing real estate. REITs own many types of commercial real estate, including office and apartment buildings, warehouses, hospitals, shopping centers, hotels and commercial forests. Some REITs engage in financing real estate.

A mortgage-backed security (MBS) is a type of asset-backed security which is secured by a mortgage or collection of mortgages. The mortgages are aggregated and sold to a group of individuals that securitizes, or packages, the loans together into a security that investors can buy. Bonds securitizing mortgages are usually treated as a separate class, termed residential; another class is commercial, depending on whether the underlying asset is mortgages owned by borrowers or assets for commercial purposes ranging from office space to multi-dwelling buildings.

Second mortgages, commonly referred to as junior liens, are loans secured by a property in addition to the primary mortgage. Depending on the time at which the second mortgage is originated, the loan can be structured as either a standalone second mortgage or piggyback second mortgage. Whilst a standalone second mortgage is opened subsequent to the primary loan, those with a piggyback loan structure are originated simultaneously with the primary mortgage. With regard to the method in which funds are withdrawn, second mortgages can be arranged as home equity loans or home equity lines of credit. Home equity loans are granted for the full amount at the time of loan origination in contrast to home equity lines of credit which permit the homeowner access to a predetermined amount which is repaid during the repayment period.

The 2000s United States housing bubble was a real-estate bubble affecting over half of the U.S. states. It was the impetus for the subprime mortgage crisis. Housing prices peaked in early 2006, started to decline in 2006 and 2007, and reached new lows in 2011. On December 30, 2008, the Case–Shiller home price index reported its largest price drop in its history. The credit crisis resulting from the bursting of the housing bubble is an important cause of the Great Recession in the United States.

Pennsylvania Real Estate Investment Trust is a publicly traded real estate investment trust that invests in shopping centers mostly in the Mid-Atlantic states.

A real-estate bubble or property bubble is a type of economic bubble that occurs periodically in local or global real estate markets, and it typically follows a land boom. A land boom is a rapid increase in the market price of real property such as housing until they reach unsustainable levels and then declines. This period, during the run-up to the crash, is also known as froth. The questions of whether real estate bubbles can be identified and prevented, and whether they have broader macroeconomic significance, are answered differently by schools of economic thought, as detailed below.

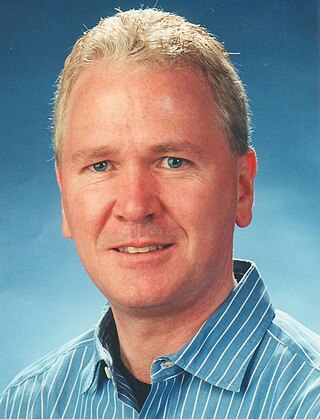

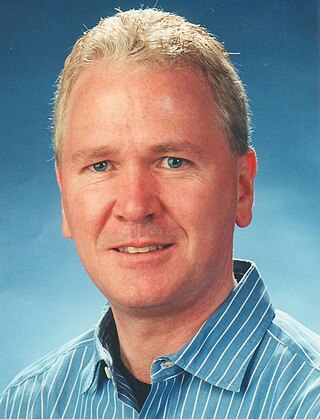

Robert Glenn Hubbard is an American economist and academic. He served as the Dean of the Columbia University Graduate School of Business from 2004 to 2019, where he remains the Russell L. Carson Professor of Finance and Economics. On September 13, 2018, he announced that he would retire from his position after his contract expired on June 30, 2019. Hubbard previously served as Deputy Assistant Secretary at the U.S. Department of the Treasury from 1991 to 1993, and as Chairman of the Council of Economic Advisers from 2001 to 2003.

The Industry Classification Benchmark (ICB) is an industry classification taxonomy launched by Dow Jones and FTSE in 2005 and now used by FTSE International and STOXX. It is used to segregate markets into sectors within the macroeconomy. The ICB uses a system of 11 industries, partitioned into 20 supersectors, which are further divided into 45 sectors, which then contain 173 subsectors.

