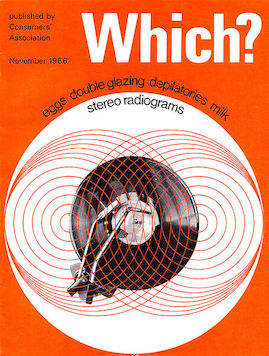

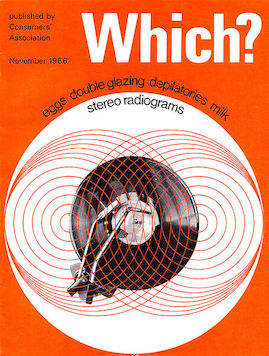

Which? is a United Kingdom brand name that promotes informed consumer choice in the purchase of goods and services by testing products, highlighting inferior products or services, raising awareness of consumer rights, and offering independent advice. The brand name is used by the Consumers' Association, a registered charity and company limited by guarantee that owns several businesses, including Which? Financial Services Limited, Which? Legal Limited and Which? Limited, which publishes the Which? Papers.

Unfair business practices describes a set of practices by businesses which are considered unfair, and which may be unlawful. It includes practices which are covered by other areas of law, such as fraud, misrepresentation, and oppressive or unconscionable contract terms. Protections may be afforded to business-to-business dealings, or may be limited to those dealing as consumers. Regulation of such practices is a departure from traditional views of freedom to agree on contractual terms, summed up in the 1804 French Civil Code as qui dit contractuel dit juste.

Consumer organizations are advocacy groups that seek to protect people from corporate abuse like unsafe products, predatory lending, false advertising, astroturfing and pollution.

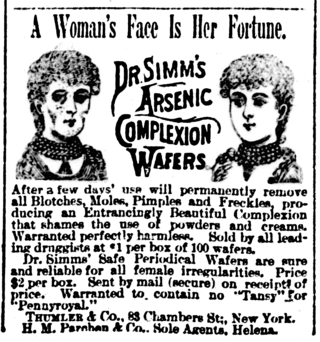

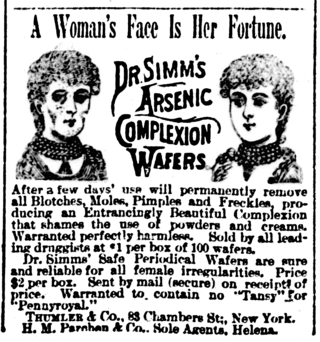

False advertising is the act of publishing, transmitting, distributing, or otherwise publicly circulating an advertisement containing a false claim, or statement, made intentionally to promote the sale of property, goods, or services. A false advertisement can be classified as deceptive if the advertiser deliberately misleads the consumer, rather than making an unintentional mistake. A number of governments use regulations or other laws and methods to limit false advertising.

Debt collection or cash collection is the process of pursuing payments of money or other agreed-upon value owed to a creditor. The debtors may be individuals or businesses. An organization that specializes in debt collection is known as a collection agency or debt collector. Most collection agencies operate as agents of creditors and collect debts for a fee or percentage of the total amount owed. Historically, debtors could face debt slavery, debtor's prison, or coercive collection methods. In the 21st century in many countries, legislation regulates debt collectors, and limits harassment and practices deemed unfair.

The Competition and Consumer Act 2010 (CCA) is an Act of the Parliament of Australia. Prior to 1 January 2011, it was known as the Trade Practices Act 1974 (TPA). The Act is the legislative vehicle for competition law in Australia, and seeks to promote competition, fair trading as well as providing protection for consumers. It is administered by the Australian Competition & Consumer Commission (ACCC) and also gives some rights for private action. Schedule 2 of the CCA sets out the Australian Consumer Law (ACL). The Federal Court of Australia has the jurisdiction to determine private and public complaints made in regard to contraventions of the Act.

Trading Standards are the local authority departments with the United Kingdom, formerly known as Weights and Measures, that enforce consumer protection legislation.

The Office of Fair Trading (OFT) was a non-ministerial government department of the United Kingdom, established by the Fair Trading Act 1973, which enforced both consumer protection and competition law, acting as the United Kingdom's economic regulator. The intention was for the OFT to make markets work well for consumers, ensuring vigorous competition between fair-dealing businesses and prohibiting unfair practices such as rogue trading, scams, and cartels. Its role was modified and its powers changed by the Enterprise Act 2002.

The Unfair Contract Terms Act 1977 is an act of Parliament of the United Kingdom which regulates contracts by restricting the operation and legality of some contract terms. It extends to nearly all forms of contract and one of its most important functions is limiting the applicability of disclaimers of liability. The terms extend to both actual contract terms and notices that are seen to constitute a contractual obligation.

The Consumer Protection Regulations 2000, SI 2000/2334, implemented European Directive 97/7/EC as UK law. They applied to contracts "concluded between a supplier and a consumer under an organised distance sales or services provision scheme run by the supplier who, for the purposes of the contract, makes use of one or more means of distance communication" up to and including the moment the contract is agreed. The legislation provided rights to the consumer and obligations which the seller must fulfill.

