Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. It is a form of risk management, primarily used to protect against the risk of a contingent or uncertain loss.

In English civil litigation, costs are the lawyers' fees and disbursements of the parties.

Life insurance is a contract between an insurance policy holder and an insurer or assurer, where the insurer promises to pay a designated beneficiary a sum of money upon the death of an insured person. Depending on the contract, other events such as terminal illness or critical illness can also trigger payment. The policyholder typically pays a premium, either regularly or as one lump sum. The benefits may include other expenses, such as funeral expenses.

Title insurance is a form of indemnity insurance, predominantly found in the United States and Canada, that insures against financial loss from defects in title to real property and from the invalidity or unenforceability of mortgage loans. Unlike some land registration systems in countries outside the United States, US states' recorders of deeds generally do not guarantee indefeasible title to those recorded titles. Title insurance will defend against a lawsuit attacking the title or reimburse the insured for the actual monetary loss incurred up to the dollar amount of insurance provided by the policy.

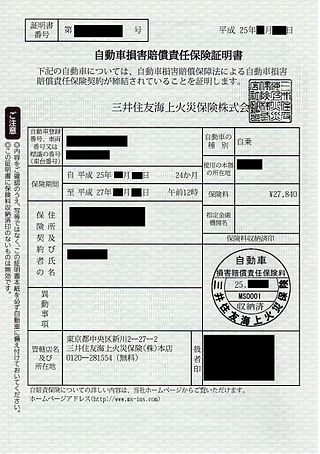

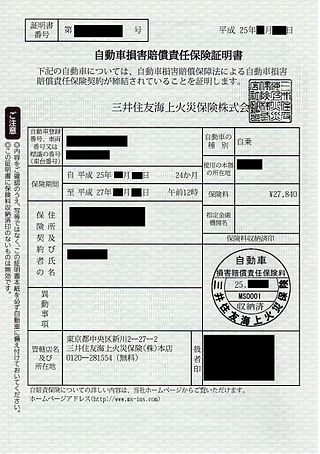

Vehicle insurance is insurance for cars, trucks, motorcycles, and other road vehicles. Its primary use is to provide financial protection against physical damage or bodily injury resulting from traffic collisions and against liability that could also arise from incidents in a vehicle. Vehicle insurance may additionally offer financial protection against theft of the vehicle, and against damage to the vehicle sustained from events other than traffic collisions, such as keying, weather or natural disasters, and damage sustained by colliding with stationary objects. The specific terms of vehicle insurance vary with legal regulations in each region.

In an insurance policy, the deductible is the amount paid out of pocket by the policy holder before an insurance provider will pay any expenses. In general usage, the term deductible may be used to describe one of several types of clauses that are used by insurance companies as a threshold for policy payments.

Home insurance, also commonly called homeowner's insurance, is a type of property insurance that covers a private residence. It is an insurance policy that combines various personal insurance protections, which can include losses occurring to one's home, its contents, loss of use, or loss of other personal possessions of the homeowner, as well as liability insurance for accidents that may happen at the home or at the hands of the homeowner within the policy territory.

Crop insurance is insurance purchased by agricultural producers and subsidized by a country's government to protect against either the loss of their crops due to natural disasters, such as hail, drought, and floods ("crop-yield insurance", or the loss of revenue due to declines in the prices of agricultural commodities.

Universal life insurance is a type of cash value life insurance, sold primarily in the United States. Under the terms of the policy, the excess of premium payments above the current cost of insurance is credited to the cash value of the policy, which is credited each month with interest. The policy is debited each month by a cost of insurance (COI) charge as well as any other policy charges and fees drawn from the cash value, even if no premium payment is made that month. Interest credited to the account is determined by the insurer but has a contractual minimum rate. When an earnings rate is pegged to a financial index such as a stock, bond or other interest rate index, the policy is an "Indexed universal life" contract. Such policies offer the advantage of guaranteed level premiums throughout the insured's lifetime at a substantially lower premium cost than an equivalent whole life policy at first. The cost of insurance always increases, as is found on the cost index table. That not only allows for easy comparison of costs between carriers but also works well in irrevocable life insurance trusts (ILITs) since cash is of no consequence.

