Nadhim Zahawi is an Iraqi-born British politician who served in various ministerial positions under prime ministers Theresa May, Boris Johnson, Liz Truss, and Rishi Sunak from 2018 to 2023. He most recently served as Chairman of the Conservative Party and Minister without Portfolio from 25 October 2022 until he was dismissed by Sunak on 29 January 2023. A member of the Conservative Party, he was Member of Parliament (MP) for Stratford-on-Avon from 2010 to 2024.

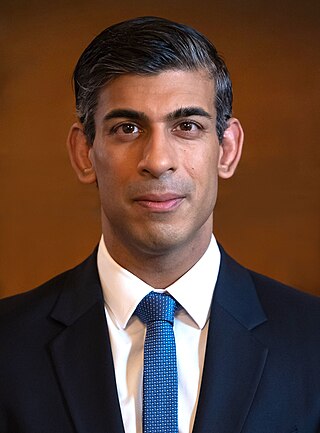

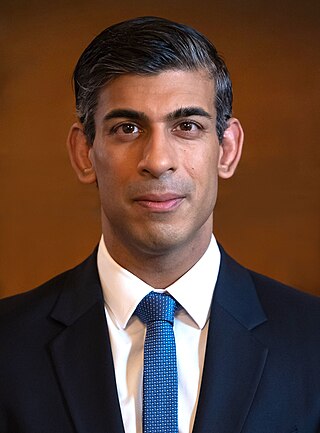

Rishi Sunak is a British politician who served as Prime Minister of the United Kingdom from 2022 to 2024. He has been Leader of the Conservative Party since October 2022; after the general election in July 2024, he became Leader of the Opposition. The first British Asian to hold those offices, he previously held two Cabinet positions under Boris Johnson, latterly as Chancellor of the Exchequer from 2020 to 2022. Sunak has been Member of Parliament (MP) for Richmond and Northallerton, previously Richmond (Yorks), since 2015. He is the most recent Conservative Party prime minister.

Boris Johnson's tenure as prime minister of the United Kingdom began on 24 July 2019 when he accepted an invitation of Queen Elizabeth II to form a government, succeeding Theresa May, and ended on 6 September 2022 upon his resignation. Johnson's premiership was dominated by Brexit, the COVID-19 pandemic, the Russian invasion of Ukraine, and the cost of living crisis. As prime minister, Johnson also served simultaneously as First Lord of the Treasury, Minister for the Civil Service, Minister for the Union and Leader of the Conservative Party.

2020s political history refers to significant political and societal historical events in the United Kingdom in the 2020s, presented as a historical overview in narrative format.

The March 2021 United Kingdom budget, officially known as Protecting the Jobs and Livelihoods of the British People was a budget delivered by Rishi Sunak, the Chancellor of the Exchequer in March 2021. It was expected to be delivered in autumn 2020, but was postponed because of the COVID-19 pandemic. It succeeds the budget held in March 2020, and the summer statement and Winter Economy Plan held in summer and autumn 2020, respectively. The budget is the second under Boris Johnson's government, also the second to be delivered by Sunak and the second since Britain's withdrawal from the European Union. The budget was the first for government expenditure in the United Kingdom to exceed £1 trillion.

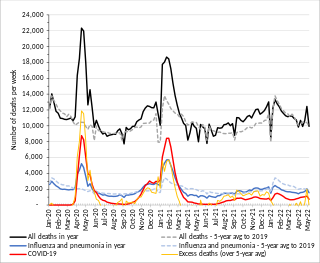

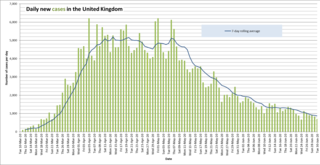

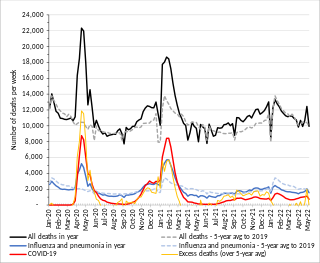

The COVID-19 pandemic was first confirmed to have spread to England with two cases among Chinese nationals staying in a hotel in York on 31 January 2020. The two main public bodies responsible for health in England were NHS England and Public Health England (PHE).

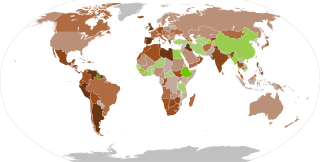

In response to the COVID-19 pandemic in the United Kingdom, the UK Government introduced various public health and economic measures to mitigate its impact. Devolution meant that the four nations' administrative responses to the pandemic differed; the Scottish Government, the Welsh Government, and the Northern Ireland Executive produced different policies to those that apply in England. Numerous laws were enacted or introduced throughout the crisis.

