Related Research Articles

The United Progressive Alliance was a political alliance in India led by the Indian National Congress. It was formed after the 2004 general election with support from left-leaning political parties when no single party got the majority.

Harshad Shantilal Mehta was an Indian stockbroker and a convicted fraudster. Mehta's involvement in the 1992 Indian securities scam made him infamous as a market manipulator.

Ketan Parekh is a former stockbroker from Mumbai, who was convicted in 2008 for involvement in the Indian stock market manipulation scam that occurred from late 1998 to 2001. During this period, Parekh artificially rigged prices of certain chosen securities, using large sums of money borrowed from banks including the Madhavpura Mercantile Co-operative Bank, of which he himself was a director.

Look out circular (LOC) is a circular letter used by authorities in India to check whether a traveling person is wanted by the police. It may be used at immigration checks at international borders such as international airports or sea ports.

The Satyam Computer Services scandal was India's largest corporate fraud until 2010. The founder and directors of India-based outsourcing company Satyam Computer Services, falsified the accounts, inflated the share price, and stole large sums from the company. Much of this was invested in property. The swindle was discovered in late 2008 when the Hyderabad property market collapsed, leaving a trail back to Satyam. The scandal was brought to light in 2009 when chairman Byrraju Ramalinga Raju confessed that the company's accounts had been falsified.

Vijay Vittal Mallya is an Indian fugitive former businessman and politician. He is the subject of an extradition effort by the Indian Government to return him from the UK to face charges of financial crimes in India.

Gitanjali Group was one of the largest branded jewellery retailers in the world. It was headquartered in Mumbai, India. Gitanjali used to sell its jewellery through over 4,000 Points of Sale and held a market share of over 50 per cent of the overall organised jewellery market in India. Prominent brands housed by the group included Nakshatra, D'damas, Gili, Asmi, Sangini, Maya, Giantti, World of Solitaire and Shuddhi. It was closed following Punjab National Bank Fraud more commonly known as Nirav Modi Fraud.

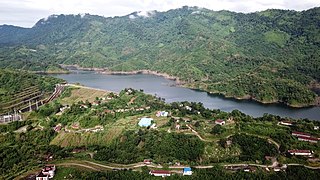

Tuirial dam is an earthfill and gravity dam on the River Sonai near Kolasib in the state of Mizoram in India. The primary purpose of the dam is hydroelectric power production. The Cabinet Committee on Economic Affairs (CCEA) approved the 60 MW Tuirial Hydro Electric Project (THEP) project costing Rs 913 crore in 2010. The project was inaugurated by Prime Minister Narendra Modi on 16 December 2017.

Also referred to as the AgustaWestland VVIP chopper deal, the Indian helicopter bribery scandal by Congress led UPA Government refers to a multimillion-dollar corruption case in India, wherein money was paid to middlemen and Indian officials in 2006 and 2007 to purchase helicopters for high level politicians. As per the CBI, this amounted to ₹2.5 billion (US$31 million), transferred through bank accounts in the UK and UAE.

National Spot Exchange Limited (NSEL) case relates to a payment default at the National Spot Exchange Limited that occurred in 2013 involving Financial Technologies India Ltd, when a payment default took place after a commodities market regulator, the Forward Markets Commission (FMC), directed NSEL to stop launching contracts. This led to the closure of the Exchange in July 2013.

Usha Ananthasubramanian is the former managing director and chief executive officer of the Allahabad Bank,

Madhavpura Mercantile Cooperative Bank (MMCB) was a Gujarat-based interstate cooperative bank that became defunct and lost its licence after it was unable to pay back the money it owed public depositors. Reserve Bank of India cancelled its licence in June 2012 under section 22 of the Banking regulations Act, 1949.

Nirav Deepak Modi is an Indian-born Belgian businessman and fugitive who was charged by Interpol and the Government of India for criminal conspiracy, criminal breach of trust, cheating and dishonesty including delivery of property, corruption, money laundering, fraud, embezzlement and breach of contract in August 2018. Modi is being investigated as a part of the $2 billion fraud case of Punjab National Bank (PNB). In March 2018, Modi applied for bankruptcy protection in Manhattan, New York. In June 2018, Modi was reported to be in the UK where he reportedly applied for political asylum. In June 2019, Swiss authorities froze a total of US$6 million present in Nirav Modi's Swiss bank accounts along with the assets.

Zulfiquar Memon is an Indian lawyer and the founder and Managing Partner of MZM Legal.

The Adarsh Credit Co-operative Society (ACCS) is a Ponzi scheme fraudulently registered under the MSCS Act w.e.f. 1986. It opened in 1999, primarily to bluff the public in Rajasthan, and all money has been siphoned off by the family members of the owners to buy properties and dupe investors of funds worth Rs. 8,000 Crore.

The Punjab National Bank Fraud Case relates to fraudulent letter of undertaking worth ₹12,000 crore issued by the Punjab National Bank at its Brady House branch in Fort, Mumbai; making Punjab National Bank liable for the amount. The fraud was allegedly organized by jeweller and designer Nirav Modi. Nirav, his wife Ami Modi, brother Nishal Modi and uncle Mehul Choksi, all partners of the firms, M/s Diamond R US, M/s Solar Exports and M/s Stellar Diamonds; along with PNB officials and employees, and directors of Nirav Modi and Mehul Choksi's firms have all been named in a charge sheet by the CBI. Nirav Modi and his family absconded in early 2018, days before the news of the scam broke in India.