The Commerce Commission is a New Zealand government agency with responsibility for enforcing legislation that relates to competition in the country's markets, fair trading and consumer credit contracts, and regulatory responsibility for areas such as electricity and gas, telecommunications, dairy products and airports. It is an independent Crown entity established under the Commerce Act 1986. Although responsible to the Minister of Commerce and Consumer Affairs and the Minister of Broadcasting, Communications and Digital Media, the Commission is run independently from the government, and is intended to be an impartial promotor and enforcer of the law.

Consumer protection is the practice of safeguarding buyers of goods and services, and the public, against unfair practices in the marketplace. Consumer protection measures are often established by law. Such laws are intended to prevent businesses from engaging in fraud or specified unfair practices to gain an advantage over competitors or to mislead consumers. They may also provide additional protection for the general public which may be impacted by a product even when they are not the direct purchaser or consumer of that product. For example, government regulations may require businesses to disclose detailed information about their products—particularly in areas where public health or safety is an issue, such as with food or automobiles.

A super-complaint is a complaint made in the UK by a state-approved "super-complainant"/watchdog organisation on behalf of consumers, which was fast-tracked to a higher authority such as the Office of Fair Trading. The official body now in charge of general consumer protection super-complaints is the Competition and Markets Authority.

The Fair Trading Act 1986 is a statute of New Zealand, developed as complementary legislation to the Commerce Act 1986. Its purpose is to encourage competition and to protect consumers/customers from misleading and deceptive conduct and unfair trade practices.

Unfair terms in English contract law are regulated under three major pieces of legislation, compliance with which is enforced by the Competition and Markets Authority (CMA). The Unfair Contract Terms Act 1977 is the first main Act, which covers some contracts that have exclusion and limitation clauses. For example, it will not extend to cover contracts which are mentioned in Schedule I, consumer contracts, and international supply contracts. The Consumer Rights Act 2015 replaced the Unfair Terms in Consumer Contracts Regulations 1999 and bolstered further requirements for consumer contracts. The Consumer Protection from Unfair Trading Regulations 2008 concerns certain sales practices.

The Fiji Commerce Commission is a statutory organisation responsible for fair trade, competition (economics) and consumer protection regulation in the Fiji Islands. It was initially established in 1998 under the Commerce Act 1998 [Fiji]. The commission is an independent statutory body that seeks to protect consumers and businesses from restrictive and unfair trade practices. When it was established, the Commission was principally responsible for enforcing Fiji's competition policies and laws. It was modelled on the Australian Competition & Consumer Commission. In 2010 the Fiji government passed the Commerce Commission Act 2010 which saw the Commission taken on extra responsibilities that notably included price control. Two of Fiji's regulatory agencies, the Department of Fair Trading & Consumer Affairs and the Prices & Incomes Board ceased to exist as separate entities following this new law. The functions, operations and staff of the two agencies are now merged into the Commerce Commission.

The Competition and Markets Authority (CMA) is the principal competition regulator in the United Kingdom. It is a non-ministerial government department in the United Kingdom, responsible for strengthening business competition and preventing and reducing anti-competitive activities. The CMA launched in shadow form on 1 October 2013 and began operating fully on 1 April 2014, when it assumed many of the functions of the previously existing Competition Commission and Office of Fair Trading, which were abolished. The CMA also has consumer protection responsibilities and take on new digital markets regulation responsibilities in late 2024 under the Digital Markets, Competition and Consumers Act 2024.

The Consumer Council is an independent statutory authority in Hong Kong, established in 1974 and formalised in April 1977 under the Consumer Council Ordinance. Its role is to enhance consumer welfare and empower consumers to protect themselves. Over the course of the past four decades the expansion in the council's duties and services on consumer protection, such as the publishing of the CHOICE Magazine in 1976, the recent launch of online price-watching tools, and conducting studies on different aspects of the consumer market, have coincided with the socio-economic development of Hong Kong. Apart from being a consumer advisor, it has assumed the role as a key stakeholder in making of consumer-related policies.

The Consumer Rights Act 2015 is an act of Parliament of the United Kingdom which consolidates existing consumer protection law legislation and also gives consumers a number of new rights and remedies. Provisions for secondary ticketing and lettings came into force on 27 May 2015, and provisions for alternative dispute resolution (ADR) came into force on 9 July 2015 as per the EU Directive on consumer ADR. Most other provisions came into force on 1 October 2015.

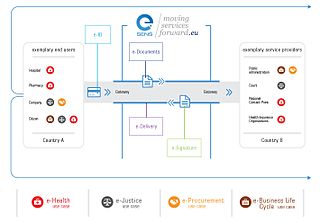

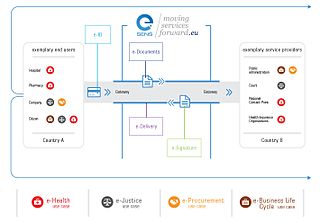

The term digital single market refers to the policy objective of eliminating national or other jurisdictional barriers to online transactions, building on the common market concept designed to remove trade barriers in other commercial fields.