History

The first merger guidelines set forth by the DOJ were the 1968 Merger Guidelines. [1] The guidelines were developed by former U.S. Assistant Attorney General Dr. Donald Turner, an economist and lawyer with expertise in the field of industrial organization. [2]

These merger guidelines were criticized in some quarters for excess concern with issues of market structure such as barriers to entry and concentration ratios at the expense of efficiency and economies of scale. [3] They were, however, a step forward in two ways: they gave more accurate advice to corporate management as to when and how mergers would be examined and brought new economic ideas into antitrust enforcement, specifically the "structure-conduct-performance" model of industrial organization. [2]

They remained largely unchanged until 1982 when Associate Attorney General Bill Baxter, under the authority of U.S. Attorney General William French Smith, released a new set of guidelines, which made heavier use of modern concepts of microeconomic theory, including using the Herfindahl index to measure market concentration. [4] The newer guidelines took a more favorable view of economies of scale and efficiency of production as rationales for integration. [2] Moreover, they raised the level of market concentration necessary for the government to scrutinize mergers, effectively treating competition as a means to greater efficiency rather than as an independent goal. [5] This approach was controversial: some antitrust lawyers saw it as a loosening of previous restraints on corporate consolidation, and some State Attorneys General responded to Baxter's changes by tightening merger enforcement at the state level. [3]

The guidelines were revised again in 1984. [6] The only portion of the 1984 guidelines that remains in effect is Section Four, which governs the examination of market effects of vertical integration. These guidelines were replaced by the 1992 Merger Guidelines, [7] which fine-tuned previously established tools and policies, such as the SSNIP test and rules governing the acquisition of failing firms. [8] The 1992 Guidelines were revised in 1997, almost concurrently with the FTC's challenge of the Staples-Office Depot merger in federal court.

The 1997 Horizontal Merger Guidelines were replaced on August 19, 2010. [9] These guidelines introduced the concept of "upward pricing pressure" resulting from a merger between competing firms. The 2010 revisions, while deemed by some to be an improvement, [10] attracted criticism from law and economics scholars who contend that they do not update efficiencies analysis, [11] that they may not be recognized by the courts [12] and that they do not embody principles that reflect dynamic competition. [13]

In the United States, antitrust law is a collection of mostly federal laws that govern the conduct and organization of businesses in order to promote economic competition and prevent unjustified monopolies. The three main U.S. antitrust statutes are the Sherman Act of 1890, the Clayton Act of 1914, and the Federal Trade Commission Act of 1914. These acts serve three major functions. First, Section 1 of the Sherman Act prohibits price fixing and the operation of cartels, and prohibits other collusive practices that unreasonably restrain trade. Second, Section 7 of the Clayton Act restricts the mergers and acquisitions of organizations that may substantially lessen competition or tend to create a monopoly. Third, Section 2 of the Sherman Act prohibits monopolization.

Price fixing is an anticompetitive agreement between participants on the same side in a market to buy or sell a product, service, or commodity only at a fixed price, or maintain the market conditions such that the price is maintained at a given level by controlling supply and demand.

The Herfindahl index is a measure of the size of firms in relation to the industry they are in and is an indicator of the amount of competition among them. Named after economists Orris C. Herfindahl and Albert O. Hirschman, it is an economic concept widely applied in competition law, antitrust regulation, and technology management. HHI has continued to be used by antitrust authorities, primarily to evaluate and understand how mergers will affect their associated markets.

The Federal Trade Commission (FTC) is an independent agency of the United States government whose principal mission is the enforcement of civil (non-criminal) antitrust law and the promotion of consumer protection. The FTC shares jurisdiction over federal civil antitrust law enforcement with the Department of Justice Antitrust Division. The agency is headquartered in the Federal Trade Commission Building in Washington, DC.

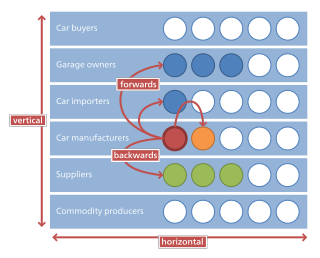

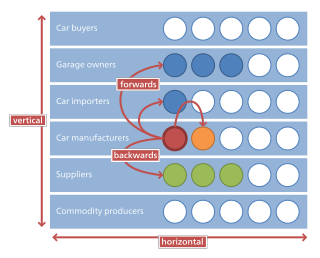

Horizontal integration is the process of a company increasing production of goods or services at the same level of the value chain, in the same industry. A company may do this via internal expansion or through mergers and acquisitions.

Anti-competitive practices are business or government practices that prevent or reduce competition in a market. Antitrust laws ensure businesses do not engage in competitive practices that harm other, usually smaller, businesses or consumers. These laws are formed to promote healthy competition within a free market by limiting the abuse of monopoly power. Competition allows companies to compete in order for products and services to improve; promote innovation; and provide more choices for consumers. In order to obtain greater profits, some large enterprises take advantage of market power to hinder survival of new entrants. Anti-competitive behavior can undermine the efficiency and fairness of the market, leaving consumers with little choice to obtain a reasonable quality of service.

