George Gideon Oliver Osborne is a British retired politician and newspaper editor who served as Chancellor of the Exchequer from 2010 to 2016 and as First Secretary of State from 2015 to 2016 in the Cameron government. A member of the Conservative Party, he was Member of Parliament (MP) for Tatton from 2001 to 2017.

In the United Kingdom, taxation may involve payments to at least three different levels of government: central government, devolved governments and local government. Central government revenues come primarily from income tax, National Insurance contributions, value added tax, corporation tax and fuel duty. Local government revenues come primarily from grants from central government funds, business rates in England, Council Tax and increasingly from fees and charges such as those for on-street parking. In the fiscal year 2023–24, total government revenue was forecast to be £1,139.1 billion, or 40.9 per cent of GDP, with income taxes and National Insurance contributions standing at around £470 billion.

The Canadian federal budget for the fiscal year 2006–07, was presented to the House of Commons of Canada by Finance Minister Jim Flaherty on May 2, 2006. Among the most notable elements of the federal budget were its reduction of the Goods and Services Tax by one percentage point, income tax cuts for middle-income earners, and $1,200-per-child childcare payment for Canadian parents.

Gordon Brown's tenure as Prime Minister of the United Kingdom began on 27 June 2007 when he accepted an invitation of Queen Elizabeth II to form a government, succeeding Tony Blair, and ended on 11 May 2010 upon his resignation. As prime minister, Brown also served simultaneously as First Lord of the Treasury, Minister for the Civil Service, and Leader of the Labour Party. He and Blair both extensively used the New Labour branding while in office, though Brown's style of government differed from that of his predecessor. Brown rescinded some of the policies which had been introduced or were planned by Blair's administrations. He remained committed to close ties with the United States and to the war in Iraq, although he established an inquiry into the reasons for Britain's participation in the conflict. He proposed a "government of all the talents" which would involve co-opting leading personalities from industry and professional occupations into government positions. Brown also appointed Jacqui Smith as the UK's first female home secretary, while Brown's former position as Chancellor of the Exchequer was taken over by Alistair Darling.

The Canadian federal budget for the 2009–10 fiscal year was presented to the House of Commons of Canada by Finance Minister Jim Flaherty on January 27, 2009. The federal budget included $20 billion in personal income tax cuts as well as major investments in infrastructure.

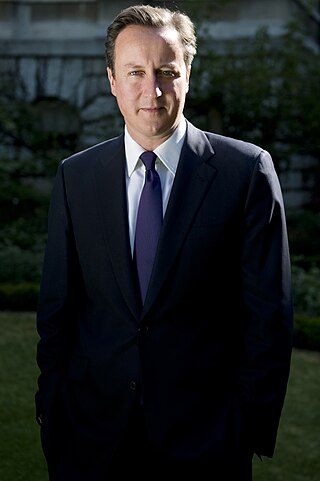

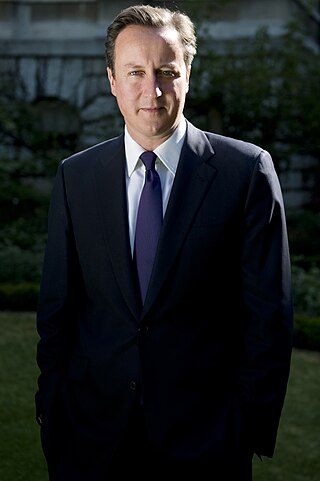

David Cameron's tenure as Prime Minister of the United Kingdom began on 11 May 2010 when he accepted an invitation of Queen Elizabeth II to form a government, succeeding Gordon Brown of the Labour Party, and ended on 13 July 2016 upon his resignation following the 2016 referendum that favoured Brexit, which he had opposed. As prime minister, Cameron also served simultaneously as First Lord of the Treasury, Minister for the Civil Service, and Leader of the Conservative Party.

The Conservative–Liberal Democrat coalition agreement was a policy document drawn up following the 2010 general election in the United Kingdom. It formed the terms of reference governing the Cameron–Clegg coalition, the coalition government comprising MPs from the Conservative Party and the Liberal Democrats.

