Related Research Articles

A monopoly exists when a specific person or enterprise is the only supplier of a particular commodity. This contrasts with a monopsony which relates to a single entity's control of a market to purchase a good or service, and with oligopoly and duopoly which consists of a few sellers dominating a market. Monopolies are thus characterized by a lack of economic competition to produce the good or service, a lack of viable substitute goods, and the possibility of a high monopoly price well above the seller's marginal cost that leads to a high monopoly profit. The verb monopolise or monopolize refers to the process by which a company gains the ability to raise prices or exclude competitors. In economics, a monopoly is a single seller. In law, a monopoly is a business entity that has significant market power, that is, the power to charge overly high prices, which is associated with a decrease in social surplus. Although monopolies may be big businesses, size is not a characteristic of a monopoly. A small business may still have the power to raise prices in a small industry.

In commerce, supply chain management (SCM), the management of the flow of goods and services, involves the movement and storage of raw materials, of work-in-process inventory, and of finished goods as well as end to end order fulfilment from point of origin to point of consumption. Interconnected, interrelated or interlinked networks, channels and node businesses combine in the provision of products and services required by end customers in a supply chain. Supply-chain management has been defined as the "design, planning, execution, control, and monitoring of supply-chain activities with the objective of creating net value, building a competitive infrastructure, leveraging worldwide logistics, synchronizing supply with demand and measuring performance globally". SCM practice draws heavily from the areas of industrial engineering, systems engineering, operations management, logistics, procurement, information technology, and marketing and strives for an integrated approach. Marketing channels play an important role in supply-chain management. Current research in supply-chain management is concerned with topics related to sustainability and risk management, among others. Some suggest that the “people dimension” of SCM, ethical issues, internal integration, transparency/visibility, and human capital/talent management are topics that have, so far, been underrepresented on the research agenda. Supply chain management (SCM) is the broad range of activities required to plan, control and execute a product's flow from materials to production to distribution in the most economical way possible. SCM encompasses the integrated planning and execution of processes required to optimize the flow of materials, information and capital in functions that broadly include demand planning, sourcing, production, inventory management and logistics -- or storage and transportation.

In commerce, a supply chain is a system of organizations, people, activities, information, and resources involved in supplying a product or service to a consumer. Supply chain activities involve the transformation of natural resources, raw materials, and components into a finished product that is delivered to the end customer. In sophisticated supply chain systems, used products may re-enter the supply chain at any point where residual value is recyclable. Supply chains link value chains.

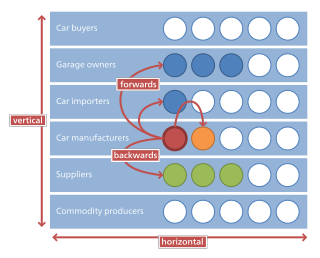

In microeconomics, management, and international political economy, vertical integration refers to an arrangement in which the supply chain of a company is integrated and owned by that company. Usually each member of the supply chain produces a different product or (market-specific) service, and the products combine to satisfy a common need. It is contrasted with horizontal integration, wherein a company produces several items that are related to one another. Vertical integration has also described management styles that bring large portions of the supply chain not only under a common ownership but also into one corporation.

Anti-competitive practices are business or government practices that unlawfully prevent or reduce competition in a market. The debate about the morality of certain business practices termed as being anti-competitive has continued both in the study of the history of economics and in the popular culture. Anti-trust laws differ among state and federal laws to ensure businesses do not engage in competitive practices that harm other, usually smaller, businesses or consumers. These laws are formed to promote healthy competition within a free market by limiting the abuse of monopoly power. Competition allows companies to compete in order for products and services to improve; promote innovation ; and provide a more choices for consumers to preference. Some business practices may be pro-competitive, economic methodological tests and empirical legal cases are used to test whether business activity constitutes as anti-competitive behavior.

