In the United Kingdom, taxation may involve payments to at least three different levels of government: central government, devolved governments and local government. Central government revenues come primarily from income tax, National Insurance contributions, value added tax, corporation tax and fuel duty. Local government revenues come primarily from grants from central government funds, business rates in England, Council Tax and increasingly from fees and charges such as those for on-street parking. In the fiscal year 2014–15, total government revenue was forecast to be £648 billion, or 37.7 per cent of GDP, with net taxes and National Insurance contributions standing at £606 billion.

The United Kingdom government austerity programme is a fiscal policy that was adopted for a period in the early 21st century following the Great Recession. The term was used by the Coalition and Conservative governments in office from 2010 to 2019. The term was applied by many observers to government policy during the 2021–present cost of living crisis, though only the Truss ministry formally referred to its actions in this second period as austerity. The two austerity periods are separated by increased spending during the COVID-19 pandemic. The first period alone was “one of the biggest deficit reduction programmes seen in any advanced economy since World War II”, with the emphasis on shrinking the state rather than fiscal consolidation as was more common elsewhere in Europe.

The 2012 United Kingdom budget was delivered by George Osborne, the Chancellor of the Exchequer, to the House of Commons on Wednesday 21 March 2012.

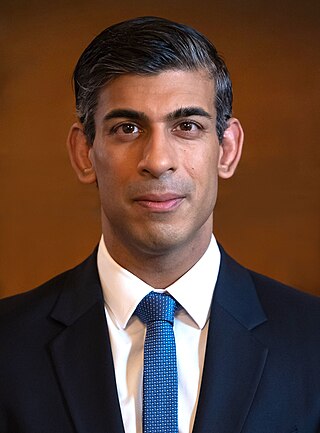

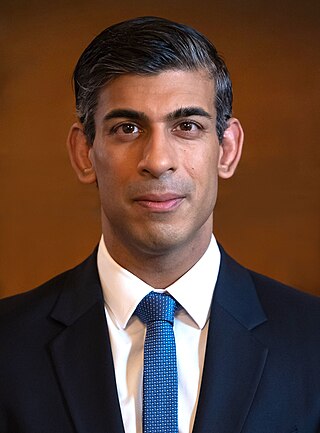

Rishi Sunak is a British politician who has served as Prime Minister of the United Kingdom and Leader of the Conservative Party since 2022. The first British Asian prime minister, he previously held two cabinet positions under Boris Johnson, latterly as Chancellor of the Exchequer from 2020 to 2022. Sunak has been Member of Parliament (MP) for Richmond (Yorks) since 2015.

Boris Johnson's tenure as Prime Minister of the United Kingdom began on 24 July 2019 when he accepted an invitation of Queen Elizabeth II to form a government, succeeding Theresa May, and ended on 6 September 2022 upon his resignation. As prime minister, Johnson served simultaneously as First Lord of the Treasury and Minister for the Civil Service. He also served as Minister for the Union, a position created by him to be held by the prime minister. Johnson's premiership was dominated by Brexit, the COVID-19 pandemic, the Russian invasion of Ukraine, and the cost of living crisis. His tenure was also characterised by several political controversies and scandals, being viewed as the most scandalous premiership of modern times by historians and biographers.

Richard John Holden is a British politician who has been Chairman of the Conservative Party and Minister without Portfolio since November 2023. He has served as Member of Parliament (MP) for North West Durham since the 2019 general election. He is the first Conservative MP in the constituency's history. Holden served as Parliamentary Under Secretary of State for Roads and Local Transport from October 2022 to November 2023.

In response to the COVID-19 pandemic in the United Kingdom, the UK Government introduced various public health and economic measures to mitigate its impact. Devolution meant that the four nations' administrative responses to the pandemic differed; the Scottish Government, the Welsh Government, and the Northern Ireland Executive produced different policies to those that apply in England. Numerous laws were enacted or introduced throughout the crisis.

The Coronavirus Job Retention Scheme (CJRS) was a furlough scheme announced by Rishi Sunak, the Chancellor of the Exchequer, on 20 March 2020, during the COVID-19 pandemic in the United Kingdom. The scheme was announced as providing grants to employers to pay 80% of a staff wage and employment costs each month, up to a total of £2,500 per person per month. The scheme initially ran for three months and was backdated to 1 March.

The July 2020 United Kingdom summer statement was a statement from the British Government, or mini-budget statement, delivered on 8 July 2020 by Rishi Sunak, the Chancellor of the Exchequer. It followed the budget delivered earlier in the year, and preceded the Winter Economy Plan. The purpose of the statement was to announce measures aimed at helping to promote economic recovery following the impact of the COVID-19 pandemic. The statement was delivered to the House of Commons, where Sunak unveiled a spending package worth £30bn. Concerns were subsequently raised by organisations including HM Revenue and Customs and the Institute for Fiscal Studies about the statement's impact, as well as its cost-effectiveness, while at least one major retailer declined to take advantage of a financial bonus scheme intended for rehiring employees placed on furlough during the pandemic.

