Related Research Articles

In economics, a recession is a business cycle contraction when there is a general decline in economic activity. Recessions generally occur when there is a widespread drop in spending. This may be triggered by various events, such as a financial crisis, an external trade shock, an adverse supply shock, the bursting of an economic bubble, or a large-scale natural or anthropogenic disaster. In the United States, it is defined as "a significant decline in economic activity spread across the market, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales". In the United Kingdom, it is defined as a negative economic growth for two consecutive quarters.

The economy of Spain is the world's thirteenth-largest by nominal GDP as well as one of the largest in the world by purchasing power parity. The country is a member of the European Union, the Organization for Economic Co-operation and Development and the World Trade Organization. Spain has a capitalist mixed economy. The Spanish economy is the sixth-largest in Europe behind Germany, United Kingdom, France, Italy and Russia as well as the fourth-largest in the eurozone based on nominal GDP statistics. In 2012, Spain was the twelfth-largest exporter in the world and the sixteenth-largest importer. Spain is listed 25th in the United Nations Human Development Index and 30th in GDP per capita by the World Bank, therefore it is classified as a high income economy and among the countries of very high human development. According to The Economist, Spain has the world's 10th highest quality of life.

In economics, inflation is a sustained increase in the general price level of goods and services in an economy over a period of time. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation reflects a reduction in the purchasing power per unit of money – a loss of real value in the medium of exchange and unit of account within the economy. The opposite of inflation is deflation, a sustained decrease in the general price level of goods and services. The common measure of inflation is the inflation rate, the annualized percentage change in a general price index, usually the consumer price index, over time.

In economics, "rational expectations" are model-consistent expectations, in that agents inside the model are assumed to "know the model" and on average take the model's predictions as valid. Rational expectations ensure internal consistency in models involving uncertainty. To obtain consistency within a model, the predictions of future values of economically relevant variables from the model are assumed to be the same as that of the decision-makers in the model, given their information set, the nature of the random processes involved, and model structure. The rational expectations assumption is used especially in many contemporary macroeconomic models.

An economic indicator is a statistic about an economic activity. Economic indicators allow analysis of economic performance and predictions of future performance. One application of economic indicators is the study of business cycles. Economic indicators include various indices, earnings reports, and economic summaries: for example, the unemployment rate, quits rate, housing starts, consumer price index, consumer leverage ratio, industrial production, bankruptcies, gross domestic product, broadband internet penetration, retail sales, stock market prices, and money supply changes.

The Phillips curve is a single-equation economic model, named after William Phillips, describing an inverse relationship between rates of unemployment and corresponding rates of rises in wages that result within an economy. Stated simply, decreased unemployment, in an economy will correlate with higher rates of wage rises. Phillips did not himself state there was any relationship between employment and inflation; this notion was a trivial deduction from his statistical findings. Samuelson and Solow made the connection explicit and subsequently Milton Friedman and Edmund Phelps put the theoretical structure in place. In so doing, Friedman was to successfully predict the imminent collapse of Phillips' a-theoretic correlation.

Economic forecasting is the process of making predictions about the economy. Forecasts can be carried out at a high level of aggregation—for example for GDP, inflation, unemployment or the fiscal deficit—or at a more disaggregated level, for specific sectors of the economy or even specific firms.

The Federal Reserve Bank of Philadelphia, also known as the Philadelphia Fed and the Philly Fed – headquartered at 10 N. Independence Mall West at Arch Street, Philadelphia, Pennsylvania, with an additional entrance at N. 7th Street – is responsible for the Third District of the Federal Reserve, which covers eastern and central Pennsylvania, the nine southern counties of New Jersey, and Delaware. Its geographical territory is by far the smallest in the system, and its population base is the second-smallest. The current President of the Philadelphia Fed is Patrick T. Harker.

Consumer confidence is an economic indicator that measures the degree of optimism that consumers feel about the overall state of the economy and their personal financial situation. If the consumer has confidence in the immediate and near future economy and his/her personal finance, then the consumer will spend more than save.

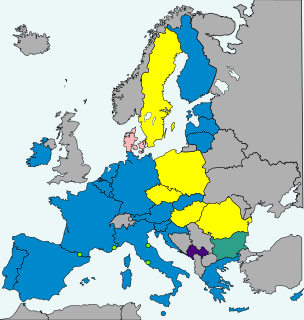

While the Hungarian government has been planning since 2003 to replace the Hungarian forint with the euro, as of 2014, there is no target date and the forint is not part of the European Exchange Rate Mechanism. An economic study in 2008 found that the adoption of the euro would increase foreign investment in Hungary by 30%, although current governor of the Hungarian National Bank (MNB) and former Minister of the National Economy György Matolcsy said they did not want to give up the country's independence regarding corporate tax matters.

The Survey of Professional Forecasters (SPF) is a quarterly survey of macroeconomic forecasts for the economy of the United States issued by the Federal Reserve Bank of Philadelphia. It is the oldest such survey in the United States.