In theories of competition in economics, a barrier to entry, or an economic barrier to entry, is a fixed cost that must be incurred by a new entrant, regardless of production or sales activities, into a market that incumbents do not have or have not had to incur. Because barriers to entry protect incumbent firms and restrict competition in a market, they can contribute to distortionary prices and are therefore most important when discussing antitrust policy. Barriers to entry often cause or aid the existence of monopolies and oligopolies, or give companies market power.

In Economics and Law, Exclusive dealing arises when a supplier entails the buyer by placing limitations on the rights of the buyer to choose what, who and where they deal. This is against the law in most countries which include the USA, Australia and Europe when it has a significant impact of substantially lessening the competition in an industry.When the sales outlets are owned by the supplier, exclusive dealing is because of vertical integration, where the outlets are independent exclusive dealing is illegal due to the Restrictive Trade Practices Act, however, if it is registered and approved it is allowed.While primarily those agreements imposed by sellers are concerned with the comprehensive literature on exclusive dealing, some exclusive dealing arrangements are imposed by buyers instead of sellers

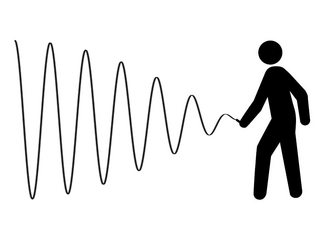

The beer distribution game is a type of gamification that is used to experience typical coordination problems of a supply chain process. It reflects a role-play simulation where several participants play with each other. The game represents a supply chain with a non-coordinated process where problems arise due to lack of information sharing. This game outlines the importance of information sharing, supply chain management and collaboration throughout a supply chain process. Due to lack of information, suppliers, manufacturers, sales people and customers often have an incomplete understanding of what the real demand of an order is. The most interesting part of the game is that each group has no control over another part of the supply chain. Therefore, each group has only significant control over their own part of the supply chain. Each group can highly influence the entire supply chain by ordering too much or too little which can lead to a bullwhip effect. Therefore, the order taking of a group also highly depends on decisions of the other groups.

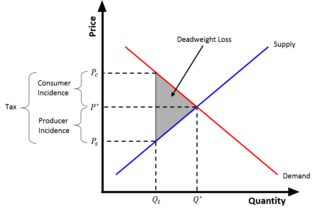

The tax wedge is the deviation from the equilibrium price/quantity as a result of the taxation of a good. Because of the tax, consumers pay more for the good than they did before the tax, and suppliers receive less for the good than they did before the tax. Put differently, the tax wedge is the difference between what consumers pay and what producers receive from a transaction. The tax effectively drives a "wedge" between the price consumers pay and the price producers receive for a product.

Business-to-business is a situation where one business makes a commercial transaction with another. This typically occurs when:

The Competition and Consumer Act 2010 (CCA) is an Act of the Parliament of Australia. Prior to 1 January 2011, it was known as the Trade Practices Act 1974 (TPA). The Act is the legislative vehicle for competition law in Australia, and seeks to promote competition, fair trading as well as providing protection for consumers. It is administered by the Australian Competition and Consumer Commission (ACCC) and also gives some rights for private action. Schedule 2 of the CCA sets out the Australian Consumer Law (ACL). The Federal Court of Australia has the jurisdiction to determine private and public complaints made in regard to contraventions of the Act.

Merger control refers to the procedure of reviewing mergers and acquisitions under antitrust / competition law. Over 130 nations worldwide have adopted a regime providing for merger control. National or supernational competition agencies such as the EU European Commission or the US Federal Trade Commission are normally entrusted with the role of reviewing mergers.

The bullwhip effect is a distribution channel phenomenon in which demand forecasts yield supply chain inefficiencies. It refers to increasing swings in inventory in response to shifts in consumer demand as one moves further up the supply chain. The concept first appeared in Jay Forrester's Industrial Dynamics (1961) and thus it is also known as the Forrester effect. It has been described as “the observed propensity for material orders to be more variable than demand signals and for this variability to increase the further upstream a company is in a supply chain”.

