Related Research Articles

In economics, a recession is a business cycle contraction when there is a general decline in economic activity. Recessions generally occur when there is a widespread drop in spending. This may be triggered by various events, such as a financial crisis, an external trade shock, an adverse supply shock, the bursting of an economic bubble, or a large-scale anthropogenic or natural disaster. In the United States, it is defined as "a significant decline in economic activity spread across the market, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales". In the United Kingdom, it is defined as a negative economic growth for two consecutive quarters.

The United States is a developed country with a market economy and has the world's largest nominal GDP and net wealth. It has the second-largest by purchasing power parity (PPP) behind China. It had the world's ninth-highest per capita GDP (nominal) and the fifteenth-highest per capita GDP (PPP) in 2021. The United States has the most technologically powerful and innovative economy in the world. Its firms are at or near the forefront in technological advances, especially in artificial intelligence, computers, pharmaceuticals, and medical, aerospace, and military equipment. The U.S. dollar is the currency most used in international transactions and is the world's foremost reserve currency, backed by its economy, its military, the petrodollar system and its linked eurodollar and large U.S. treasuries market. Several countries use it as their official currency and in others it is the de facto currency. The largest U.S. trading partners are China, the European Union, Canada, Mexico, India, Japan, South Korea, the United Kingdom, and Taiwan. The U.S. is the world's largest importer and the second-largest exporter. It has free trade agreements with several countries, including the USMCA, Australia, South Korea, Switzerland, Israel and several others that are in effect or under negotiation.

The Bureau of Labor Statistics (BLS) is a unit of the United States Department of Labor. It is the principal fact-finding agency for the U.S. government in the broad field of labor economics and statistics and serves as a principal agency of the U.S. Federal Statistical System. The BLS is a governmental statistical agency that collects, processes, analyzes, and disseminates essential statistical data to the American public, the U.S. Congress, other Federal agencies, State and local governments, business, and labor representatives. The BLS also serves as a statistical resource to the United States Department of Labor, and conducts research into how much families need to earn to be able to enjoy a decent standard of living.

An economic indicator is a statistic about an economic activity. Economic indicators allow analysis of economic performance and predictions of future performance. One application of economic indicators is the study of business cycles. Economic indicators include various indices, earnings reports, and economic summaries: for example, the unemployment rate, quits rate, housing starts, consumer price index, Inverted yield curve, consumer leverage ratio, industrial production, bankruptcies, gross domestic product, broadband internet penetration, retail sales, price index, and money supply changes.

Business cycles are intervals of expansion followed by recession in economic activity. They have implications for the welfare of the broad population as well as for private institutions. Typically business cycles are measured by applying a band pass filter to a broad economic indicator such as Real Gross Domestic Production. Here important problems may arise with a commonly used filter called the "ideal filter". For instance if a series is a purely random process without any cycle, an "ideal" filter, better called a block filter, a spurious cycle is produced as output. Fortunately methods such as those in [Harvey and Trimbur, 2003, Review of Economics and Statistics] have been designed so that the band pass filter may be adapted to the time series at hand.

The Recession of 1958, also known as the Eisenhower Recession, was a sharp worldwide economic downturn in 1958. The effect of the recession spread beyond United States borders to Europe and Canada, causing many businesses to shut down. It was the most significant recession during the post-World War II boom between 1945 and 1970 and caused a sharp economic decline that only lasted eight months. By the time recovery began in May 1958, most lost ground had been regained. As 1958 ended, the economy was heading towards new high levels of employment and production. Overall, the recession was regarded as a moderate one based on the duration and extent of declines in employment, production, and income.

The Conference Board Leading Economic Index is an American economic leading indicator intended to forecast future economic activity. It is calculated by The Conference Board, a non-governmental organization, which determines the value of the index from the values of ten key variables. These variables have historically turned downward before a recession and upward before an expansion. The per cent change year over year of the Leading Economic Index is a lagging indicator of the market directions.

