In mathematics, the geometric mean is a mean or average which indicates a central tendency of a finite set of real numbers by using the product of their values. The geometric mean is defined as the nth root of the product of n numbers, i.e., for a set of numbers a1, a2, ..., an, the geometric mean is defined as

In mathematics, generalized means are a family of functions for aggregating sets of numbers. These include as special cases the Pythagorean means.

In mathematics, the harmonic mean is one of several kinds of average, and in particular, one of the Pythagorean means. It is sometimes appropriate for situations when the average rate is desired.

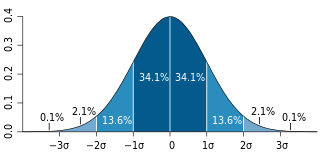

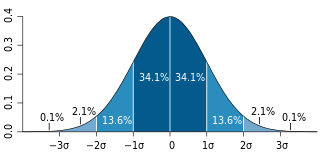

In statistics, the standard deviation is a measure of the amount of variation or dispersion of a set of values. A low standard deviation indicates that the values tend to be close to the mean of the set, while a high standard deviation indicates that the values are spread out over a wider range.

In mathematics, a tensor is an algebraic object that describes a multilinear relationship between sets of algebraic objects related to a vector space. Tensors may map between different objects such as vectors, scalars, and even other tensors. There are many types of tensors, including scalars and vectors, dual vectors, multilinear maps between vector spaces, and even some operations such as the dot product. Tensors are defined independent of any basis, although they are often referred to by their components in a basis related to a particular coordinate system; those components form an array, which can be thought of as a high-dimensional matrix.

In mathematics, the Euler numbers are a sequence En of integers defined by the Taylor series expansion

The time value of money is the widely accepted conjecture that there is greater benefit to receiving a sum of money now rather than an identical sum later. It may be seen as an implication of the later-developed concept of time preference.

In mathematics, in the area of number theory, a Gaussian period is a certain kind of sum of roots of unity. The periods permit explicit calculations in cyclotomic fields connected with Galois theory and with harmonic analysis. They are basic in the classical theory called cyclotomy. Closely related is the Gauss sum, a type of exponential sum which is a linear combination of periods.

A cost-of-living index is a theoretical price index that measures relative cost of living over time or regions. It is an index that measures differences in the price of goods and services, and allows for substitutions with other items as prices vary.

In economics, nominal value refers to value measured in terms of absolute money amounts, whereas real value is considered and measured against the actual goods or services for which it can be exchanged at a given time. For example, if one is offered a salary of $40,000, in that year, the real and nominal values are both $40,000. The following year, any inflation means that although the nominal value remains $40,000, because prices have risen, the salary will buy fewer goods and services, and thus its real value has decreased in accordance with inflation. On the other hand, ownership of an asset that holds its value, such as a diamond may increase in nominal price increase from year to year, but its real value, i.e. its value in relation to other goods and services for which it can be exchanged, or its purchasing power, is consistent over time, because inflation has affected both its nominal value and other goods' nominal value. In spite of changes in the price, it can be sold and an equivalent amount of emeralds can be purchased, because the emerald's prices will have increased with inflation as well.

A price index is a normalized average of price relatives for a given class of goods or services in a given region, during a given interval of time. It is a statistic designed to help to compare how these price relatives, taken as a whole, differ between time periods or geographical locations.

The general price level is a hypothetical measure of overall prices for some set of goods and services, in an economy or monetary union during a given interval, normalized relative to some base set. Typically, the general price level is approximated with a daily price index, normally the Daily CPI. The general price level can change more than once per day during hyperinflation.

A diversity index is a quantitative measure that reflects how many different types there are in a dataset. More sophisticated indices accounting for the phylogenetic relatedness among the types. Diversity indices are statistical representations of different aspects of biodiversity, that are useful simplifications to compare different communities or sites.

In finance, return is a profit on an investment. It comprises any change in value of the investment, and/or cash flows which the investor receives from that investment over a specified time period, such as interest payments, coupons, cash dividends and stock dividends. It may be measured either in absolute terms or as a percentage of the amount invested. The latter is also called the holding period return.

In monetary economics, the equation of exchange is the relation:

The MICEX 10 Index is an unweighted price index that tracks the ten most liquid Russian stocks listed on Moscow Exchange. Composition of the index is assessed quarterly following the liquidity criterion. Components are assigned equal weight.

In economics, the Törnqvist index is a price or quantity index. In practice, Törnqvist index values are calculated for consecutive periods, then these are strung together, or "chained". Thus, the core calculation does not refer to a single base year.

In finance, the weighted-average life (WAL) of an amortizing loan or amortizing bond, also called average life, is the weighted average of the times of the principal repayments: it's the average time until a dollar of principal is repaid.

In physical chemistry, there are numerous quantities associated with chemical compounds and reactions; notably in terms of amounts of substance, activity or concentration of a substance, and the rate of reaction. This article uses SI units.