The economy of Ecuador is the eighth largest in Latin America and the 69th largest in the world by total GDP. Ecuador's economy is based on the export of oil, bananas, shrimp, gold, other primary agricultural products and money transfers from Ecuadorian emigrants employed abroad. In 2017, remittances constituted 2.7% of country's GDP. The total trade amounted to 42% of the Ecuador's GDP in 2017.

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution funded by 190 member countries, with headquarters in Washington, D.C. It is regarded as the global lender of last resort to national governments, and a leading supporter of exchange-rate stability. Its stated mission is "working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world." Established on December 27, 1945 at the Bretton Woods Conference, primarily according to the ideas of Harry Dexter White and John Maynard Keynes, it started with 29 member countries and the goal of reconstructing the international monetary system after World War II. It now plays a central role in the management of balance of payments difficulties and international financial crises. Through a quota system, countries contribute funds to a pool from which countries can borrow if they experience balance of payments problems. As of 2016, the fund had SDR 477 billion.

The Economy of Qatar is one of the highest in the world based on GDP per capita, ranking generally among the top ten richest countries on world rankings for 2015 and 2016 data compiled by the World Bank, the United Nations, and the International Monetary Fund (IMF). The country's economy has grown despite sanctions by its neighbors, Saudi Arabia and the United Arab Emirates. Mainly because the country exports primarily to Japan, South Korea, India and China, making the sanctions effectively redundant as neither Saudi Arabia nor the United Arab Emirates have imposed trading penalties such as tariffs or embargoes on either of these countries for trading with Qatar, or offering incentives such as discounts for their own energy exports to reduce Qatari exports.

The economy of Yemen has significantly weakened since the breakout of the Yemeni Civil War and the humanitarian crisis, which has caused instability, escalating hostilities, and flooding in the region. At the time of unification, South Yemen and North Yemen had vastly different but equally struggling underdeveloped economic systems. Since unification, the economy has been forced to sustain the consequences of Yemen's support for Iraq during the 1990–91 Persian Gulf War: Saudi Arabia expelled almost 1 million Yemeni workers, and both Saudi Arabia and Kuwait significantly reduced economic aid to Yemen. The 1994 civil war further drained Yemen's economy. As a consequence, Yemen has relied heavily on aid from multilateral agencies to sustain its economy for the past 24 years. In return, it has pledged to implement significant economic reforms. In 1997 the International Monetary Fund (IMF) approved two programs to increase Yemen's credit significantly: the enhanced structural adjustment facility and the extended funding facility (EFF). In the ensuing years, Yemen's government attempted to implement recommended reforms: reducing the civil service payroll, eliminating diesel and other subsidies, lowering defense spending, introducing a general sales tax, and privatizing state-run industries. However, limited progress led the IMF to suspend funding between 1999 and 2001.

The economy of Uganda has a great potential and appears poised for rapid growth and development. Uganda is endowed with significant natural resources, including ample fertile land, regular rainfall, and mineral deposits.

A reserve currency is a foreign currency that is held in significant quantities by central banks or other monetary authorities as part of their foreign exchange reserves. The reserve currency can be used in international transactions, international investments and all aspects of the global economy. It is often considered a hard currency or safe-haven currency.

A country's gross external debt is the liabilities that are owed to nonresidents by residents. The debtors can be governments, corporations or citizens. External debt may be denominated in domestic or foreign currency. It includes amounts owed to private commercial banks, foreign governments, or international financial institutions such as the International Monetary Fund (IMF) and the World Bank.

Money creation, or money issuance, is the process by which the money supply of a country, or of an economic or monetary region, is increased. In most modern economies, money is created by both central banks and commercial banks. Money issued by central banks is termed reserve deposits and is only available for use by central bank accounts holders, which is generally large commercial banks and foreign central banks. Central banks can increase the quantity of reserve deposits directly, by engaging in open market operations or quantitative easing. However, the majority of the money supply used by the public for conducting transactions is created by the commercial banking system in the form of bank deposits. Bank loans issued by commercial banks expands the quantity of bank deposits.

Structural adjustment programs (SAPs) consist of loans provided by the International Monetary Fund (IMF) and the World Bank (WB) to countries that experience economic crises. Their stated purpose is to adjust the country's economic structure, improve international competitiveness, and restore its balance of payments.

Petrodollar recycling is the international spending or investment of a country's revenues from petroleum exports ("petrodollars"). It generally refers to the phenomenon of major petroleum-exporting states, mainly the OPEC members plus Russia and Norway, earning more money from the export of crude oil than they could efficiently invest in their own economies. The resulting global interdependencies and financial flows, from oil producers back to oil consumers, can reach a scale of hundreds of billions of US dollars per year – including a wide range of transactions in a variety of currencies, some pegged to the US dollar and some not. These flows are heavily influenced by government-level decisions regarding international investment and aid, with important consequences for both global finance and petroleum politics. The phenomenon is most pronounced during periods when the price of oil is historically high.