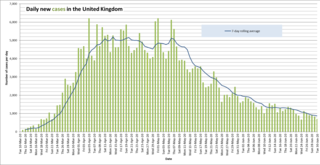

The following is a timeline of the COVID-19 pandemic in the United Kingdom from January 2020 to June 2020.

The economic impact of the global COVID-19 pandemic on the United Kingdom has been largely disruptive. It has adversely affected travel, financial markets, employment, a number of industries, and shipping.

Project Birch is the British government's bailout plan to help save companies that are critical to the British economy during the COVID-19 pandemic. It was announced in May 2020. As of September 2020, only one company has qualified for help.

The July 2020 United Kingdom summer statement was a statement from the British Government, or mini-budget statement, delivered on 8 July 2020 by Rishi Sunak, the Chancellor of the Exchequer. It followed the budget delivered earlier in the year, and preceded the Winter Economy Plan. The purpose of the statement was to announce measures aimed at helping to promote economic recovery following the impact of the COVID-19 pandemic. The statement was delivered to the House of Commons, where Sunak unveiled a spending package worth £30bn. Concerns were subsequently raised by organisations including HM Revenue and Customs and the Institute for Fiscal Studies about the statement's impact, as well as its cost-effectiveness, while at least one major retailer declined to take advantage of a financial bonus scheme intended for rehiring employees placed on furlough during the pandemic.

The Winter Economy Plan was a statement from the British Government, or mini-budget statement, delivered on 24 September 2020 by Rishi Sunak, the Chancellor of the Exchequer. It succeeded the summer statement held earlier in the year, and was a partial replacement to the cancelled budget scheduled for the Autumn. The purpose of the statement was to announce measures aimed at further helping to promote economic recovery following the impact of the COVID-19 pandemic. The statement was delivered to the House of Commons. The plan aimed to further promote economic recovery while preserving jobs and businesses which were considered viable.

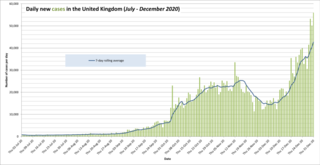

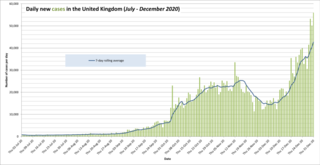

The following is a timeline of the COVID-19 pandemic in the United Kingdom from July 2020 to December 2020.

The Fraud Advisory Panel is a UK charitable organisation. Incorporated in 2001, the Panel focuses on offering advice and education to the general public on how to mitigate and avoid fraud. Panel members have provided evidence to the House of Commons Treasury Select Committee and frequently participate in government consultations and commentary on the television, radio, and newspapers.

The Greensill scandal is a political controversy in the United Kingdom related to lobbying activities on behalf of financial services company Greensill Capital. It implicated former Prime Minister David Cameron, former Cabinet Secretary Jeremy Heywood and several other civil servants, and occurred during the COVID-19 pandemic.

Rishi Sunak served as Chancellor of the Exchequer of the United Kingdom from his appointment on 13 February 2020 to his resignation on 5 July 2022. His tenure was dominated by the COVID-19 pandemic in the United Kingdom, with Sunak becoming a prominent figure in the government's response to the pandemic, giving economic support to struggling businesses through various schemes. He was also involved in the government's response to the cost of living crisis, UK energy supply crisis, and global energy crisis.

Akshata Narayana Murty is an Indian heiress, businesswoman, fashion designer, and venture capitalist. She is the wife of former Prime Minister of the United Kingdom Rishi Sunak and the daughter of N. R. Narayana Murthy, a founder of the Indian multinational IT company Infosys, and Sudha Murty. She holds a 0.93 per cent stake in Infosys, along with shares in several other British businesses.

The October 2022 Conservative Party leadership election was triggered by Liz Truss's announcement that she would resign as Leader of the Conservative Party and Prime Minister of the United Kingdom, amid an economic and political crisis.

Rishi Sunak's tenure as Prime Minister of the United Kingdom began on 25 October 2022 when he accepted an invitation from King Charles III to form a government, succeeding Liz Truss, and ended upon his resignation on 5 July 2024. He is the first British Indian and the first Hindu to hold the office. His premiership was dominated by the Russian invasion of Ukraine, the Israel-Hamas war, the cost-of-living crisis, and the Rwanda asylum plan. As prime minister, Sunak also served simultaneously as First Lord of the Treasury, Minister for the Civil Service, Minister for the Union and Leader of the Conservative Party.