The Kyoto Protocol (Japanese: 京都議定書, Hepburn: Kyōto Giteisho) was an international treaty which extended the 1992 United Nations Framework Convention on Climate Change (UNFCCC) that commits state parties to reduce greenhouse gas emissions, based on the scientific consensus that global warming is occurring and that human-made CO2 emissions are driving it. The Kyoto Protocol was adopted in Kyoto, Japan, on 11 December 1997 and entered into force on 16 February 2005. There were 192 parties (Canada withdrew from the protocol, effective December 2012) to the Protocol in 2020.

Carbon offsetting is a carbon trading mechanism that allows entities such as governments or businesses to compensate for (i.e. “offset”) their greenhouse gas emissions. It works by supporting projects that reduce, avoid, or remove emissions elsewhere. In other words, carbon offsets work by offsetting emissions through investments in emission reduction projects. When an entity invests in a carbon offsetting program, it receives carbon credits. These "tokens" are then used to account for net climate benefits from one entity to another. A carbon credit or offset credit can be bought or sold after certification by a government or independent certification body. One carbon offset or credit represents a reduction, avoidance or removal of one tonne of carbon dioxide or its carbon dioxide-equivalent (CO2e).

The European Union Emissions Trading System is a carbon emission trading scheme which began in 2005 and is intended to lower greenhouse gas emissions by the European Union countries. Cap and trade schemes limit emissions of specified pollutants over an area and allow companies to trade emissions rights within that area. The EU ETS covers around 45% of the EU's greenhouse gas emissions.

Flexible mechanisms, also sometimes known as Flexibility Mechanisms or Kyoto Mechanisms, refers to emissions trading, the Clean Development Mechanism and Joint Implementation. These are mechanisms defined under the Kyoto Protocol intended to lower the overall costs of achieving its emissions targets. These mechanisms enable Parties to achieve emission reductions or to remove carbon from the atmosphere cost-effectively in other countries. While the cost of limiting emissions varies considerably from region to region, the benefit for the atmosphere is in principle the same, wherever the action is taken.

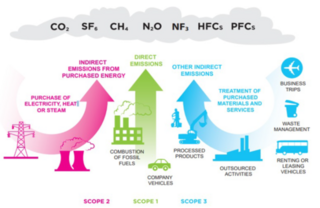

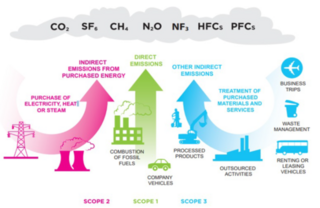

Carbon accounting is a framework of methods to measure and track how much greenhouse gas (GHG) an organization emits. It can also be used to track projects or actions to reduce emissions in sectors such as forestry or renewable energy. Corporations, cities and other groups use these techniques to help limit climate change. Organizations will often set an emissions baseline, create targets for reducing emissions, and track progress towards them. The accounting methods enable them to do this in a more consistent and transparent manner.

Carbon pricing is a method for nations to address climate change. The cost is applied to greenhouse gas emissions in order to encourage polluters to reduce the combustion of coal, oil and gas – the main driver of climate change. The method is widely agreed and considered to be efficient. Carbon pricing seeks to address the economic problem that emissions of CO2 and other greenhouse gases (GHG) are a negative externality – a detrimental product that is not charged for by any market.

The Carbon Pollution Reduction Scheme was a cap-and-trade emissions trading scheme for anthropogenic greenhouse gases proposed by the Rudd government, as part of its climate change policy, which had been due to commence in Australia in 2010. It marked a major change in the energy policy of Australia. The policy began to be formulated in April 2007, when the federal Labor Party was in Opposition and the six Labor-controlled states commissioned an independent review on energy policy, the Garnaut Climate Change Review, which published a number of reports. After Labor won the 2007 federal election and formed government, it published a Green Paper on climate change for discussion and comment. The Federal Treasury then modelled some of the financial and economic impacts of the proposed CPRS scheme.

