The Australian dollar is the official currency and legal tender of Australia, including all of its external territories, and three independent sovereign Pacific Island states: Kiribati, Nauru, and Tuvalu. In April 2022, it was the sixth most-traded currency in the foreign exchange market and as of Q4 2023 the seventh most-held reserve currency in global reserves.

Federal Reserve Notes are the currently issued banknotes of the United States dollar. The United States Bureau of Engraving and Printing produces the notes under the authority of the Federal Reserve Act of 1913 and issues them to the Federal Reserve Banks at the discretion of the Board of Governors of the Federal Reserve System. The Reserve Banks then circulate the notes to their member banks, at which point they become liabilities of the Reserve Banks and obligations of the United States.

A banknote – also called a bill, paper money, or simply a note – is a type of negotiable promissory note, made by a bank or other licensed authority, payable to the bearer on demand. Banknotes were originally issued by commercial banks, which were legally required to redeem the notes for legal tender when presented to the chief cashier of the originating bank. These commercial banknotes only traded at face value in the market served by the issuing bank. Commercial banknotes have primarily been replaced by national banknotes issued by central banks or monetary authorities.

Legal tender is a form of money that courts of law are required to recognize as satisfactory payment for any monetary debt. Each jurisdiction determines what is legal tender, but essentially it is anything which when offered ("tendered") in payment of a debt extinguishes the debt. There is no obligation on the creditor to accept the tendered payment, but the act of tendering the payment in legal tender discharges the debt.

The pound was the currency of Ireland until 2002. Its ISO 4217 code was IEP, and the symbol was £ The Irish pound was replaced by the euro on 1 January 1999. Euro currency did not begin circulation until the beginning of 2002.

The pound sterling is the official currency of the United Kingdom, Jersey, Guernsey, the Isle of Man, British Antarctic Territory, South Georgia and the South Sandwich Islands, and Tristan da Cunha.

The Belize dollar is the official currency in Belize. It is normally abbreviated with the dollar sign $, or alternatively BZ$ to distinguish it from other dollar-denominated currencies.

The pound was the currency of Australia from 1910 until 14 February 1966, when it was replaced by the Australian dollar. Like other £sd currencies, it was subdivided into 20 shillings, each of 12 pence.

The pound is the currency of Gibraltar. It is pegged to – and exchangeable with – British pound sterling at par value. Coins and banknotes of the Gibraltar pound are issued by the Government of Gibraltar.

The Bermudian dollar is the official currency of the British Overseas Territory of Bermuda. It is subdivided into 100 cents. The Bermudian dollar is not normally traded outside Bermuda, and is pegged to the United States dollar at a one-to-one ratio. Both currencies circulate in Bermuda on an equal basis.

The pound is the currency of Jersey. Jersey is in currency union with the United Kingdom, and the Jersey pound is not a separate currency but is an issue of banknotes and coins by the States of Jersey denominated in sterling, in a similar way to the banknotes issued in Scotland and Northern Ireland. It can be exchanged at par with other sterling coinage and notes.

The pound, or Manx pound, is the currency of the Isle of Man, at parity with sterling. The Manx pound is divided into 100 pence. Notes and coins, denominated in pounds and pence, are issued by the Isle of Man Government.

Banknotes have been issued for use specifically in Northern Ireland since 1929, and are denominated in pounds sterling. They are legal currencies, but technically not legal tender anywhere. This is not uncommon as most bank notes are not recognised as tender. However, the banknotes are still widely accepted as currency by larger merchants and institutions elsewhere in the United Kingdom. Issuing banks have been granted legal rights to issue currency, and back the notes with deposits at the Bank of England.

The Bank Charter Act 1844, sometimes referred to as the Peel Banking Act of 1844, was an Act of the Parliament of the United Kingdom, passed under the government of Robert Peel, which restricted the powers of British banks and gave exclusive note-issuing powers to the central Bank of England. It is one of the Bank of England Acts 1694 to 1892.

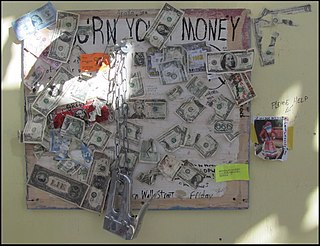

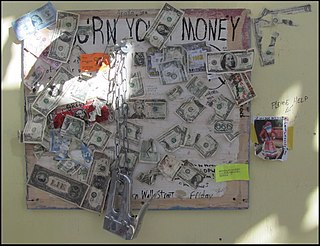

Mutilated currency is a term used by the United States Bureau of Engraving and Printing (BEP) and the Bank of Canada to describe currency which is damaged to the point where it is difficult to determine the value of the currency, or where it is not clear that at least half of the note is present. Common causes of damage are fire, water damage, chemicals, explosives, damage caused by animals or damage from extended burying of the currency.

The Banking Act 2009 is an act of the Parliament of the United Kingdom that entered into force in part on the 21 February 2009 in order, amongst other things, to replace the Banking Act 2008. The Act makes provision for the nationalisation of banks, amends the law on bank insolvency and administration, and makes provision about the Financial Services Compensation Scheme. It also makes provision about the regulation of inter-bank payment schemes, amends the law on the issue of banknotes by Scottish and Northern Irish banks, and makes other miscellaneous amendments to the law on banking.

Money burning or burning money is the purposeful act of destroying money. In the prototypical example, banknotes are destroyed by setting them on fire. Burning money decreases the wealth of the owner without directly enriching any particular party. It also reduces the money supply and slows down the inflation rate.

Bank Notes Act is a stock short title used in the United Kingdom for legislation relating to bank notes.

The High Denomination Bank Notes (Demonetisation) Act, 1978 was an act of the Indian Parliament that demonetized the high-denomination banknotes of ₹1000, ₹5000, and ₹10000. It was first introduced as the High Denomination Bank Notes (Demonetisation) Ordinance, 1978, by the then President of India Neelam Sanjiva Reddy. The then Prime Minister of India, Morarji Desai of Janata Party, and Finance Minister Hirubhai M. Patel were considered key architects of the policy, while RBI Governor I. G. Patel was opposed to it.

The Bank of England £100,000,000 note, also referred to as Titan, is a non-circulating Bank of England sterling banknote used to back the value of Scottish and Northern Irish banknotes. It is the highest denomination of banknote printed by the Bank of England. As both Scotland and Northern Ireland have banknotes issued by particular local banks, the non-circulating notes provide the essential link between those banknotes and that of England and Wales, and security if a local issuing bank were to fail.