A security is a tradable financial asset. The term commonly refers to any form of financial instrument, but its legal definition varies by jurisdiction. In some countries and languages people commonly use the term "security" to refer to any form of financial instrument, even though the underlying legal and regulatory regime may not have such a broad definition. In some jurisdictions the term specifically excludes financial instruments other than equity and fixed income instruments. In some jurisdictions it includes some instruments that are close to equities and fixed income, e.g., equity warrants.

The U.S. Securities and Exchange Commission (SEC) is an independent agency of the United States federal government, created in the aftermath of the Wall Street Crash of 1929. The primary purpose of the SEC is to enforce the law against market manipulation.

In financial services, a broker-dealer is a natural person, company or other organization that engages in the business of trading securities for its own account or on behalf of its customers. Broker-dealers are at the heart of the securities and derivatives trading process.

The Securities Exchange Act of 1934 is a law governing the secondary trading of securities in the United States of America. A landmark piece of wide-ranging legislation, the Act of '34 and related statutes form the basis of regulation of the financial markets and their participants in the United States. The 1934 Act also established the Securities and Exchange Commission (SEC), the agency primarily responsible for enforcement of United States federal securities law.

A nationally recognized statistical rating organization (NRSRO) is a credit rating agency (CRA) approved by the U.S. Securities and Exchange Commission (SEC) to provide information that financial firms must rely on for certain regulatory purposes.

The Securities Investor Protection Corporation is a federally mandated, non-profit, member-funded, United States government corporation created under the Securities Investor Protection Act (SIPA) of 1970 that mandates membership of most US-registered broker-dealers. Although created by federal legislation and overseen by the Securities and Exchange Commission, the SIPC is neither a government agency nor a regulator of broker-dealers. The purpose of the SIPC is to expedite the recovery and return of missing customer cash and assets during the liquidation of a failed investment firm.

OTC Markets Group, Inc. is an American financial market providing price and liquidity information for almost 12,400 over-the-counter (OTC) securities. The group has its headquarters in New York City. OTC-traded securities are organized into three markets to inform investors of opportunities and risks: OTCQX, OTCQB and Pink.

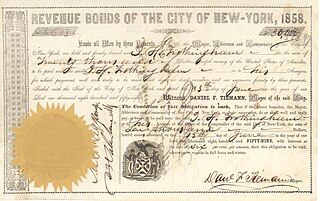

A revenue bond is a special type of municipal bond distinguished by its guarantee of repayment solely from revenues generated by a specified revenue-generating entity associated with the purpose of the bonds, rather than from a tax. Unlike general obligation bonds, only the revenues specified in the legal contract between the bond holder and bond issuer are required to be used for repayment of the principal and interest of the bonds; other revenues and the general credit of the issuing agency are not so encumbered. Because the pledge of security is not as great as that of general obligation bonds, revenue bonds may carry a slightly higher interest rate than G.O. bonds; however, they are usually considered the second-most secure type of municipal bonds.

An investment company is a financial institution principally engaged in holding, managing and investing securities. These companies in the United States are regulated by the U.S. Securities and Exchange Commission and must be registered under the Investment Company Act of 1940. Investment companies invest money on behalf of their clients who, in return, share in the profits and losses.

Securities regulation in the United States is the field of U.S. law that covers transactions and other dealings with securities. The term is usually understood to include both federal and state-level regulation by governmental regulatory agencies, but sometimes may also encompass listing requirements of exchanges like the New York Stock Exchange and rules of self-regulatory organizations like the Financial Industry Regulatory Authority (FINRA).

A financial adviser or financial advisor is a professional who provides financial services to clients based on their financial situation. In many countries, financial advisors must complete specific training and be registered with a regulatory body in order to provide advice.

A self-regulatory organization (SRO) is an organization that exercises some degree of regulatory authority over an industry or profession. The regulatory authority could exist in place of government regulation, or applied in addition to government regulation. The ability of an SRO to exercise regulatory authority does not necessarily derive from a grant of authority from the government.