Mehul Chinubhai Choksi is an Indian-born businessman living in Antigua and Barbuda, who is wanted by the Indian judicial authorities for criminal conspiracy, criminal breach of trust, cheating and dishonesty including delivery of property, corruption and money laundering. In an interview, Choksi claimed that he is innocent and all allegations against him are false, baseless and motivated by political expediency. Choksi has held Antiguan citizenship since 2017. He is the owner of Gitanjali Group, a retail jewellery company with 4,000 stores in India. An arrest warrant for Choksi has been issued in connection with the alleged Punjab National Bank fraud case. He was allegedly involved in stock market manipulation in 2013. In late May 2021, he went missing from Antigua and Barbuda. Choksi claims that he was kidnapped from Antigua by agents of the Indian state, while others stated that he fled the country. After being found and arrested in Dominica under charges of illegal entry he was then returned to Antigua and Barbuda on interim bail for medical treatment. In May 2022 the charge of illegal entry was dropped by the Dominican Government. Investigations into his disappearance are ongoing.

Bad Boy Billionaires: India is a 2020 Indian Netflix original documentary anthology webseries which focuses on the lives of four prominent business magnates of India, including Vijay Mallya, Nirav Modi, Subrata Roy and Ramalinga Raju, who achieved predominant success in their businesses during their lifetime before being accused of corruption.

Events in the year 2021 in India for real time basis.

References

- 1 2 The Hindu Net Desk (4 August 2018). "List of fugitive economic offenders living abroad" – via www.thehindu.com.

- ↑ "28 Fugitive Economic Offenders Living Outside India, Says Govt". 6 August 2018.

- ↑ "Who Are the Top Financial Offenders Besides Mallya? Govt Makes List Public - Dailyhunt ExamPrep". Dailyhunt.

- 1 2 3 4 5 Upadhyay, Jayshree P. (16 March 2018). "Nirav Modi, Vijay Mallya, and 29 other Indian fugitives owe Rs40,000 crore". Mint.

- ↑ "31 business people under CBI probe absconding: Ministry of External Affairs". The New Indian Express.

- ↑ "27 economic offenders fled India in last 5 yrs". 4 January 2019.

- ↑ "India catches only 2 of 72 fugitive economic offenders in 5 years: RTI". Business Standard . 20 November 2020.

- 1 2 3 4 5 "Mallya Leads The List Of India's 28 Fugitive Economic Offenders". BloombergQuint.

- ↑ "PNB scam: Mehul Choksi says use of Antigua PM's powers to extradite him violates nation's democracy". businesstoday.in.

- ↑ "How Jatin Mehta Of Winsome Diamonds Pulled Off A Rs 7000 Cr Scam & Is Living Peacefully In Caribbean Islands". 22 February 2018.

- ↑ "CBI seeks info from Nigeria on accused Nitin Sandesara for Rs 5,300 crore fraud". Hindustan Times . 25 September 2018.

- ↑ "The Fall of Sterling Biotech and the Brothers Sandesara". The Wire.

- ↑ "Shree Ganesh Jewellery promoter arrested in multi-crore fraud case". @businessline.

- ↑ "Will NAMO bring back Vijay Mallya, NiMo, Umesh Parekh?". 7 July 2018.

- ↑ "Lalit Modi to be put on notice for Rs 1,700 crore IPL scam". Deccan Chronicle. 16 June 2015.

- ↑ "India seeks UK help in extradition of Mallya, Lalit Modi". 30 May 2018 – via The Economic Times.

- ↑ "ED all set to book diamond trader for laundering Rs 1,500 crore - Times of India". The Times of India.

- ↑ "ED issues summons to 'middlemen' before nailing politicians in Rs 1500cr diamond remittance scam". in.news.yahoo.com.

- ↑ Ghunawat, Virendrasingh (9 March 2017). "Mumbai: Politicians, bankers under ED's lens in Rs 1500 crore diamond remittance case". India Today.

- ↑ "Cheating, forgery charges framed against accused in Rs 157 crore fraud - Times of India". The Times of India.

- ↑ "Why CBI is inactive in Rs 770-crore bill discounting scam?". DNA India. 12 April 2016.

- ↑ "OBC fraud: CBI quizzes Sabhya Seth's family - Times of India". The Times of India.

- ↑ Chauhan, Neeraj (25 February 2018). "Oriental Bank of Commerce fraud: Delhi jewellers fled India in 2014, CBI says". The Times of India.

- ↑ "Arms dealer Sanjay Bhandari's companies function merrily". 6 October 2018.

- ↑ "HC sets aside 6 arrest orders against extradited industrialist Vinay Mittal in fraud cases". in.news.yahoo.com.

- ↑ "Industrialist Vinay Mittal, wanted in 7 bank fraud cases, extradited from Indonesia". Zee News. 16 October 2018.

- 1 2 "CBI deports Sunny Kalra in PNB fraud case" – via The Economic Times.