In economics, competition is a scenario where different economic firms are in contention to obtain goods that are limited by varying the elements of the marketing mix: price, product, promotion and place. In classical economic thought, competition causes commercial firms to develop new products, services and technologies, which would give consumers greater selection and better products. The greater the selection of a good is in the market, prices are typically lower for the products, compared to what the price would be if there was no competition (monopoly) or little competition (oligopoly). This is because there is now no rivalry between firms to obtain the product as there is enough for everyone. The level of competition that exists within the market is dependant on a variety of factors both on the firm/ seller side; the number of firms, barriers to entry, information availability, availability/ accessibility of resources. The number of buyers within the market also factors into competition with each buyer having a willingness to pay, influencing overall demand for the product in the market.

ISO 22000 is a standard developed by the International Organization for Standardization dealing with food safety. It is a general derivative of ISO 9000.

Internal Market in Electricity Directive is the Directive 2003/54/EC of the European Parliament and the Council of 26 June 2003 concerning common rules for the internal market in electricity and repealing Directive 96/92/EC is based in the Treaty establishing the European Community, and in particular Article 47(2), Article 55 and Article 95 thereof. Note: The Directive 2003/54/EC has been replaced by the Directive 2009/72/EC.

Third-party logistics in logistics and supply chain management is an organization's use of third-party businesses to outsource elements of its distribution, warehousing, and fulfillment services.

Standard Oil Co. v. United States, 337 U.S. 293 (1949), more commonly referred to as the Standard Stations case, is a 1947 decision of the United States Supreme Court in which requirements contracts for gasoline stations were held to violate section 3 of the Clayton Act. That statute prohibits selling goods on the condition that the customer must not deal in the goods of a competitor of the seller, such as in a requirements contract, if the effect is to "substantially lessen competition" or "tend to create a monopoly." The doctrine of this case has been referred to as "quantitative substantiality," and its exact contours were unsettled and controversial for many years until the Supreme Court authoritatively explained it in United States v. Philadelphia National Bank.

FTC v. Motion Picture Advertising Service Co., 344 U.S. 392 (1953), was a 1953 decision of the United States Supreme Court in which the Court held that, where exclusive output contracts used by one company "and the three other major companies have foreclosed to competitors 75 percent of all available outlets for this business throughout the United States" the practice is "a device which has sewed up a market so tightly for the benefit of a few [that it] falls within the prohibitions of the Sherman Act, and is therefore an 'unfair method of competition' " under § 5 of the FTC Act. In so ruling, the Court extended the analysis under § 3 of the Clayton Act of requirements contracts that it made in the Standard Stations case to output contracts brought under the Sherman or FTC Acts.

Double marginalization is a vertical externality that occurs when two firms with market power, at different vertical levels in the same supply chain, apply a mark-up to their prices. This is caused by the prospect of facing a steep demand curve slope, prompting the firm to mark-up the price beyond its marginal costs. Double marginalization is clearly negative from a welfare point of view, as the double markup induces a deadweight loss, because the retail price is higher than the optimal monopoly price a vertically integrated company would set, leading to underproduction. Thus all social groups are negatively affected because the overall profit for the company is lower, the consumer has to pay more and a smaller amount of units are consumed.

References

- ↑ Christodoulos Stefanadis. Downstream Vertical Foreclosure and Upstream Innovation. Journal of Industrial Economics . December 1997

- ↑ Markus, Reisinger; Tarantino, Emanuele (Fall 2015). "Vertical integration, foreclosure, and productive efficiency". The RAND Journal of Economics.

- ↑ Tasneem Chipty. Vertical Integration, Market Foreclosure, and Consumer Welfare in the Cable Television Industry. American Economic Review , June 2001

- ↑ Stefan Buehler; Zava Aydemir. Estimating Vertical Foreclosure in U.S. Gasoline Supply. University of Zurich, Socieconomic Institute Working Paper No. 0212. December 2002

- ↑ Ali Hortaçsu; Chad Syverson. Cementing Relationships: Vertical Integration, Foreclosure, Productivity, and Prices. Journal of Political Economy. April 2007

- ↑ John Asker. Diagnosing Foreclosure due to Exclusive Dealing. September 2015