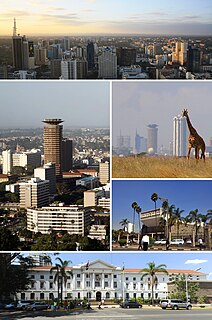

KCB Bank Kenya Limited is a financial services provider headquartered in Nairobi, Kenya. It is licensed as a commercial bank, by the Central Bank of Kenya, the national banking regulator. The bank has also been running Agency banking model.

Spire Bank, formerly known as Equatorial Commercial Bank(ECB), is a commercial bank in Kenya, the largest economy in the East African Community. It is licensed by the Central Bank of Kenya, the central bank and national banking regulator.

Nation Media Group is a Kenyan media group listed on the Nairobi Stock Exchange. NMG was founded by Aga Khan IV in 1959 and is the largest private media house in East and Central Africa with offices in Kenya, Uganda, and Tanzania. In 1999, NMG launched NTV, a news channel in Kenya, and Easy FM.

Diamond Trust Bank Group is a major banking group in East Africa, active in Burundi, Kenya, Tanzania, and Uganda. The flagship company of the group, Diamond Trust Bank Kenya, is licensed by the Central Bank of Kenya, the central bank and national banking regulator in Kenya, the largest economy in the East African Community.

Guaranty Trust Bank (Kenya), commonly referred to as GT Bank Kenya, is a commercial bank in Kenya and part of Nigerian Guaranty Trust Bank. It is licensed by the Central Bank of Kenya, the central bank and national banking regulator.

Commercial Bank of Africa (CBA) is a financial services provider headquartered in Nairobi, Kenya, the largest economy in the East African Community. CBA is licensed by the Central Bank of Kenya, the central bank and national banking regulator.

Commercial Bank of Africa (Tanzania)(CBAT) is a commercial bank in Tanzania. It is licensed by the Bank of Tanzania, the country's central bank and national banking regulator.The bank is a subsidiary of the Commercial Bank of Africa Group and has its headquarters in Nairobi, Kenya.

National Bank of Kenya (NBK), also known as National Bank, is a commercial bank in Kenya, the largest economy in the East African Community. It is licensed by the Central Bank of Kenya, the central bank, and national banking regulator.

Commercial Bank of Africa Group is a financial services provider in East Africa. Its headquarters are located in Nairobi, Kenya, with subsidiaries in Kenya, Rwanda, Tanzania, Uganda and Ivory Coast.

Equity Bank Kenya Limited, is a financial services provider headquartered in Nairobi, Kenya. It is licensed as a commercial bank, by the Central Bank of Kenya, the central bank and national banking regulator.In 2010 the entity introduced Agency banking model which has proved a successand still regulated by Central Bank of Kenya Prudential guidelines.

Imperial Bank Limited (IBKL), commonly known as Imperial Bank, is a commercial bank in Kenya, the largest economy in the East African Community. It is one of the forty-three commercial banks licensed by the Central Bank of Kenya (CBK), the central bank and national banking regulator.

Gulf African Bank (GAB), whose full name is Gulf African Bank Limited, is a commercial bank in Kenya operating under an Islamic banking regime. It is licensed by the Central Bank of Kenya, the central bank and national banking regulator.

Middle East Bank Kenya(MEBK), is a commercial bank in Kenya. It is licensed by the Central Bank of Kenya (CBK), the central bank and national banking regulator.

Standard Chartered Kenya, whose official name is Standard Chartered Bank Kenya Limited, but is sometimes referred to as Stanchart Kenya, is a commercial bank in Kenya. It is a subsidiary of the British multinational financial conglomerate headquartered in London, United Kingdom, known as Standard Chartered. Stanchart Kenya is one of the banks licensed by the Central Bank of Kenya, the central bank and national banking regulator, in the largest economy in the East African Community.

NIC Bank Group, is a financial services organization in East Africa. The Group's headquarters are located in Nairobi, Kenya, with subsidiaries in Kenya, Tanzania, and Uganda.

NC Bank Uganda (NCBU), whose complete name is NC Bank Uganda Limited, is a commercial bank in Uganda. It is one of the commercial banks licensed by the Bank of Uganda, the country's central bank and national banking regulator.

The Commercial Bank of Africa (Uganda)(CBAU) is a commercial bank in Uganda. The bank opened in 2014, following the issuance of a commercial banking license by the Bank of Uganda, the central bank and the national banking regulator. The bank is a member of the Commercial Bank of Africa Group, headquartered in Nairobi, Kenya.

Stanbic Holdings plc, formerly known as CfC Stanbic Holdings Limited, is a financial services organization in Kenya. The Group's headquarters are located in Nairobi, Kenya, with subsidiaries in Kenya and South Sudan. Stanbic Holdings is a member of the Standard Bank Group, a financial services giant based in South Africa. The institution is licensed and governed by the Central Bank of Kenya, the national banking regulator.

Equity Group Holdings Limited (EGHL), formerly Equity Bank Group, is a financial services holding company based in the African Great Lakes region. EGHL's headquarters are in Nairobi, Kenya, with subsidiaries in Kenya, Uganda, Tanzania, South Sudan, Rwanda, and the Democratic Republic of the Congo.