In its broadest sense, no-fault insurance is any type of insurance contract under which the insured party is indemnified by their own insurance company for losses, regardless of the source of the cause of loss. In this sense, it is similar to first-party coverage. The term "no-fault" is most commonly used in the United States, Australia, and Canada when referring to state or provincial automobile insurance laws where a policyholder and their passengers are reimbursed by the policyholder's own insurance company without proof of fault, and are restricted in their right to seek recovery through the civil-justice system for losses caused by other parties. No-fault insurance has the goal of lowering premium costs by avoiding expensive litigation over the causes of the collision, while providing quick payments for injuries or loss of property.

Liability insurance is a part of the general insurance system of risk financing to protect the purchaser from the risks of liabilities imposed by lawsuits and similar claims and protects the insured if the purchaser is sued for claims that come within the coverage of the insurance policy.

The Embedded Value (EV) of a life insurance company is the present value of future profits plus adjusted net asset value. It is a construct from the field of actuarial science which allows insurance companies to be valued.

Critical illness insurance, otherwise known as critical illness cover or a dread disease policy, is an insurance product in which the insurer is contracted to typically make a lump sum cash payment if the policyholder is diagnosed with one of the specific illnesses on a predetermined list as part of an insurance policy.

Mortgage life insurance is a form of insurance specifically designed to protect a repayment mortgage. If the policyholder were to die while the mortgage life insurance was in force, the policy would pay out a capital sum that will be just sufficient to repay the outstanding mortgage.

Insurance bad faith is a tort unique to the law of the United States that an insurance company commits by violating the "implied covenant of good faith and fair dealing" which automatically exists by operation of law in every insurance contract.

Australia's insurance market can be divided into roughly three components: life insurance, general insurance and health insurance. These markets are fairly distinct, with most larger insurers focusing on only one type, although in recent times several of these companies have broadened their scope into more general financial services, and have faced competition from banks and subsidiaries of foreign financial conglomerates. With services such as disability insurance, income protection and even funeral insurance, these insurance giants are stepping in to fill the gap where people may have otherwise been in need of a personal or signature loan from their financial institution.

Professional liability insurance (PLI), also called professional indemnity insurance (PII) but more commonly known as errors & omissions (E&O) in the US, is a form of liability insurance which helps protect professional advising, consulting, and service-providing individuals and companies from bearing the full cost of defending against a negligence claim made by a client in a civil lawsuit. The coverage focuses on alleged failure to perform on the part of, financial loss caused by, and error or omission in the service or product sold by the policyholder. These are causes for legal action that would not be covered by a more general liability insurance policy which addresses more direct forms of harm. Professional liability insurance may take on different forms and names depending on the profession, especially medical and legal, and is sometimes required under contract by other businesses that are the beneficiaries of the advice or service.

Captive insurance is an alternative to self-insurance in which a parent group or groups create a licensed insurance company to provide coverage for itself. The main purpose of doing so is to avoid using traditional commercial insurance companies, which have volatile pricing and may not meet the specific needs of the company. By creating their own insurance company, the parent company can reduce their costs, insure difficult risks, have direct access to reinsurance markets, and increase cash flow. When a company creates a captive they are indirectly able to evaluate the risks of subsidiaries, write policies, set premiums and ultimately either return unused funds in the form of profits, or invest them for future claim payouts. Captive insurance companies sometimes insure the risks of the group's customers. This is an alternative form of risk management that is becoming a more practical and popular means through which companies can protect themselves financially while having more control over how they are insured.

A with-profits policy (Commonwealth) or participating policy (U.S.) is an insurance contract that participates in the profits of a life insurance company. The company is often a mutual life insurance company, or had been one when it began its with-profits product line. Similar arrangements are found in other countries such as those in continental Europe.

Cyber-insurance is a specialty insurance product intended to protect businesses from Internet-based risks, and more generally from risks relating to information technology infrastructure and activities. Risks of this nature are typically excluded from traditional commercial general liability policies or at least are not specifically defined in traditional insurance products. Coverage provided by cyber-insurance policies may include first and third parties coverage against losses such as data destruction, extortion, theft, hacking, and denial of service attacks; liability coverage indemnifying companies for losses to others caused, for example, by errors and omissions, failure to safeguard data, or defamation; and other benefits including regular security-audit, post-incident public relations and investigative expenses, and criminal reward funds.