This article has multiple issues. Please help improve it or discuss these issues on the talk page . (Learn how and when to remove these template messages)

|

In 2020, Lithium has been included in the list for Critical global elements critical metal, [1] and will be one of the drivers of the fourth industrial revolution. Lithium company stocks on the worldwide exchanges have rallied from the end of 2020 and through 2021 with many Lithium Explorers/Developers/Producer miners' share prices' rising 1000% to 6000% within 12 months on the ASX: the Australian Securities Stock Exchange. Stocks are expected to continue to rally as a shortfall deficit of Lithium supply world-wide is expected from beginning of 2022. The Battery-grade Lithium deficit is expected to persist to an incredible 2030, as there are not enough mines coming online to supply the demand in EV Batteries & Energy Storage systems to 2030. This makes Lithium a highly lucrative commodity to invest into, the term entered a "Lithium commodities Super-cycle" has been used by industry commentators during 2021 to describe the event, also the term "A Once in a Century" event is occurring in 2021 and will persist till new Energy technologies come online to replace Lithium Batteries, this is not expected till after 2040 as there are no technologies that will be suitable for the diversity of applications for Lithium Energy storage systems. Lithium carbonate prices have made a resurgence from 2019-2020 all time lows, rising some 500% as of 21/11/2021 trading at US$29,000/tonne, [2] Lithium Carbonate/Lithium Hydroxide is a Lithium chemical compound also known as LCE(Lithium Carbonate Equivalent) and is used as a Precursor in the manufacture of Cathode Cells for electric vehicle (EV) batteries. As a result and along with major Governmental new energy policies in 2020, in preparation to the fazing out of fossil fuels & reductions in carbon emissions vehicles & coal power, has kick-started a flurry of renewed investments & Joint Ventures/acquisitions between Miners & Strategic major investor companies throughout the world. Recently the world saw the COP26: Climate Change Summit for Action in Glasgow during November 2021. The agreements signed by all countries involved, has accelerated the action towards renewables adoption & the reforestation among other items & actions. Lithium will play a key & critical role towards the reduction of Carbon emissions, "1.5ToStayAlive" "1.5toSurvive" slogans for maintaining the critical 1.5 degrees & the storage of renewables clean green energy, harnessed from the sustainable wind, solar & hydropower, also tidal. Also big on the COP26 agenda was the fazing out of coal all-together.

Contents

- Uses of lithium

- Global resources and production

- Democratic Republic of Congo

- Europe

- Australia

- Chile

- Argentina

- Canada

- The Lithium Triangle

- Investment vehicles

- Lithium Index

- Mining companies

- Exchange traded funds

- Direct investment

- See also

- References

- External links

Lithium is an essential mineral that goes into the manufacture of electric batteries (Lithium-ion battery: portable electronics, EV and renewable ESS [3] ). Lithium supply is expected to fall short of the demand for this metal by 2022. [4] Demand/supply discrepancy "the Great divide" ratio has been witnessed in July 2021 when the BMX Spot price Platform went live and the price for Lithium Spodumene Concentrate 6% (SC6) reached a record price of US$1,400/tonne, rising from its lowest of US$395/tonne in September 2020. Today SC6 price(21 November 2021) trades at US$2,550/tonne, Australia's Pilbara Minerals, the company that developed the BMX Spot Sales Platform are commended for this initiative with Ken Brinson, CEO, saying the price for Spodumene Concentrate 6% is now transparent to the market making it a fairer playing field for the Miners and the Chemical Converter Customers.

