Orimulsion is a registered trademark name for a bitumen-based fuel that was developed for industrial use by Intevep, the Research and Development Affiliate of Petroleos de Venezuela SA (PDVSA), following earlier collaboration on oil emulsions with BP.

Oil sands, tar sands, crude bitumen, or bituminous sands, are a type of unconventional petroleum deposit. Oil sands are either loose sands or partially consolidated sandstone containing a naturally occurring mixture of sand, clay, and water, soaked with bitumen, a dense and extremely viscous form of petroleum.

Petroleum politics have been an increasingly important aspect of diplomacy since the rise of the petroleum industry in the Middle East in the early 20th century. As competition continues for a vital resource, the strategic calculations of major and minor countries alike place prominent emphasis on the pumping, refining, transport, sale and use of petroleum products.

Petróleos de Venezuela, S.A. is the Venezuelan state-owned oil and natural gas company. It has activities in exploration, production, refining and exporting oil as well as exploration and production of natural gas. Since its founding on 1 January 1976, with the nationalization of the Venezuelan oil industry, PDVSA has dominated the oil industry of Venezuela, the world's fifth largest oil exporter.

Heavy crude oil is highly viscous oil that cannot easily flow from production wells under normal reservoir conditions.

Petrocaribe was a regional oil procurement agreement between Venezuela and Caribbean member states. The alliance was founded on 29 June 2005 in Puerto La Cruz, Venezuela during Hugo Chavez' presidency. Venezuela offered member states oil supplies on a concessionary financial agreement. Petrocaribe has been part of the "pink tide" in Latin America seeking to achieve post-neoliberal development in the region. In 2013 Petrocaribe established links with the Bolivarian Alliance for the Americas (ALBA) aiming to go beyond oil trade and promoting economic cooperation. The deal fell apart by 2019 after dwindling oil production, corruption, and oil price fluctuations took their toll.

The Orinoco Belt is a territory in the southern strip of the eastern Orinoco River Basin in Venezuela which overlies the world's largest deposits of petroleum. Its local Spanish name is Faja Petrolífera del Orinoco.

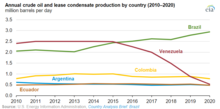

Brazil is the 10th largest energy consumer in the world and the largest in South America. At the same time, it is an important oil and gas producer in the region and the world's second largest ethanol fuel producer. The government agencies responsible for energy policy are the Ministry of Mines and Energy (MME), the National Council for Energy Policy (CNPE), the National Agency of Petroleum, Natural Gas and Biofuels (ANP) and the National Agency of Electricity (ANEEL). State-owned companies Petrobras and Eletrobras are the major players in Brazil's energy sector, as well as Latin America's.

Energy in Kazakhstan describes energy and electricity production, consumption and import in Kazakhstan and the politics of Kazakhstan related to energy.

Energy consumption across Russia in 2020 was 7,863 TWh. Russia is a leading global exporter of oil and natural gas and is the fourth highest greenhouse emitter in the world. As of September 2019, Russia adopted the Paris Agreement In 2020, CO2 emissions per capita were 11.2 tCO2.

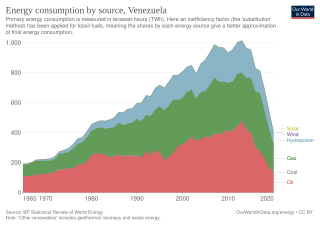

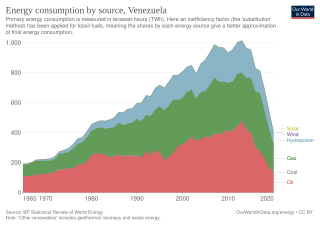

Venezuela was one of the world's largest producers of oil, and the country with the largest proven oil reserves in the world. Venezuela is a member of OPEC.

Oil reserves in Canada were estimated at 172 billion barrels as of the start of 2015 . This figure includes the oil sands reserves that are estimated by government regulators to be economically producible at current prices using current technology. According to this figure, Canada's reserves are third only to Venezuela and Saudi Arabia. Over 95% of these reserves are in the oil sands deposits in the province of Alberta. Alberta contains nearly all of Canada's oil sands and much of its conventional oil reserves. The balance is concentrated in several other provinces and territories. Saskatchewan and offshore areas of Newfoundland in particular have substantial oil production and reserves. Alberta has 39% of Canada's remaining conventional oil reserves, offshore Newfoundland 28% and Saskatchewan 27%, but if oil sands are included, Alberta's share is over 98%.

The proven oil reserves in Venezuela are recognized as the largest in the world, totaling 300 billion barrels (4.8×1010 m3) as of 1 January 2014. The 2019 edition of the BP Statistical Review of World Energy reports the total proved reserves of 303.3 billion barrels for Venezuela (slightly more than Saudi Arabia's 297.7 billion barrels).

The mineral industry of Paraguay includes the production of cement, iron and steel, and petroleum derivatives. Paraguay has no known natural gas or oil reserves. To meet its crude oil and petroleum products demand, Paraguay relies completely on results of approximately 25,400 barrels per day (4,040 m3/d) (bbl/d). The mining sector contributes little to the country's economy, accounting for only 0.1% of its gross domestic production (GDP).

Electricity in Paraguay comes almost entirely from hydropower. As Paraguay is landlocked and has no significant natural gas reserves, its citizens often burn firewood which contributes to deforestation. The government imports fuel to use, and state-owned Petróleos Paraguayos (Petropar) has a monopoly on all crude oil and petroleum product sales and imports in Paraguay. It operates Paraguay's sole refinery, the 7,500 bbl/d (1,190 m3/d) Villa Elisa facility.

This article describes the energy and electricity production, consumption and import in Egypt.

The Paraguaná Refinery Complex is a crude oil refinery complex in Venezuela. It is considered the world's second largest refinery complex, just after Jamnagar Refinery (India). The Paraguaná Refinery Complex was created by the fusion of Amuay Refinery, Bajo Grande Refinery and Cardón Refinery. The Paraguana Refinery Complex is still the largest refinery in the Western Hemisphere. As of 2012, it refined 955 thousand barrels per day (151,800 m3/d). The complex is located in the Paraguaná Peninsula in Falcón state and the western coast of Lake Maracaibo in the Zulia state. The complex accounts for 71% of the refining capacity of Venezuela and it belongs to the state-owned company Petróleos de Venezuela (PDVSA).

Mineral industry of Colombia refers to the extraction of valuable minerals or other geological materials in Colombia. Colombia is well-endowed with minerals and energy resources. It has the largest coal reserves in Latin America, and is second to Brazil in hydroelectric potential. Estimates of petroleum reserves in 1995 were 3.1 billion barrels (490,000,000 m3). Colombia also possesses significant amounts of nickel and gold. Other important metals included platinum and silver, which were extracted in much smaller quantities. Colombia also produces copper, small amounts of iron ore, and bauxite. Nonmetallic mined minerals include salt, limestone, sulfur, gypsum, dolomite, barite, feldspar, clay, magnetite, mica, talcum, and marble. Colombia also produces most of the world's emeralds. Despite the variety of minerals available for exploitation, Colombia still had to import substances such as iron, copper, and aluminum to meet its industrial needs.

The electricity sector in Venezuela is one of the few in the world to rely primarily on hydroelectricity, which accounted for 64% in 2015.

Energy in Serbia describes energy and electricity production, consumption and import in Serbia.