The Great Recession was a period of marked general decline (recession) observed in national economies globally during the late 2000s. The scale and timing of the recession varied from country to country. The International Monetary Fund (IMF) formerly concluded that it was the most severe economic and financial meltdown since the Great Depression, although it was ultimately eclipsed by the Great Lockdown in 2020.

A nominal income target is a monetary policy target. Such targets are adopted by central banks to manage national economic activity. Nominal aggregates are not adjusted for inflation. Nominal income aggregates that can serve as targets include nominal gross domestic product (NGDP) and nominal gross domestic income (GDI). Central banks use a variety of techniques to hit their targets, including conventional tools such as interest rate targeting or open market operations, unconventional tools such as quantitative easing or interest rates on excess reserves and expectations management to hit its target. The concept of NGDP targeting was formally proposed by Neo-Keynesian economists James Meade in 1977 and James Tobin in 1980, although Austrian economist Friedrich Hayek argued in favor of the stabilization of nominal income as a monetary policy norm as early as 1931 and as late as 1975.

Blue Chip Economic Indicators is a monthly survey and associated publication by the Blue Chip Publications division of Aspen Publishers collecting macroeconomic forecasts related to the economy of the United States. The survey polls America's top business economists, collecting their forecasts of U.S. economic growth, inflation, interest rates, and a host of other critical indicators of future business activity. It has a sister publication called Blue Chip Financial Forecasts, which surveys forecasts of the future direction and level of U.S. interest rates.

Economic Outlook is a twice-yearly analysis published by the Organisation for Economic Co-operation and Development (OECD) with economic analysis and forecasts for future economic performance of OECD countries. The main version is in English, and it is also published in French and German. The OECD also publishes Monthly Economic Indicators to complement the twice-yearly Economic Outlook.

The Greenbook of the Federal Reserve Board of Governors is a book with projections of various economic indicators for the economy of the United States produced by the Federal Reserve Board before each meeting of the Federal Open Market Committee. The projections are referred to as Greenbook projections or Greenbook forecasts. Many of the variables projected coincide with variables covered in the Survey of Professional Forecasters.

The Wall Street Journal Economic Survey, also known as the Wall Street Journal Economic Forecasting Survey, could refer to either the monthly or the semi-annual survey conducted by the Wall Street Journal of over 50 economists on important indicators of the economy of the United States.

The Asian Development Outlook is an annual publication produced by the Asian Development Bank (ADB). It offers economic analysis and forecasts, as well as an examination of social development issues, for most countries in Asia. It is published each March/April with an update published in September and brief supplements published in July and December. The publication is prepared by staff of ADB’s regional departments, and field offices, under the coordination of the Economic Research and Regional Cooperation Department with the goal of developing "consistent forecasts for the region".

The economic policy of the Donald Trump administration is characterized by individual and corporate tax cuts, attempts to repeal the Patient Protection and Affordable Care Act ("Obamacare"), trade protectionism, immigration restriction, deregulation focused on the energy and financial sectors, and responses to the 2020 coronavirus pandemic.

Joseph Arnold Livingston was a business journalist and economist known for his long-running syndicated economics column for which he received a Pulitzer Prize and three Gerald Loeb awards. He created the Livingston Survey, a twice-yearly economic forecast survey he personally conducted from 1946 until his death in 1989.

References

- 1 2 "Livingston Survey". Federal Reserve Bank of Philadelphia . Retrieved April 17, 2014.

- 1 2 3 4 5 Waters, Robert L.; Rubin, Daniel (December 26, 1989). "Joseph A. Livingston, columnist, dies at 84". The Philadelphia Inquirer . 320 (360). pp. 1-A, 10-A. Retrieved February 28, 2020– via Newspapers.com.

- 1 2 3 4 5 "Livingston Survey Documentation" (PDF). Federal Reserve Bank of Philadelphia. November 26, 2013. Retrieved April 17, 2014.

- ↑ Croushure, Dean (March–April 1997). "The Livingston Survey: Still Useful After All These Years" (PDF). Federal Reserve Bank of Philadelphia . Retrieved April 17, 2014.

- ↑ "Data Sources and Descriptions" (PDF). Retrieved April 17, 2014.

- ↑ "Academic Bibliography". Federal Reserve Bank of Philadelphia . Retrieved April 17, 2014.

- ↑ Figlewski, Stephen; Wachtel, Paul (February 1981). "The Formation of Inflationary Expectations". The Review of Economics and Statistics . MIT Press. 63 (1): 1–10. doi:10.2307/1924211. JSTOR 1924211.

- ↑ Dietrich, Kimball; Joines, Douglas (August 1983). "Rational Expectations, Informational Efficiency, and Tests Using Survey Data: A Comment". The Review of Economics and Statistics . MIT Press. 65: 525–529. JSTOR 1924203.

- ↑ Kavadas, Ted. "S&P500 Price Projections – Livingston Survey December 2013". EconomicGreenfield.

- ↑ "Livingston Survey: Cut Predictions for Growth Early Next Year". Global Economic Intersection. December 12, 2013. Retrieved April 17, 2014.