Real estate investing involves the purchase, management and sale or rental of real estate for profit. Someone who actively or passively invests in real estate is called a real estate entrepreneur or a real estate investor. Some investors actively develop, improve or renovate properties to make more money from them.

In finance, subprime lending is the provision of loans to people in the United States who may have difficulty maintaining the repayment schedule. Historically, subprime borrowers were defined as having FICO scores below 600, although this threshold has varied over time.

The United States subprime mortgage crisis was a multinational financial crisis that occurred between 2007 and 2010 that contributed to the 2007–2008 global financial crisis. The crisis led to a severe economic recession, with millions of people losing their jobs and many businesses going bankrupt. The U.S. government intervened with a series of measures to stabilize the financial system, including the Troubled Asset Relief Program (TARP) and the American Recovery and Reinvestment Act (ARRA).

United States housing prices experienced a major market correction after the housing bubble that peaked in early 2006. Prices of real estate then adjusted downwards in late 2006, causing a loss of market liquidity and subprime defaults.

Observers and analysts have attributed the reasons for the 2001–2006 housing bubble and its 2007–10 collapse in the United States to "everyone from home buyers to Wall Street, mortgage brokers to Alan Greenspan". Other factors that are named include "Mortgage underwriters, investment banks, rating agencies, and investors", "low mortgage interest rates, low short-term interest rates, relaxed standards for mortgage loans, and irrational exuberance" Politicians in both the Democratic and Republican political parties have been cited for "pushing to keep derivatives unregulated" and "with rare exceptions" giving Fannie Mae and Freddie Mac "unwavering support".

The Emergency Economic Stabilization Act of 2008, often called the "bank bailout of 2008" or the "Wall Street bailout", was proposed by Treasury Secretary Henry Paulson, passed by the 110th United States Congress, and signed into law by President George W. Bush. It became law as part of Public Law 110-343 on October 3, 2008, in the midst of the financial crisis of 2007–2008. It created the $700 billion Troubled Asset Relief Program (TARP) to purchase toxic assets from banks. The funds were mostly redirected to inject capital into banks and other financial institutions while the Treasury continued to examine the usefulness of targeted asset purchases.

Rebel A. Cole is the Lynn Eminent Scholar Professor of Finance in the College of Business at Florida Atlantic University in Boca Raton, Florida, where he has taught since August 2016. He teaches graduate-level classes in corporate finance and financial institutions.

The 2007–2008 financial crisis, or Global Financial Crisis (GFC), was a severe worldwide economic crisis that occurred in the early 21st century. It was the most serious financial crisis since the Great Depression (1929). Predatory lending targeting low-income homebuyers, excessive risk-taking by global financial institutions, and the bursting of the United States housing bubble culminated in a "perfect storm".

Jeremy James Siegel is the Russell E. Palmer Professor of Finance at the Wharton School of the University of Pennsylvania in Philadelphia, Pennsylvania. Siegel comments extensively on the economy and financial markets. He appears regularly on networks including CNN, CNBC and NPR, and writes regular columns for Kiplinger's Personal Finance and Yahoo! Finance. Siegel's paradox is named after him.

The Canadian property bubble refers to a significant rise in Canadian real estate prices from 2002 to present which some observers have called a real estate bubble. From 2003 to 2018, Canada saw an increase in home and property prices of up to 337% in some cities. By 2018, home-owning costs were above 1990 levels when Canada saw its last housing bubble burst. Bloomberg Economics ranks Canada as the second largest housing bubble across the OECD in 2019 and 2021. Starting in February 2022, prices started to decline rapidly as the Bank of Canada hiked interest rates culminating in detached prices to decline by $40 in the Greater Toronto Area by September of 2022.

Timothy Riddiough is an American researcher and academic. He is the James A. Graaskamp Chair and the Chair of the department of real estate and urban land economics at University of Wisconsin–Madison. He is best known for his work on credit risk in mortgage lending, mortgage securitization, real options, REIT investment and corporate finance, and land use regulation.