The Winter Economy Plan was a statement from the British Government, or mini-budget statement, delivered on 24 September 2020 by Rishi Sunak, the Chancellor of the Exchequer. It succeeded the summer statement held earlier in the year, and was a partial replacement to the cancelled budget scheduled for the Autumn. The purpose of the statement was to announce measures aimed at further helping to promote economic recovery following the impact of the COVID-19 pandemic. The statement was delivered to the House of Commons. The plan aimed to further promote economic recovery while preserving jobs and businesses which were considered viable.

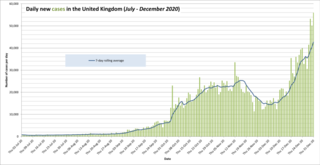

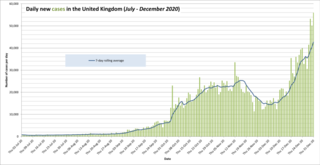

The following is a timeline of the COVID-19 pandemic in the United Kingdom from July 2020 to December 2020.

Capital gains tax in the United Kingdom is a tax levied on capital gains, the profit realised on the sale of a non-inventory asset by an individual or trust in the United Kingdom. The most common capital gains are realised from the sale of shares, bonds, precious metals, real estate, and property, so the tax principally targets business owners, investors and employee share scheme participants.

Rishi Sunak served as Chancellor of the Exchequer of the United Kingdom from his appointment on 13 February 2020 to his resignation on 5 July 2022. His tenure was dominated by the COVID-19 pandemic in the United Kingdom, with Sunak becoming a prominent figure in the government's response to the pandemic, giving economic support to struggling businesses through various schemes. He was also involved in the government's response to the cost of living crisis, UK energy supply crisis, and global energy crisis.

The October 2021 United Kingdom budget, officially known as the Autumn Budget and Spending Review 2021. A Stronger Economy for the British People, was a budget statement made by Chancellor of the Exchequer Rishi Sunak on 27 October 2021. It was the third and final consecutive budget delivered by Sunak before his resignation in July 2022.

Liz Truss's tenure as Prime Minister of the United Kingdom began on 6 September 2022 when she accepted an invitation from Elizabeth II to form a government, succeeding Boris Johnson, and ended 49 days later on 25 October upon her resignation. As prime minister, she served simultaneously as First Lord of the Treasury, Minister for the Civil Service, and Minister for the Union.

On 23 September 2022, the Chancellor of the Exchequer, Kwasi Kwarteng, delivered a Ministerial Statement entitled "The Growth Plan" to the House of Commons. Widely referred to in the media as a mini-budget, it contained a set of economic policies and tax cuts such as bringing forward the planned cut in the basic rate of income tax from 20% to 19%; abolishing the highest (45%) rate of income tax in England, Wales and Northern Ireland; reversing a plan announced in March 2021 to increase corporation tax from 19% to 25% from April 2023; reversing the April 2022 increase in National Insurance; and cancelling the proposed Health and Social Care Levy. Following widespread negative response to the mini-budget, the planned abolition of the 45% tax rate was reversed 10 days later, while plans to cancel the increase in corporation tax were reversed 21 days later.

The November 2022 United Kingdom autumn statement was delivered to the House of Commons on 17 November 2022 by Chancellor of the Exchequer Jeremy Hunt, after being delayed by three weeks from its original scheduled date of 31 October. The budget addressed the ongoing cost of living crisis, and saw the announcement of a five-year package of tax increases and spending cuts designed to steer the UK through recession. An economic forecast published on the same day by the Office for Budget Responsibility (OBR) stated the UK had entered a recession after experiencing two quarters of a shrinking economy, and predicted the UK's economy would shrink during 2023. A reduction in households' disposable income was also forecast.

The 2023 United Kingdom budget was delivered to the House of Commons on 15 March 2023 by Chancellor of the Exchequer Jeremy Hunt. It was the first full budget statement to be presented by Hunt since his appointment as chancellor. The date of the budget was confirmed by Hunt on 19 December 2022. At the same time he confirmed the budget would be accompanied by a full budget report from the Office for Budget Responsibility. The statement was presented as a budget for growth, with the objective of bringing about the conditions for long-term sustainable economic growth within the UK.

The November 2023 United Kingdom autumn statement was outlined to the House of Commons on 22 November 2023 by Chancellor of the Exchequer Jeremy Hunt. The statement, Hunt's second as Chancellor, came at a time when the governing Conservative Party was trailing in the opinion polls, with the Labour Party experiencing a double-digit lead, and was expected to be his last autumn statement before the next general election.