Governments are adopting the New Energy Lithium Technology rapidly as the pressure to meet the Paris Agreement CO2 Carbon emissions reductions. Major Car Manufacturers are planning on a large line-up of new Electric Vehicles by 2025, in what's called the "EV Revolution". The growing adoption of electric vehicles (EVs) is driving the increasing demand for lithium, significant amounts of lithium supply will need to be brought online to meet this demand growth to 2030 and beyond. The situation is seen as critical as the world depends on Lithium. A new technology in the extraction of Lithium from Geothermal brine, the extraction method is called DLE-Direct Lithium Extraction and if/when the technology succeeds in "scale" it will be celebrated as it will help alleviate the pressure on the tight Lithium supply, the technology is not expected for another 4-5 yrs(2025/26) if not longer. See Start-ups Vulcan Energies(ASX:VUL) & Lilac Solutions(USA) for their efforts in DLE. Pond evaporation extraction Technology is considered old & expected to be obsolete as it conflicts with a world turning towards ESG(Environmental Social & Governance) compliance in mining/extractive practices. Products that reduce carbon emissions, including electric batteries, are globally expected to create a $23 Trillion market over the next decade to 2030.

Lithium is considered a superior lightweight metal element for its electrochemical properties as a charge carrier in the electric battery, currently there is no known replacement element to achieve such effective performance for automotive battery applications. According to Volkswagen, in the near future lithium will be one of the most sought-after raw metals on earth.

Forecasted EV battery demand growth is driving the need to significantly increase battery production globally. Major battery manufacturers have already committed $175Billion by the start of 2021. Even though a significant amount of capital has already been committed, further investment is expected, to satisfy the forecasted growing supply chain demand of batteries to 2030. [5]

There has been a trend already with lithium chemicals compounds producing companies, battery manufacturer companies and even major car manufacturers investing or partnering with raw material suppliers/miners. Large investments are flowing into the lithium supply chain from established majors. Companies with partnerships or joint ventures will be more resilient in the long run. [4] Major car manufacturers' plans to spend over $300 billion are being invested and forecasted over the next 4 (2025) to 10 years (2030) during the adoption of electric vehicles (EV). [6] Automakers’ plans to spend at least $300 billion on EVs are driven largely by environmental concerns and government policy for GHG reduction and supported by rapid technological advances that have improved battery cost, range and charging time. Since 2018, we have seen an accelerated rate of industry spending especially through 2020.

Most importantly, with the global push for sustainable and low carbon footprint mining, processing and manufacturing, where will the lithium that is ESG sustainably sourced with a GHG low-carbon footprint come from. Necessary to feed the burgeoning energy storage needs for the growing transport and military sector; electronic consumer requirements; and in particular the domestic & commercial automotive supply chain where investment spending and forecasts are $US400 to $US500 billion . [7] [8] [9]

Both the drive to decarbonize and the 4IR depend on critical minerals like lithium.

The Fourth Industrial Revolution (4IR or Industry 4.0) has been defined as technological developments in cyber-physical systems such as high capacity connectivity; new human-machine interaction modes such as touch interfaces and virtual reality systems; and improvements in transferring digital instructions to the physical world [10] including robotics and 3D printing (additive manufacturing); the Internet of Things (IoT); “big data” and cloud computing; artificial intelligence-based systems; improvements to and the uptake of Off-Grid / Stand-Alone Renewable Energy Systems: [11] solar, wind, wave, hydroelectric and the Lithium-ion electric batteries (for renewable ESS [3] and EV).

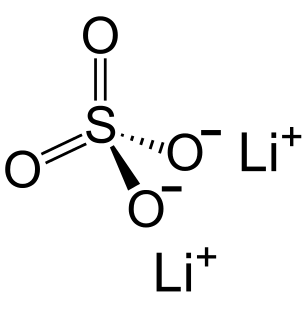

Speculation in lithium compounds used as feedstocks for major applications. The main intermediates are lithium hydroxide and lithium carbonate, and these are the commodities that the LME has chosen as the most appropriate to establish reference pricing. [12] Speculators hope to make a viable play on a perceived growth in demand for lithium metal due to the widespread adoption of lithium batteries in emerging technologies. Lithium batteries have become a preferred power source for energy-hungry devices such as cell phones because they are more efficient and scalable than previous-generation nickel-metal hydride batteries thus they are in high demand in support of automobile and electronics manufacturing.

Factors that could result in limitations affecting overall lithium supply are seen by some as prescient; with predicted supply chain volatility potentially overpowering other market factors and becoming the primary price driver, essentially resulting in a seller's market and thereby making the metal a profitable investment.