Shell Canada Limited is the principal Canadian subsidiary of British energy major Shell plc and one of Canada's largest integrated oil companies. Exploration and production of oil, natural gas and sulphur is a major part of its business, as well as the marketing of gasoline and related products through the company's approximately 1,800 stations across Canada.

Pacific Investment Management Company, LLC is an American investment management firm focusing on active fixed income management worldwide. PIMCO manages investments in many asset classes such as fixed income, equities, commodities, asset allocation, ETFs, hedge funds, and private equity. PIMCO is one of the largest investment managers, actively managing more than $2 trillion in assets for central banks, sovereign wealth funds, pension funds, corporations, foundations and endowments, and individual investors around the world. According to the Sovereign Wealth Fund Institute, PIMCO is the 6th-largest asset manager in the world by managed AUM.

Tearfund is an international Christian relief and development agency based in Teddington, UK. It currently works in around 50 countries, with a primary focus on supporting those in poverty and providing disaster relief for disadvantaged communities.

The Ontario Teachers' Pension Plan Board is an independent organization responsible for administering defined-benefit pensions for school teachers of the Canadian province of Ontario. Ontario Teachers' also invests the plan's pension fund and it is one of the world's largest institutional investors, acting as a partner organization of the World Economic Forum. The plan is a multi-employer pension plan, jointly sponsored by the Government of Ontario and the Ontario Teachers' Federation.

Stop Climate Chaos is a coalition of non-governmental organizations (NGOs) in the United Kingdom that focuses on climate change. It was established in September 2005 and is known for running the "I Count" campaign from 2006 to 2007. In addition, the coalition organized 'The Wave" on 5 December 2009 as a lead-up to the UN talks in Copenhagen.

The Caisse de dépôt et placement du Québec is an institutional investor that manages several public and parapublic pension plans and insurance programs in the Canadian province of Quebec. It was established in 1965 by an act of the National Assembly, under the government of Jean Lesage, as part of the Quiet Revolution, a period of social and political change in Quebec. It is the second-largest pension fund in Canada, after the Canada Pension Plan Investment Board. It was created to manage the funds of the newly created Quebec Pension Plan, a public pension plan that aimed to provide financial security for Quebecers in retirement. The CDPQ’s mandate was to invest the funds prudently and profitably while also contributing to Quebec’s economic development. As of December 31, 2023, CDPQ managed assets of C$434 billion, invested in Canada and elsewhere. CDPQ is headquartered in Quebec City at the Price building and has its main business office in Montreal at the Édifice Jacques-Parizeau.

Sir Mark Moody-Stuart KCMG is a British businessman, He was appointed non-executive chairman of Anglo American PLC in 2001, serving until 2009. He has been chairman of Hermes Equity Ownership Services since 2009.

Paul Myners, Baron Myners, was a British businessman and politician. In October 2008 he was elevated to the House of Lords as a life peer and was appointed City Minister in the Labour Government of Gordon Brown, serving until May 2010. As City Minister Myners was responsible for overseeing the financial services sector during the global financial crisis and its aftermath, including leading the controversial 2008 United Kingdom bank rescue package. Myners sat in the House of Lords as a Labour peer until 2014, resigning to become a non-affiliated member before joining the crossbench group in 2015.

Sir Ronald Mourad Cohen is an Egyptian-born British businessman and political figure. He is the chairman of The Portland Trust and Bridges Ventures. He has been described as "the father of British venture capital" and "the father of social investment".

Stop Climate Chaos Scotland

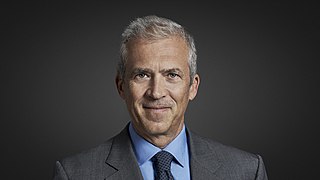

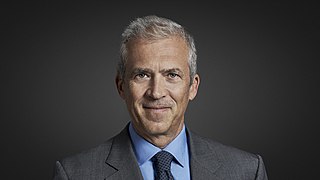

Mark Joseph Carney is a Canadian economist and banker who was the governor of the Bank of Canada from 2008 to 2013 and the governor of the Bank of England from 2013 to 2020. He is chairman, and head of impact investing at Brookfield Asset Management since 2020, and was named chairman of Bloomberg Inc., parent company of Bloomberg L.P., in 2023. He was the chair of the Financial Stability Board from 2011 to 2018. Prior to his governorships, Carney worked at Goldman Sachs as well as the Department of Finance Canada. He also serves as the UN Special Envoy for Climate Action and Finance.

Alberta Investment Management Corporation (AIMCo) is a Canadian Crown corporation and institutional investor established to manage several public funds and pensions headquartered in Edmonton, Alberta. AIMCo was established by an act of the Legislative Assembly of Alberta in 2008 under the government of Progressive Conservative Premier Ed Stelmach.

John Yap is a Canadian politician and former banker. He represented the electoral district of Richmond-Steveston in the Legislative Assembly of British Columbia from 2005 to 2020, as part of the BC Liberal caucus. During his time in government, he served as Minister of State for Climate Action, Minister Responsible for Multiculturalism, and Minister of Advanced Education, Innovation and Technology in the cabinets of premiers Gordon Campbell and Christy Clark.

The California State Teachers' Retirement System (CalSTRS) provides retirement, disability and survivor benefits for California's 965,000 prekindergarten through community college educators and their families. CalSTRS was established by law in 1913 and is part of the State of California's Government Operations Agency. As of September 2020, CalSTRS is the largest teachers' retirement fund in the United States. CalSTRS is also currently the eleventh largest public pension fund in the world. As of October 31, 2020, CalSTRS managed a portfolio worth $254.7 billion.

The R20 – Regions of Climate Action is a non-profit environmental organization founded in September 2011, by former governor of California, Arnold Schwarzenegger, with the support of the United Nations. R20 is a coalition of sub-national governments, private companies, international organizations, NGOs, and academic & financial institutions. Its mission is to accelerate sub-national infrastructure investments in the green economy to meaningfully contribute to the Sustainable Development Goals (SDGs). The NGO operates at the sub-national level as R20 believes sub-national governments constitute a powerful force for change and are best positioned to take action & implement green projects.

The B Team is a global nonprofit initiative co-founded by Sir Richard Branson and Jochen Zeitz. It advocates for business practices that are more centered on humanity and the climate.

Fossil fuel divestment or fossil fuel divestment and investment in climate solutions is an attempt to reduce climate change by exerting social, political, and economic pressure for the institutional divestment of assets including stocks, bonds, and other financial instruments connected to companies involved in extracting fossil fuels.

Andreas Ernst Ferdinand Utermann commonly referred to as Andreas E.F. Utermann(born January 1966) is an Anglo-German businessman and banking executive. Utermann was appointed Chairman of the Board of Directors of Vontobel Holding AG at the company’s AGM on April 6, 2022. Utermann led Allianz Global Investors, a global investment company owned by Allianz, for eight years from 2012, initially as a co-head and Global Chief Investment Officer and then as CEO from 2016.

The Oil and Gas Climate Initiative (OGCI), is an international industry-led organization which includes 12 member companies from the oil and gas industry: BP, Chevron, CNPC, Eni, Equinor, ExxonMobil, Occidental, Petrobras, Repsol, Saudi Aramco, Shell and TotalEnergies represent over "30% of global operated oil and gas production." It was established in 2014 and has a mandate to work together to "accelerate the reduction of greenhouse gas emissions" in full support of the Paris Agreement and its aims."

The Glasgow Financial Alliance for Net Zero (GFANZ) is a group that formed during the COP26 climate conference in Glasgow, and describes itself as "a global coalition of leading financial institutions committed to accelerating the decarbonization of the economy."