In economics, adaptive expectations is a hypothesized process by which people form their expectations about what will happen in the future based on what has happened in the past. For example, if people want to create an expectation of the inflation rate in the future, they can refer to past inflation rates to infer some consistencies and could derive a more accurate expectation the more years they consider.

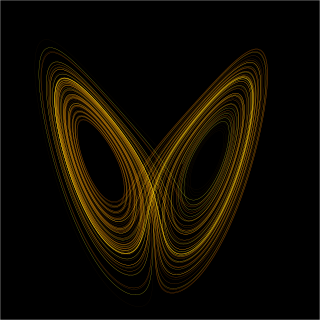

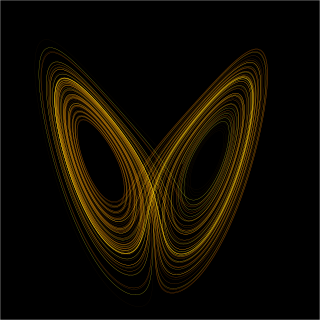

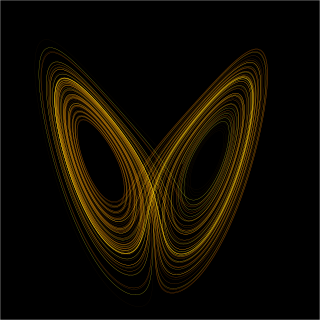

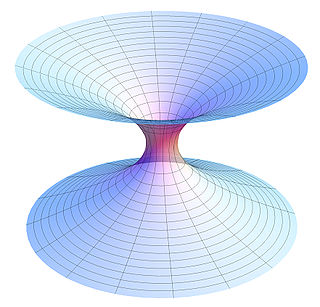

In chaos theory, the butterfly effect is the sensitive dependence on initial conditions in which a small change in one state of a deterministic nonlinear system can result in large differences in a later state.

Chaos theory is an interdisciplinary area of scientific study and branch of mathematics focused on underlying patterns and deterministic laws of dynamical systems that are highly sensitive to initial conditions, and were once thought to have completely random states of disorder and irregularities. Chaos theory states that within the apparent randomness of chaotic complex systems, there are underlying patterns, interconnection, constant feedback loops, repetition, self-similarity, fractals, and self-organization. The butterfly effect, an underlying principle of chaos, describes how a small change in one state of a deterministic nonlinear system can result in large differences in a later state. A metaphor for this behavior is that a butterfly flapping its wings in Texas can cause a tornado in Brazil.

Econometrics is an application of statistical methods to economic data in order to give empirical content to economic relationships. More precisely, it is "the quantitative analysis of actual economic phenomena based on the concurrent development of theory and observation, related by appropriate methods of inference." An introductory economics textbook describes econometrics as allowing economists "to sift through mountains of data to extract simple relationships." Jan Tinbergen is one of the two founding fathers of econometrics. The other, Ragnar Frisch, also coined the term in the sense in which it is used today.

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, which is the study of production, distribution, and consumption of goods and services; the discipline of financial economics bridges the two. Financial activities take place in financial systems at various scopes; thus, the field can be roughly divided into personal, corporate, and public finance.

Measurement is the quantification of attributes of an object or event, which can be used to compare with other objects or events. In other words, measurement is a process of determining how large or small a physical quantity is as compared to a basic reference quantity of the same kind. The scope and application of measurement are dependent on the context and discipline. In natural sciences and engineering, measurements do not apply to nominal properties of objects or events, which is consistent with the guidelines of the International vocabulary of metrology published by the International Bureau of Weights and Measures. However, in other fields such as statistics as well as the social and behavioural sciences, measurements can have multiple levels, which would include nominal, ordinal, interval and ratio scales.

Neoclassical economics is an approach to economics in which the production, consumption, and valuation (pricing) of goods and services are observed as driven by the supply and demand model. According to this line of thought, the value of a good or service is determined through a hypothetical maximization of utility by income-constrained individuals and of profits by firms facing production costs and employing available information and factors of production. This approach has often been justified by appealing to rational choice theory.