The employment cost index (ECI) is a quarterly economic series detailing the changes in the costs of labor for businesses in the United States economy. The ECI is prepared by the Bureau of Labor Statistics (BLS), in the U.S. Department of Labor.

The U.S. Import and Export Price Indexes measure average changes in prices of goods and services that are imported to or exported from the U.S.. The indexes are produced monthly by the International Price Program (IPP) of the Bureau of Labor Statistics. The Import and Export Price Indexes were published quarterly starting in 1974 and monthly since 1989.

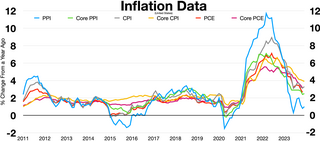

The United States Consumer Price Index (CPI) is a set of consumer price indices calculated by the U.S. Bureau of Labor Statistics (BLS). To be precise, the BLS routinely computes many different CPIs that are used for different purposes. Each is a time series measure of the price of consumer goods and services. The BLS publishes the CPI monthly.

The Great Moderation is a period starting from the mid-1980s until 2007 characterized by the reduction in the volatility of business cycle fluctuations in developed nations compared with the decades before. It is believed to be caused by institutional and structural changes, particularly in central bank policies, in the second half of the twentieth century.

This page lists details of the consumer price index by country

See Business Cycle.

Federal Reserve Economic Data (FRED) is a database maintained by the Research division of the Federal Reserve Bank of St. Louis that has more than 816,000 economic time series from various sources. They cover banking, business/fiscal, consumer price indexes, employment and population, exchange rates, gross domestic product, interest rates, monetary aggregates, producer price indexes, reserves and monetary base, U.S. trade and international transactions, and U.S. financial data. The time series are compiled by the Federal Reserve and many are collected from government agencies such as the U.S. Census and the Bureau of Labor Statistics.

The Economic Cycle Research Institute (ECRI) based in New York City, is an independent institute formed in 1996 by Geoffrey H. Moore, Anirvan Banerji, and Lakshman Achuthan.

Shadowstats.com is a website that analyzes and offers alternatives to government economic statistics for the United States. Shadowstats primarily focuses on inflation, but also keeps track of the money supply, unemployment and GDP by utilizing methodologies abandoned by previous administrations from the Clinton era to the Great Depression.

The International Labor Comparisons Program (ILC) of the U.S. Bureau of Labor Statistics (BLS) adjusts economic statistics to a common conceptual framework in order to make data comparable across countries. Its data can be used to evaluate the economic performance of one country relative to that of other countries and to assess international competitiveness.

The United States entered recession in January 1980 and returned to growth six months later in July 1980. Although recovery took hold, the unemployment rate remained unchanged through the start of a second recession in July 1981. The downturn ended 16 months later, in November 1982. The economy entered a strong recovery and experienced a lengthy expansion through 1990.

The US Commercial Real Estate Index ("CREI") is designed to demonstrate the relative strength of the US Commercial Real Estate market. The index is composed of eight economic drivers and is calculated weekly.

The economy of the Australian Capital Territory (ACT) is the fastest-growing, sixth biggest economy of Australia as of the end of the 2017-18 financial year. Since the introduction of its self-government status in 1989, and with few exceptions in 1992, 1996, and 2014, the ACT economy has exhibited positive growth at a 1991-2018 average of 3.17 percent per year. A vast majority of the economy is concentrated in Canberra, the capital city of Australia, and is composed primarily by service industries, particularly those related to the administration of federal and local government. Construction also contributes to an important part of the economy, boosted by large government-funded projects and an active residential market. In contrast to other Australian states and territories, primary sectors such as agriculture, forestry, and mining, represent a very small proportion of the economy (±1%). A negative balance of trade has characterised the ACT economy since 2012-13, with small goods trade and a growing service export industry comprised mainly by education and public administration services.