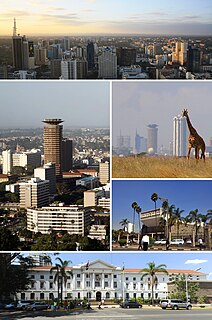

KCB Bank Kenya Limited is a financial services provider headquartered in Nairobi, Kenya. It is licensed as a commercial bank, by the Central Bank of Kenya, the national banking regulator. The bank has also been running Agency banking model.

Spire Bank, formerly known as Equatorial Commercial Bank(ECB), is a commercial bank in Kenya, the largest economy in the East African Community. It is licensed by the Central Bank of Kenya, the central bank and national banking regulator.

Stanbic Bank Uganda Limited (SBU) is a commercial bank in Uganda and is licensed by the Bank of Uganda, the national banking regulator.

KCB Group Limited, also known as the KCB Group, is a financial services holding company based in the African Great Lakes region. The Group's headquarters are in Nairobi, Kenya, with its subsidiaries being KCB Bank Kenya Limited, KCB Bank Burundi Limited, KCB Bank Rwanda Limited, KCB Bank South Sudan Limited, KCB Bank Tanzania Limited, and KCB Bank Uganda Limited.

I&M Holdings Limited, also I&M Bank Group, is a conglomerate comprising financial service providers. The group's headquarters are located in Nairobi, Kenya, with subsidiaries in Kenya, Mauritius, Rwanda and Tanzania. The flagship company of the group is I&M Bank Limited, with headquarters in the I&M Bank Tower on Kenyatta Avenue in the central business district of Nairobi, Kenya's capital and largest city.

NIC Bank, whose full name is NIC Bank Kenya Plc, is a commercial bank in Kenya. It is licensed by the Central Bank of Kenya, the country's central bank and national banking regulator.

Commercial Bank of Africa Group is a financial services provider in East Africa. Its headquarters are located in Nairobi, Kenya, with subsidiaries in Kenya, Rwanda, Tanzania, Uganda and Ivory Coast.

Equity Bank Kenya Limited, is a financial services provider headquartered in Nairobi, Kenya. It is licensed as a commercial bank, by the Central Bank of Kenya, the central bank and national banking regulator.In 2010 the entity introduced Agency banking model which has proved a successand still regulated by Central Bank of Kenya Prudential guidelines.

Standard Chartered Kenya, whose official name is Standard Chartered Bank Kenya Limited, but is sometimes referred to as Stanchart Kenya, is a commercial bank in Kenya. It is a subsidiary of the British multinational financial conglomerate headquartered in London, United Kingdom, known as Standard Chartered. Stanchart Kenya is one of the banks licensed by the Central Bank of Kenya, the central bank and national banking regulator, in the largest economy in the East African Community.

NIC Bank Group, is a financial services organization in East Africa. The Group's headquarters are located in Nairobi, Kenya, with subsidiaries in Kenya, Tanzania, and Uganda.

Britam Holdings Limited, previously known by as British-American Investments Company, is a diversified financial services group and is listed on the Nairobi Securities Exchange. The group offers a wide range of financial products and services in insurance, asset management, property, and banking in the African Great Lakes region.

Stanbic IBTC Holdings, commonly referred to as Stanbic IBTC, is a financial service holding company in Nigeria with subsidiaries in banking, stock brokerage, investment advisory, pension and trustee businesses. Stanbic IBTC Holdings is a member of the Standard Bank Group, a financial services giant based in South Africa. Standard Bank is Africa's largest banking group ranked by assets and earnings operations in 20 African countries and 13 countries outside Africa.

Equity Group Holdings Limited (EGHL), formerly Equity Bank Group, is a financial services holding company based in the African Great Lakes region. EGHL's headquarters are in Nairobi, Kenya, with subsidiaries in Kenya, Uganda, Tanzania, South Sudan, Rwanda, and the Democratic Republic of the Congo.

Jubilee Holdings Limited is a financial services holding company, with its headquarters in Nairobi, Kenya. The company maintains subsidiaries in Kenya, Uganda, Tanzania, Burundi, Mauritius, and Pakistan. Its activities are mainly in the insurance sector.

Philip Odera is an economist, businessman and bank executive in Kenya, the largest economy in the East African Community. He is the current designate managing director and chief executive officer of CfC Stanbic Bank Limited, a Kenyan financial institution, with total assets valued at approximately US$2 billion, as of December 2013. Prior to that, from 2007 until 2014, he served as the CEO and managing director of Stanbic Bank Uganda, the largest commercial bank in Uganda.

The Liberty Life Assurance Kenya Limited, commonly referred to as Liberty Life, is a Kenyan life insurance company headquartered in Nairobi, Kenya. It is among the five largest life insurance companies in Kenya. It is a subsidiary of Liberty Kenya Holdings, which is an insurance holding company with headquarters in Nairobi.