United Bank Limited (UBL) is a Pakistani commercial bank headquartered in Karachi. It is a subsidiary of British multinational conglomerate, Bestway Group.

Saeed Ahmed was a Pakistani Test cricketer who captained the national team, and later became a preacher and member of Tablighi Jamaat.

Habib Bank Limited is a Pakistani commercial bank based at Habib Bank Plaza, Karachi. It is a subsidiary of Swiss-based organisation Aga Khan Fund for Economic Development.

Seylan Bank PLC is a publicly owned Commercial Bank in Sri Lanka. It has branches in both urban and rural areas of Sri Lanka. Seylan bank had 170 banking centres island-wide, 3173 staff members, an ATM network of 182 units covering crucial locations, 11 branches providing 365-day banking in 2020. The bank was formed as a licensed commercial bank incorporated with a shareholder base.

The Association for Social Advancement is a non-governmental organisation based in Bangladesh which provides microcredit financing.

The Pakistani passport is an passport issued by the government of Pakistan to its citizens for international travel purposes. The Directorate General of Immigration & Passports holds the responsibility for passport issuance, under the regulation of the Ministry of Interior.

Bharat Financial Inclusion Limited or BFIL is a banking & finance company (NBFC), licensed by the Reserve Bank of India. It was founded in 1997 by Vikram Akula, who served as its executive chair until working. The company's mission is to providefinancial services to the poor under the premise that providing financial service to poor borrowers helps to alleviate poverty. In 2011, the company operated across 11 Indian states.

Samaa TV is a Pakistani Urdu language news channel owned by a Pakistani politician, Aleem Khan.

Bank Makramah Limited, formerly Summit Bank, is a Pakistani Islamic bank based in Karachi, Pakistan.

Agha Shorish Kashmiri was a Pakistani journalist, scholar, writer, debater, and a leader of the Majlis-e-Ahrar-e-Islam party.

Easypaisa is a Pakistani mobile wallet, mobile payments and branchless banking services provider. It was founded in October 2009 by Telenor Pakistan. It also provides digital payment services through a QR code in partnership with Masterpass and it is the only GSMA mobile money certified service in Pakistan.

Loan-to-deposit ratio, in short LTD ratio or LDR, is a ratio between the banks total loans and total deposits. The ratio is generally expressed in percentage terms

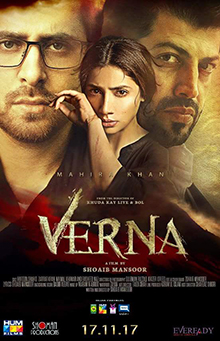

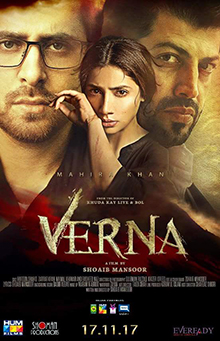

Verna is a 2017 Pakistani drama film written, directed and produced by Shoaib Mansoor under his Shoman Productions. The film stars Mahira Khan and debutants Haroon Shahid, Zarrar Khan and Naimal Khawar.

ESAF Small Finance Bank is an Indian small finance bank headquartered in Thrissur, Kerala, providing banking services and small loans to the underbanked. Having started its operations as an NGO in 1992 under the name of Evangelical Social Action Forum, ESAF Microfinance was a non-banking finance company and microfinance institution (NBFC-MFI), licensed by the Reserve Bank of India (RBI). It became a small finance bank in March 2017 and started operating in January 2018.

Teefa in Trouble is a 2018 Pakistani romantic action comedy film. The film is the directorial debut of Ahsan Rahim, who was previously known for directing music videos and television commercials, under his Tadpole Films banner. It stars Ali Zafar, Abdullah Solangi and Maya Ali, who also made their Pakistani film debuts. It is also the debut film under Zafar's banner Lightingale Productions.

Telenor Microfinance Bank, formerly Tameer Microfinance Bank, is a Pakistani microfinance bank which is based in Karachi, Pakistan. It is jointly owned by Telenor Group and Ant Group, an affiliate company of Alibaba Group.

Baitul Mukarram Mosque is a mosque in Karachi, Pakistan. It is located in Block 8 Gulshan e Iqbal, Karachi. It is near Urdu University and Expo Center Karachi.

Sultan Ali Allana is a prominent Pakistani banker, philanthropist,and business leader he is also chairman of Habib Bank Limited and a director of the Aga Khan Fund for Economic Development. Sultan Ali Allana is the son of Akbar Ali Allana and the grandson of Nathu, one of the 72 Ismailis killed in the Battle of Jhirk when Mir Sher Mohammed attacked the settlement where Aga Khan I was residing. Khalfan, the son of Nathu, later migrated to Karachi around 1850 and established his home in what is today the Kharadar area of Karachi. Akbar Ali Allana married Malak Sultan Bandeali, the daughter of Bandeali Kersam, in 1946.

Afshan Qureshi is a Pakistani actress. She is known for roles in dramas Baba Jani, Barfi Laddu, Malika-e-Aliya and Log Kya Kahenge.

Bhupat Singh was a famous dacoit of India in the late 1940s and early 1950s. He was the man responsible for delay in the 1951–52 Indian general election. He was active in Saurashtra (state). Later, he came to Pakistan, converted to Islam and adopted the name "Amin Yusuf". In 1956, Indian prime minister Jawaharlal Nehru and Pakistani prime minister Mohammad Ali Bogra talked about handing Bhupat back over to India secretly. However, when this was reported in Indian media, Pakistani officials stepped back. He died in 2006. He left behind two sons and two daughters.