EU Allowances (EUA) are climate credits (or carbon credits) used in the European Union Emissions Trading Scheme (EU ETS). EU Allowances are issued by the EU Member States into Member State Registry accounts. By April 30 of each year, operators of installations covered by the EU ETS must surrender an EU Allowance for each tonne (1,000 kg) of CO2 emitted in the previous year. The emission allowance is defined in Article 3(a) of the EU ETS Directive as being "an allowance to emit one tonne of carbon dioxide equivalent during a specified period, which shall be valid only for the purposes of meeting the requirements of this Directive and shall be transferable in accordance with the provisions of this Directive".

The UK Emissions Trading Scheme is the carbon emission trading scheme of the United Kingdom. It is cap and trade and came into operation on 1 January 2021 following the UK's departure from the European Union. The cap is reduced in line with the UK's 2050 net zero commitment.

Carbon emission trading (also called carbon market, emission trading scheme (ETS) or cap and trade) is a type of emission trading scheme designed for carbon dioxide (CO2) and other greenhouse gases (GHG). It is a form of carbon pricing. Its purpose is to limit climate change by creating a market with limited allowances for emissions. This can reduce the competitiveness of fossil fuels, and instead accelerate investments into renewable energy, such as wind power and solar power. Fossil fuels are the main driver for climate change. They account for 89% of all CO2 emissions and 68% of all GHG emissions.

The climate policy of China is to peak its greenhouse gas emissions before 2030 and to be carbon neutral before 2060. Due to the large buildout of solar power in China and burning of coal in China the energy policy of China is closely related to its climate policy. There is also policy to adapt to climate change. Ding Xuexiang represented China at the 2023 United Nations Climate Change Conference in 2023, and may be influential in setting climate policy.

The Chinese national carbon trading scheme is an intensity-based trading system for carbon dioxide emissions by China, which started operating in 2021. This emission trading scheme (ETS) creates a carbon market where emitters can buy and sell emission credits. The scheme will allow carbon emitters to reduce emissions or purchase emission allowances from other emitters. Through this scheme, China will limit emissions while allowing economic freedom for emitters. China is the largest emitter of greenhouse gases (GHG) and many major Chinese cities have severe air pollution. The scheme is run by the Ministry of Ecology and Environment, which eventually plans to limit emissions from six of China's top carbon dioxide emitting industries. In 2021 it started with its power plants, and covers 40% of China's emissions, which is 15% of world emissions. China was able to gain experience in drafting and implementation of an ETS plan from the United Nations Framework Convention on Climate Change (UNFCCC), where China was part of the Clean Development Mechanism (CDM). China's national ETS is the largest of its kind, and will help China achieve its Nationally Determined Contribution (NDC) to the Paris Agreement. In July 2021, permits were being handed out for free rather than auctioned, and the market price per tonne of CO2e was around RMB 50, far less than the EU ETS and the UK ETS.

Greenhouse gas emissions by Australia totalled 533 million tonnes CO2-equivalent based on greenhouse gas national inventory report data for 2019; representing per capita CO2e emissions of 21 tons, three times the global average. Coal was responsible for 30% of emissions. The national Greenhouse Gas Inventory estimates for the year to March 2021 were 494.2 million tonnes, which is 27.8 million tonnes, or 5.3%, lower than the previous year. It is 20.8% lower than in 2005. According to the government, the result reflects the decrease in transport emissions due to COVID-19 pandemic restrictions, reduced fugitive emissions, and reductions in emissions from electricity; however, there were increased greenhouse gas emissions from the land and agriculture sectors.

China Beijing Environmental Exchange (CBEEX) is a corporate domestic and international environmental equity public trading platform initiated by the China Beijing Equity Exchange (CBEX) and authorized by the Beijing municipal government.

The New Zealand Emissions Trading Scheme is an all-gases partial-coverage uncapped domestic emissions trading scheme that features price floors, forestry offsetting, free allocation and auctioning of emissions units.