Competition law is the field of law that promotes or seeks to maintain market competition by regulating anti-competitive conduct by companies. Competition law is implemented through public and private enforcement. It is also known as antitrust law, anti-monopoly law, and trade practices law; the act of pushing for antitrust measures or attacking monopolistic companies is commonly known as trust busting.

Merger control refers to the procedure of reviewing mergers and acquisitions under antitrust / competition law. Over 130 nations worldwide have adopted a regime providing for merger control. National or supernational competition agencies such as the EU European Commission, the UK Competition and Markets Authority, or the US Department of Justice or Federal Trade Commission are normally entrusted with the role of reviewing mergers.

In economics, market concentration is a function of the number of firms and their respective shares of the total production in a market. Market concentration is the portion of a given market's market share that is held by a small number of businesses. To ascertain whether an industry is competitive or not, it is employed in antitrust law land economic regulation. When market concentration is high, it indicates that a few firms dominate the market and oligopoly or monopolistic competition is likely to exist. In most cases, high market concentration produces undesirable consequences such as reduced competition and higher prices.

Christine A. Varney is an American antitrust attorney who served as the U.S. assistant attorney general of the Antitrust Division for the Obama administration and as a Federal Trade commissioner in the Clinton administration. Since August 2011, Varney has been a partner of the New York law firm Cravath, Swaine & Moore, where she chairs the antitrust department.

The United States Department of Justice Antitrust Division is a division of the U.S. Department of Justice that enforces U.S. antitrust law. It has exclusive jurisdiction over federal criminal antitrust prosecutions, and it shares jurisdiction over civil antitrust enforcement with the Federal Trade Commission (FTC).

European Union merger law is a part of the law of the European Union. It is charged with regulating mergers between two or more entities in a corporate structure. This institution has jurisdiction over concentrations that might or might not impede competition. Although mergers must comply with policies and regulations set by the commission; certain mergers are exempt if they promote consumer welfare. Mergers that fail to comply with the common market may be blocked. It is part of competition law and is designed to ensure that firms do not acquire such a degree of market power on the free market so as to harm the interests of consumers, the economy and society as a whole. Specifically, the level of control may lead to higher prices, less innovation and production.

In competition law, a relevant market is a market in which a particular product or service is sold. It is the intersection of a relevant product market and a relevant geographic market. The European Commission defines a relevant market and its product and geographic components as follows:

- A relevant product market comprises all those products and/or services which are regarded as interchangeable or substitutable by the consumer by reason of the products' characteristics, their prices and their intended use;

- A relevant geographic market comprises the area in which the firms concerned are involved in the supply of products or services and in which the conditions of competition are sufficiently homogeneous.

Donald Frank Turner was an American lawyer, economist, and legal scholar known for his expertise in United States antitrust law. He was a professor at Harvard Law School from 1954 to 1979 and served as the Assistant Attorney General in charge of the Antitrust Division of the U.S. Department of Justice from 1965 to 1968.

William Joseph Baer is an American lawyer who served as the Assistant Attorney General for the United States Department of Justice Antitrust Division under the administration of President Barack Obama. He is a partner at the American law firm Arnold & Porter, where he works in antitrust law and white collar defense. Since January 2020, Baer has been a visiting fellow in Governance Studies at the Brookings Institution.

United States v. Philadelphia National Bank, 374 U.S. 321 (1963), also called the Philadelphia Bank case, was a 1963 decision of the United States Supreme Court that held Section 7 of the Clayton Act, as amended in 1950, applied to bank mergers. It was the first case in which the Supreme Court considered the application of antitrust laws to the commercial banking industry. In addition to holding the statute applicable to bank mergers, the Court established a presumption that mergers that covered at least 30 percent of the relevant market were presumptively unlawful.

Makan Delrahim is an Iranian-American attorney and lobbyist. From 2017 to 2021, Delrahim served under President Donald Trump as Assistant Attorney General for the Department of Justice Antitrust Division.

The New Brandeis or neo-Brandeis movement is an antitrust academic and political movement in the United States which argues that excessively centralized private power is dangerous for economical, political and social reasons. Initially called hipster antitrust by its detractors, also referred to as the "Columbia school" or "Neo-Progressive antitrust," the movement advocates that United States antitrust law return to a broader concern with private power and its negative effects on market competition, income inequality, consumer rights, unemployment, and wage growth.

Jonathan Seth Kanter is an American lawyer who served as Assistant Attorney General for the Antitrust Division of the U.S. Department of Justice (DOJ) from 2021 to 2024, during the administration of President Joe Biden. Kanter previously worked as an antitrust attorney at the Federal Trade Commission (FTC) and in private practice.

In the context of U.S. competition law, the consumer welfare standard (CWS) or consumer welfare principle (CWP) is a legal doctrine used to determine the applicability of antitrust enforcement.