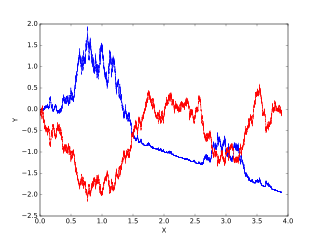

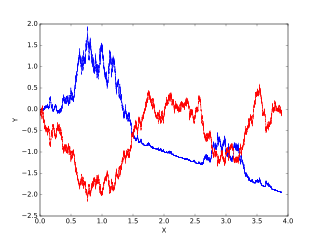

In physics, a Langevin equation is a stochastic differential equation describing how a system evolves when subjected to a combination of deterministic and fluctuating ("random") forces. The dependent variables in a Langevin equation typically are collective (macroscopic) variables changing only slowly in comparison to the other (microscopic) variables of the system. The fast (microscopic) variables are responsible for the stochastic nature of the Langevin equation. One application is to Brownian motion, which models the fluctuating motion of a small particle in a fluid.

In statistical mechanics, the Fokker–Planck equation is a partial differential equation that describes the time evolution of the probability density function of the velocity of a particle under the influence of drag forces and random forces, as in Brownian motion. The equation can be generalized to other observables as well.

In probability theory, the Girsanov theorem tells how stochastic processes change under changes in measure. The theorem is especially important in the theory of financial mathematics as it tells how to convert from the physical measure which describes the probability that an underlying instrument will take a particular value or values to the risk-neutral measure which is a very useful tool for evaluating the value of derivatives on the underlying.

In mathematical finance, a risk-neutral measure is a probability measure such that each share price is exactly equal to the discounted expectation of the share price under this measure. This is heavily used in the pricing of financial derivatives due to the fundamental theorem of asset pricing, which implies that in a complete market, a derivative's price is the discounted expected value of the future payoff under the unique risk-neutral measure. Such a measure exists if and only if the market is arbitrage-free.

Monte Carlo methods are used in corporate finance and mathematical finance to value and analyze (complex) instruments, portfolios and investments by simulating the various sources of uncertainty affecting their value, and then determining the distribution of their value over the range of resultant outcomes. This is usually done by help of stochastic asset models. The advantage of Monte Carlo methods over other techniques increases as the dimensions of the problem increase.

Itô calculus, named after Kiyosi Itô, extends the methods of calculus to stochastic processes such as Brownian motion. It has important applications in mathematical finance and stochastic differential equations.

In mathematics, progressive measurability is a property in the theory of stochastic processes. A progressively measurable process, while defined quite technically, is important because it implies the stopped process is measurable. Being progressively measurable is a strictly stronger property than the notion of being an adapted process. Progressively measurable processes are important in the theory of Itô integrals.

In mathematics, classical Wiener space is the collection of all continuous functions on a given domain, taking values in a metric space. Classical Wiener space is useful in the study of stochastic processes whose sample paths are continuous functions. It is named after the American mathematician Norbert Wiener.

In mathematics, the theory of optimal stopping or early stopping is concerned with the problem of choosing a time to take a particular action, in order to maximise an expected reward or minimise an expected cost. Optimal stopping problems can be found in areas of statistics, economics, and mathematical finance. A key example of an optimal stopping problem is the secretary problem. Optimal stopping problems can often be written in the form of a Bellman equation, and are therefore often solved using dynamic programming.

In probability theory, Novikov's condition is the sufficient condition for a stochastic process which takes the form of the Radon–Nikodym derivative in Girsanov's theorem to be a martingale. If satisfied together with other conditions, Girsanov's theorem may be applied to a Brownian motion stochastic process to change from the original measure to the new measure defined by the Radon–Nikodym derivative.

In probability theory, a real valued stochastic process X is called a semimartingale if it can be decomposed as the sum of a local martingale and a càdlàg adapted finite-variation process. Semimartingales are "good integrators", forming the largest class of processes with respect to which the Itô integral and the Stratonovich integral can be defined.

In probability theory, a random measure is a measure-valued random element. Random measures are for example used in the theory of random processes, where they form many important point processes such as Poisson point processes and Cox processes.

In finance, a volatility swap is a forward contract on the future realised volatility of a given underlying asset. Volatility swaps allow investors to trade the volatility of an asset directly, much as they would trade a price index. Its payoff at expiration is equal to

In mathematical finance, the Black–Scholes equation is a partial differential equation (PDE) governing the price evolution of a European call or European put under the Black–Scholes model. Broadly speaking, the term may refer to a similar PDE that can be derived for a variety of options, or more generally, derivatives.

The trinomial tree is a lattice-based computational model used in financial mathematics to price options. It was developed by Phelim Boyle in 1986. It is an extension of the binomial options pricing model, and is conceptually similar. It can also be shown that the approach is equivalent to the explicit finite difference method for option pricing. For fixed income and interest rate derivatives see Lattice model (finance)#Interest rate derivatives.

The Brownian motion models for financial markets are based on the work of Robert C. Merton and Paul A. Samuelson, as extensions to the one-period market models of Harold Markowitz and William F. Sharpe, and are concerned with defining the concepts of financial assets and markets, portfolios, gains and wealth in terms of continuous-time stochastic processes.

In the theory of stochastic processes in discrete time, a part of the mathematical theory of probability, the Doob decomposition theorem gives a unique decomposition of every adapted and integrable stochastic process as the sum of a martingale and a predictable process starting at zero. The theorem was proved by and is named for Joseph L. Doob.

The Vanna–Volga method is a mathematical tool used in finance. It is a technique for pricing first-generation exotic options in foreign exchange market (FX) derivatives.

In probability, weak dependence of random variables is a generalization of independence that is weaker than the concept of a martingale. A (time) sequence of random variables is weakly dependent if distinct portions of the sequence have a covariance that asymptotically decreases to 0 as the blocks are further separated in time. Weak dependence primarily appears as a technical condition in various probabilistic limit theorems.

In mathematics, stochastic analysis on manifolds or stochastic differential geometry is the study of stochastic analysis over smooth manifolds. It is therefore a synthesis of stochastic analysis and differential geometry.