The Climate Change Response Amendment Act 2008 was a statute enacted in September 2008 by the Fifth Labour Government of New Zealand that established the first version of the New Zealand Emissions Trading Scheme, a national all-sectors all-greenhouse gases uncapped and highly internationally linked emissions trading scheme. After the New Zealand general election, 2008, the incoming National-led government announced that a Parliamentary committee would review the New Zealand emissions trading scheme and recommend changes. Significant amendments were enacted in November 2009. Obligations for pastoral agriculture were further delayed. Obligations for energy and industry were halved via a "two for one" deal. Free allocation of units to industry was made uncapped and output based and with a slower phase-out. A price cap of $25 NZD per tonne was introduced.

Carbon retirement is a mechanism within carbon emission trading, notably the European Union Emission Trading Scheme (DUETS), designed to mitigate climate change by permanently removing emission allowances from circulation. These allowances, or EU Emission Allowances (EUAs), permit holders to emit a specified amount of carbon dioxide. This process contributes to the overall reduction of carbon emissions and incentives industries to adopt more sustainable practices due to the increasing scarcity and cost of allowances.

In 2021, net greenhouse gas (GHG) emissions in the United Kingdom (UK) were 427 million tonnes (Mt) carbon dioxide equivalent, 80% of which was carbon dioxide itself. Emissions increased by 5% in 2021 with the easing of COVID-19 restrictions, primarily due to the extra road transport. The UK has over time emitted about 3% of the world total human caused CO2, with a current rate under 1%, although the population is less than 1%.

The reduction of carbon emissions, along with other greenhouse gases (GHGs), has become a vitally important task of international, national and local actors. If we understand governance as the creation of “conditions for ordered rule and collective action” then, given the fact that the reduction of carbon emissions will require concerted collective action, it follows that the governance of carbon will be of paramount concern. We have seen numerous international conferences over the past 20 years tasked with finding a way of facilitating this, and while international agreements have been infamously difficult to reach, action at the national level has been much more effective. In the UK, the Climate Change Act 2008 committed the government to meeting significant carbon reduction targets. In England, these carbon emissions are governed using numerous different instruments, which involve a variety of actors. While it has been argued by authors like Rhodes that there has been a “hollowing out” of the nation state, and that governments have lost their capabilities to govern to a variety of non-state actors and the European Union, the case of carbon governance in England actually runs counter to this. The government body responsible for the task, the Department of Energy and Climate Change (DECC), is the “main external dynamic” behind governing actions in this area, and “rather than hollowing out central co-ordination”. The department may rely on other bodies to deliver its desired outcomes, but it is still ultimately responsible for the imposition of the rules and regulations that “steer (carbon) governmental action at the national level”. It is therefore evident that carbon governance in England is hierarchical in nature, in that “legislative decisions and executive decisions” are the main dynamic behind carbon governance action. This does not deny the existence of a network of bodies around DECC who are part of the process, but they are supplementary actors who are steered by central decisions. This article focuses on carbon governance in England as the other countries of the UK all have devolved assemblies who are responsible for the governance of carbon emissions in their respective countries.

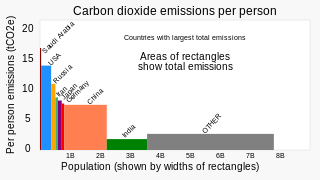

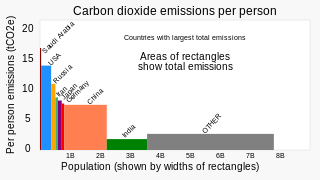

China's greenhouse gas emissions are the largest of any country in the world both in production and consumption terms, and stem mainly from coal burning, including coal power, coal mining, and blast furnaces producing iron and steel. When measuring production-based emissions, China emitted over 14 gigatonnes (Gt) CO2eq of greenhouse gases in 2019, 27% of the world total. When measuring in consumption-based terms, which adds emissions associated with imported goods and extracts those associated with exported goods, China accounts for 13 gigatonnes (Gt) or 25% of global emissions.