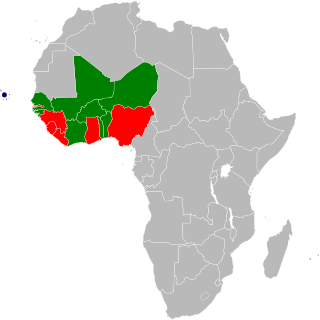

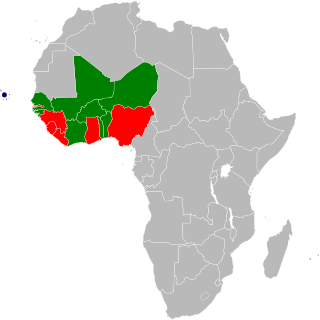

The eco is the name for the proposed common currency of the Economic Community of West African States (ECOWAS). Plans originally called for the West African Monetary Zone (WAMZ) states to introduce the currency first, which would eventually be merged with the Euro pegged CFA franc which is used by the French-speaking West African region within the West African Economic and Monetary Union (UEMOA). This will also enable the UEMOA states to gain complete fiscal and monetary independence from France. The UEMOA states have alternatively proposed to reform the CFA franc into the eco first, which could then be extended to all ECOWAS states.

The Central Bank of Iran (CBI), also known as Bank Markazi, officially the Central Bank of the Islamic Republic of Iran is the central bank of Iran.

The economy of the Middle East is very diverse, with national economies ranging from hydrocarbon-exporting rentiers to centralized socialist economies and free-market economies. The region is best known for oil production and export, which significantly impacts the entire region through the wealth it generates and through labor utilization. In recent years, many of the countries in the region have undertaken efforts to diversify their economies.

The Arab Monetary Fund (AMF) is a regional Arab organization, a working sub-organization of the Arab League. It was founded 1976, and has been operational since 1977.

Vietnam joined the International Monetary Fund (IMF) on September 21, 1956, under the policy of Article VIII. Their quota contributes an estimated SDR of 1,153 millions and voting power of 0.24%. As of August 2016, the current IMF Resident Representative to Vietnam is Jonathan Dunn.

Cambodia officially joined the IMF on December 31, 1969. After years of internal and external strife, the Cambodian government is currently focusing its attention to rebuilding and renovating the national economy through grants and loans from multilateral sources like the International Monetary Fund. Cambodia gained independence in 1953, which was the starting point of industrialization. Cambodia faced a downhill between 1975 till 1979, which damaged all the infrastructure and economy, economical and a tragic event — genocide which killed millions of innocent citizens and especially the loss of human resources, which caused the Cambodian economy to drop to the lowest point. The Cambodian economy started lively in 1993, hugely relying on the foreign market to export agricultural produce, especially rice. In March 1994, the International Committee for the Reconstruction of Cambodia (ICORC) developed a comprehensive plan in effort to support Washington Consensus policy prescriptions. These reforms aimed to shift the economy from a socialist state-controlled economy towards a capitalistic market-controlled one. Since then they've had a total of two arrangements addressing fiscal management. Directors approved a loan for SDR 28.0 million in support of Cambodia's 1995-96 macroeconomic and structural reformations. In 1997 domestic political uncertainty following an alleged coup d’état halted IMF disbursements but resumed again in 1998 after the formation of a new government. Since the 1990s there have been no active IMF loans, but Cambodian and IMF relations continue through Technical Assistant strategies and yearly Article IV reports.

Iran and the International Monetary Fund have been in partnership since 1945. Iran has gone to the IMF on only two occasions, both before the 1979 revolution of Iran.

Iraq was one of the original members of the IMF, joining the IMF on December 27, 1945. Iraq provided $1663.89 million SDR, Special Drawing Rights, to the IMF, which is 0.35% of total SDR paid to the IMF. It also has 18,103 votes, which is 0.36% of the total votes distributed to the member countries of the IMF. The current Board of Governor of Iraq is Ali Muhsin Ismail with an alternative Board of Governor, Khaled Salah Alddin Mohammed Murad. Iraq is the part of the constituency with other countries such as Bahrain, Egypt, Jordan, Kuwait, Lebanon, Maldives, Oman, Qatar, United Arab Emirates, and Republic of Yemen. This constituency has 127,164 votes, 2.53% of total votes in the IMF. Since first joined, Iraq faced 4 official arrangements from the IMF: first arrangement on December 23, 2005, and the latest arrangement on July 7, 2016.