The June 2010 United Kingdom Budget, officially also known as Responsibility, freedom, fairness: a five-year plan to re-build the economy, was delivered by George Osborne, Chancellor of the Exchequer, to the House of Commons in his budget speech that commenced at 12.33pm on Tuesday, 22 June 2010. It was the first budget of the Conservative-Liberal Democrat coalition formed after the general election of May 2010. The government dubbed it an "emergency budget", and stated that its purpose was to reduce the national debt accumulated under the Labour government.

The 2011 United Kingdom budget, officially called 2011 Budget – A strong and stable economy, growth and fairness, was delivered by George Osborne, the Chancellor of the Exchequer, to the House of Commons on 23 March 2011.

The United Kingdom government austerity programme was a fiscal policy that was adopted for a period in the early 21st century following the era of the Great Recession. Coalition and Conservative governments in office from 2010 to 2019 used the term, and it was applied again by many observers to describe Conservative Party policies from 2021 to 2024, during the cost of living crisis. With the exception of the short-lived Truss ministry, the governments in power over the second period did not formally re-adopt the term. The two austerity periods are separated by increased spending during the COVID-19 pandemic. The first period was one of the most extensive deficit reduction programmes seen in any advanced economy since the Second World War, with emphasis placed on shrinking the state, rather than consolidating fiscally as was more common elsewhere in Europe.

The 2012 United Kingdom budget was delivered by George Osborne, the Chancellor of the Exchequer, to the House of Commons on Wednesday 21 March 2012.

The 2013 United Kingdom budget was delivered by George Osborne, the Chancellor of the Exchequer, to the House of Commons on Wednesday 20 March 2013.

This article details the fourteen austerity packages passed by the Government of Greece between 2010 and 2017. These austerity measures were a result of the Greek government-debt crisis and other economic factors. All of the legislation listed remains in force.

The 2013 Ontario budget, known as the Prosperous and Fair Ontario Act, is the budget for the province of Ontario for fiscal year 2013. It was presented to the Legislative Assembly of Ontario for its first reading on 2 May 2013 by Charles Sousa, the Minister of Finance of the Government of Ontario, and received Royal Assent on 13 June 2013.

Tuition fees in the United Kingdom were reintroduced for full-time resident students in 1998, as a means of funding tuition to undergraduate and postgraduate certificate students at universities. Since their introduction, the fees have been reformed multiple times by several bills, with the cap on fees notably rising to £9,000 a year for the 2012-13 academic year.

The 2016 United Kingdom budget was delivered by George Osborne, the Chancellor of the Exchequer, to the House of Commons on Wednesday, 16 March 2016.

The March 2021 United Kingdom budget, officially known as Protecting the Jobs and Livelihoods of the British People was a budget delivered by Rishi Sunak, the Chancellor of the Exchequer in March 2021. It was expected to be delivered in autumn 2020, but was postponed because of the COVID-19 pandemic. It succeeds the budget held in March 2020, and the summer statement and Winter Economy Plan held in summer and autumn 2020, respectively. The budget is the second under Boris Johnson's government, also the second to be delivered by Sunak and the second since Britain's withdrawal from the European Union. The budget was the first for government expenditure in the United Kingdom to exceed £1 trillion.

George Osborne served as Chancellor of the Exchequer from May 2010 to July 2016 in the David Cameron–Nick Clegg coalition Conservative-Liberal Democrat government and the David Cameron majority Conservative government. His tenure pursued austerity policies aimed at reducing the budget deficit and launched the Northern Powerhouse initiative. He had previously served as Shadow Chancellor in the Shadow Cabinet of David Cameron from 2005 to 2010.

The 1992 United Kingdom budget was delivered by Norman Lamont, the Chancellor of the Exchequer, to the House of Commons on 10 March 1992. It was the second budget to be presented by Lamont. It was also the last before the 1992 general election, which was called the following day, and shaped the Conservative Party's election campaign for that year.

The October 2024 United Kingdom budget was delivered to the House of Commons by Rachel Reeves, the Chancellor of the Exchequer, on 30 October 2024. She is the inaugural female to present a UK Budget, marking the Labour Party's first Budget in over 14 years. It covered Labour's fiscal plans, with a focus on investment, healthcare, education, childcare, sustainable energy, transport, and workers' rights enrichment.