In economics, general equilibrium theory attempts to explain the behavior of supply, demand, and prices in a whole economy with several or many interacting markets, by seeking to prove that the interaction of demand and supply will result in an overall general equilibrium. General equilibrium theory contrasts with the theory of partial equilibrium, which analyzes a specific part of an economy while its other factors are held constant. In general equilibrium, constant influences are considered to be noneconomic, or in other words, considered to be beyond the scope of economic analysis. The noneconomic influences may change given changes in the economic factors however, and therefore the prediction accuracy of an equilibrium model may depend on the independence of the economic factors from noneconomic ones.

Financial economics is the branch of economics characterized by a "concentration on monetary activities", in which "money of one type or another is likely to appear on both sides of a trade". Its concern is thus the interrelation of financial variables, such as share prices, interest rates and exchange rates, as opposed to those concerning the real economy. It has two main areas of focus: asset pricing and corporate finance; the first being the perspective of providers of capital, i.e. investors, and the second of users of capital. It thus provides the theoretical underpinning for much of finance.

Rational expectations is an economic theory used to explain how individuals make predictions about the future based on all available information. It states that individuals will also learn from past trends and experiences in order to make the best possible prediction about what will happen. They could be wrong sometimes, but that, on average, they will be correct.

A prediction, or forecast, is a statement about a future event or data. They are often, but not always, based upon experience or knowledge. There is no universal agreement about the exact difference from "estimation"; different authors and disciplines ascribe different connotations.

Theoretical computer science (TCS) is a subset of general computer science and mathematics that focuses on mathematical aspects of computer science such as the theory of computation, formal language theory, the lambda calculus and type theory.

An economic model is a theoretical construct representing economic processes by a set of variables and a set of logical and/or quantitative relationships between them. The economic model is a simplified, often mathematical, framework designed to illustrate complex processes. Frequently, economic models posit structural parameters. A model may have various exogenous variables, and those variables may change to create various responses by economic variables. Methodological uses of models include investigation, theorizing, and fitting theories to the world.

The Lakatos Award is given annually for an outstanding contribution to the philosophy of science, widely interpreted. The contribution must be in the form of a monograph, co-authored or single-authored, and published in English during the previous six years. The award is in memory of the influential Hungarian philosopher of science and mathematics Imre Lakatos, whose tenure as Professor of Logic at the London School of Economics and Political Science (LSE) was cut short by his early and unexpected death. While administered by an international management committee organised from the LSE, it is independent of the LSE Department of Philosophy, Logic, and Scientific Method, with many of the committee's members being academics from other institutions. The value of the award, which has been endowed by the Latsis Foundation, is £10,000, and to take it up a successful candidate must visit the LSE and deliver a public lecture.

Jacob Marschak was an American economist.

Theoretical physics is a branch of physics that employs mathematical models and abstractions of physical objects and systems to rationalize, explain and predict natural phenomena. This is in contrast to experimental physics, which uses experimental tools to probe these phenomena.

An index list of articles about the philosophy of science.

Apollo’s Arrow: The Science of Prediction and the Future of Everything is a non-fiction book about prediction written by Canadian author and mathematician David Orrell. The book was initially published in Canada by HarperCollins in 2007, and was a national bestseller. It was published in the United States as The Future of Everything: The Science of Prediction, and translated versions were also published in Japan, South Korea and China.

Economyths is a book by the mathematician David Orrell about the problems with mainstream economics, written for the general reader. The book was initially published in 2010 by Icon Books in the UK with the subtitle Ten Ways That Economics Gets it Wrong, and by John Wiley & Sons in North America. Icon published a revised version in 2012, with the subtitle How the Science of Complex Systems Is Transforming Economic Thought. Translated versions were also published in Brazil, China, Japan, and Korea. In 2017, Icon published a revised and expanded version with the subtitle 11 Ways Economics Gets it Wrong.

Quantum economics is an emerging research field which applies mathematical methods and ideas from quantum physics to the field of economics. It is motivated by the belief that economic processes such as financial transactions have much in common with quantum processes, and can be appropriately modeled using the quantum formalism. It draws on techniques from the related areas of quantum finance and quantum cognition, and is a sub-field of quantum social science.