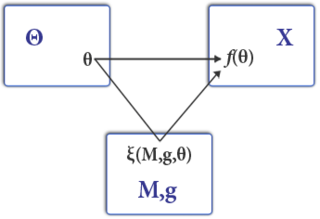

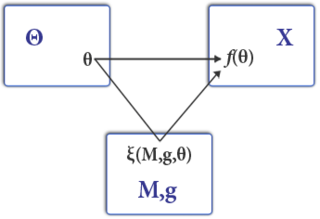

Mechanism design, sometimes called implementation theory or institutionaldesign, is a branch of economics, social choice, and game theory that deals with designing game forms to implement a given social choice function. Because it starts with the end of the game and then works backwards to find a game that implements it, it is sometimes described as reverse game theory.

In mechanism design, a strategyproof (SP) mechanism is a game form in which each player has a weakly-dominant strategy, so that no player can gain by "spying" over the other players to know what they are going to play. When the players have private information, and the strategy space of each player consists of the possible information values, a truthful mechanism is a game in which revealing the true information is a weakly-dominant strategy for each player. An SP mechanism is also called dominant-strategy-incentive-compatible (DSIC), to distinguish it from other kinds of incentive compatibility.

A double auction is a process of buying and selling goods with multiple sellers and multiple buyers. Potential buyers submit their bids and potential sellers submit their ask prices to the market institution, and then the market institution chooses some price p that clears the market: all the sellers who asked less than p sell and all buyers who bid more than p buy at this price p. Buyers and sellers that bid or ask for exactly p are also included. A common example of a double auction is stock exchange.

A mechanism is called incentive-compatible (IC) or truthful if every participant can achieve their own best outcome by acting according to their true preferences. For example, there is incentive compatibility if high-risk clients are better off in identifying themselves as high-risk to insurance firms, who only sell discounted insurance to high-risk clients. Likewise, they would be worse off if they pretend to be low-risk. Low-risk clients who pretend to be high-risk would also be worse off.

The revelation principle is a fundamental result in mechanism design, social choice theory, and game theory which shows it is always possible to design a strategy-resistant implementation of a social decision-making mechanism. It can be seen as a kind of mirror image to Gibbard's theorem. The revelation principle says that if a social choice function can be implemented with some non-honest mechanism—one where players have an incentive to lie—the same function can be implemented by an incentive-compatible (honesty-promoting) mechanism with the same equilibrium outcome (payoffs).

Revenue equivalence is a concept in auction theory that states that given certain conditions, any mechanism that results in the same outcomes also has the same expected revenue.

A Vickrey–Clarke–Groves (VCG) auction is a type of sealed-bid auction of multiple items. Bidders submit bids that report their valuations for the items, without knowing the bids of the other bidders. The auction system assigns the items in a socially optimal manner: it charges each individual the harm they cause to other bidders. It gives bidders an incentive to bid their true valuations, by ensuring that the optimal strategy for each bidder is to bid their true valuations of the items; it can be undermined by bidder collusion and in particular in some circumstances by a single bidder making multiple bids under different names. It is a generalization of a Vickrey auction for multiple items.

Single-peaked preferences are a class of preference relations. A group has single-peaked preferences over a set of outcomes if the outcomes can be ordered along a line such that:

- Each agent has a "best outcome" in the set, and

- For each agent, outcomes that are further from his or her best outcome are preferred less.

In mechanism design, a Vickrey–Clarke–Groves (VCG) mechanism is a generic truthful mechanism for achieving a socially optimal solution. It is a generalization of a Vickrey–Clarke–Groves auction. A VCG auction performs a specific task: dividing items among people. A VCG mechanism is more general: it can be used to select any outcome out of a set of possible outcomes.

In mechanism design, an agent is said to have single-parameter utility if his valuation of the possible outcomes can be represented by a single number. For example, in an auction for a single item, the utilities of all agents are single-parametric, since they can be represented by their monetary evaluation of the item. In contrast, in a combinatorial auction for two or more related items, the utilities are usually not single-parametric, since they are usually represented by their evaluations to all possible bundles of items.

A Bayesian-optimal mechanism (BOM) is a mechanism in which the designer does not know the valuations of the agents for whom the mechanism is designed, but the designer knows that they are random variables and knows the probability distribution of these variables.

Rental harmony is a kind of a fair division problem in which indivisible items and a fixed monetary cost have to be divided simultaneously. The housemates problem and room-assignment-rent-division are alternative names to the same problem.

In mechanism design and auction theory, a profit extraction mechanism is a truthful mechanism whose goal is to win a pre-specified amount of profit, if it is possible.

In economics and mechanism design, a cost-sharing mechanism is a process by which several agents decide on the scope of a public product or service, and how much each agent should pay for it. Cost-sharing is easy when the marginal cost is constant: in this case, each agent who wants the service just pays its marginal cost. Cost-sharing becomes more interesting when the marginal cost is not constant. With increasing marginal costs, the agents impose a negative externality on each other; with decreasing marginal costs, the agents impose a positive externality on each other. The goal of a cost-sharing mechanism is to divide this externality among the agents.

In economics, dichotomous preferences (DP) are preference relations that divide the set of alternatives to two subsets: "Good" versus "Bad".

Random priority (RP), also called Random serial dictatorship (RSD), is a procedure for fair random assignment - dividing indivisible items fairly among people.

The Price of Anarchy (PoA) is a concept in game theory and mechanism design that measures how the social welfare of a system degrades due to selfish behavior of its agents. It has been studied extensively in various contexts, particularly in auctions.

Truthful resource allocation is the problem of allocating resources among agents with different valuations over the resources, such that agents are incentivized to reveal their true valuations over the resources.

Donor coordination is a problem in social choice. There are several donors, each of whom wants to donate some money. Each donor supports a different set of targets. The goal is to distribute the total donated amount among the various targets in a way that respects the donors' preferences.

The median voting rule or median mechanism is a rule for group decision-making along a one-dimensional domain. Each person votes by writing down his/her ideal value, and the rule selects a single value which is the median of all votes.