An auction rate security (ARS) typically refers to a debt instrument with a long-term nominal maturity for which the interest rate is regularly reset through a Dutch auction. Since February 2008, most such auctions have failed, and the auction market has been largely frozen. In late 2008, investment banks that had marketed and distributed auction rate securities agreed to repurchase most of them at par.

A registered investment adviser (RIA) is a firm that is an investment adviser in the United States, registered as such with the Securities and Exchange Commission (SEC) or a state's securities agency. The numerous references to RIAs within the Investment Advisers Act of 1940 popularized the term, which is closely associated with the term investment adviser. An investment adviser is defined by the Securities and Exchange Commission as an individual or a firm that is in the business of giving advice about securities. However, an RIA is the actual firm, while the employees of the firm are called Investment Adviser Representatives (IARs).

The Financial Industry Regulatory Authority (FINRA) is a private American corporation that acts as a self-regulatory organization (SRO) that regulates member brokerage firms and exchange markets. FINRA is the successor to the National Association of Securities Dealers, Inc. (NASD) as well as to the member regulation, enforcement, and arbitration operations of the New York Stock Exchange. The U.S. government agency that acts as the ultimate regulator of the U.S. securities industry, including FINRA, is the U.S. Securities and Exchange Commission (SEC).

The National Market System (NMS) is a regulatory mechanism that governs the operations of securities trading in the United States. Its primary focus is ensuring transparency and full disclosure regarding stock price quotations and trade executions. It was initiated in 1975, when, in the Securities Acts Amendments of 1975, Congress directed the Securities and Exchange Commission (SEC) to use its authority to facilitate the establishment of a national market system. The system has been updated periodically, for example with the Regulation NMS in 2005 which took into account technological innovations and other market changes.

The Electronic Municipal Market Access (EMMA) system, operated by the Municipal Securities Rulemaking Board (MSRB), serves as the official source for municipal securities disclosures and related financial data in the United States. EMMA provides free on-line access to centralized new issue municipal securities disclosure documents, on-going continuing disclosures for all municipal securities, escrow deposit agreements for advance refundings of outstanding bonds, real-time municipal bond trade price information, interest rates and auction results for municipal auction rate securities and interest rate reset information for variable rate demand obligations, together with daily statistics on trading activity and investor education materials.

The Investor Protections and Improvements to the Regulation of Securities is a United States Act of Congress, which forms Title IX, sections 901 to 991 of the much broader and larger Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010. Its main purpose is to revise the powers and structure of the Securities and Exchange Commission, credit rating organizations, and the relationships between customers and broker-dealers or investment advisers. This title calls for various studies and reports from the SEC and Government Accountability Office (GAO). This title contains nine subtitles.

The Securities Acts Amendments of 1975 is a U.S. federal law that amended the Securities Act of 1933 and the Securities Exchange Act of 1934. It was enacted by the 94th United States Congress and signed into law by President Gerald Ford on June 4, 1975. The Securities Acts Amendments imposed an obligation on the Securities and Exchange Commission to consider the impacts that any new regulation would have on competition. The law also empowered the Securities and Exchange Commission (SEC) to establish a national market system and a system for nationwide clearance and settlement of securities transactions, enabling the SEC to enact Regulation NMS, and created the Municipal Securities Rulemaking Board (MSRB), a self-regulatory organization that writes investor protection rules and other rules regulating broker-dealers and banks in the United States municipal securities market.

Securities market participants in the United States include corporations and governments issuing securities, persons and corporations buying and selling a security, the broker-dealers and exchanges which facilitate such trading, banks which safe keep assets, and regulators who monitor the markets' activities. Investors buy and sell through broker-dealers and have their assets retained by either their executing broker-dealer, a custodian bank or a prime broker. These transactions take place in the environment of equity and equity options exchanges, regulated by the U.S. Securities and Exchange Commission (SEC), or derivative exchanges, regulated by the Commodity Futures Trading Commission (CFTC). For transactions involving stocks and bonds, transfer agents assure that the ownership in each transaction is properly assigned to and held on behalf of each investor.