Related Research Articles

The free-market economy of Sri Lanka was worth $84 billion by nominal gross domestic product (GDP) in 2019 and $296.959 billion by purchasing power parity (PPP). The country had experienced an annual growth of 6.4 percent from 2003 to 2012,well above its regional peers. This growth was driven by the growth of non-tradable sectors,which the World Bank warned to be both unsustainable and unequitable. Growth has slowed since then. In 2019 with an income per capita of 13,620 PPP Dollars or 3,852 (2019) nominal US dollars,Sri Lanka was re-classified as a lower middle income nation with the population around 22 million (2021) by the World Bank from a previous upper middle income status.

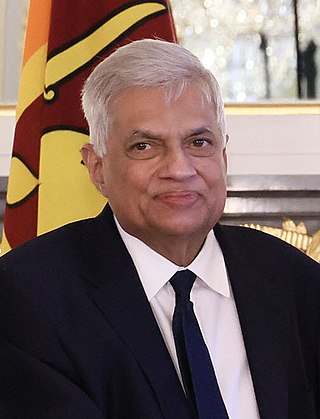

Ranil Wickremesinghe is a Sri Lankan politician who is the 9th and current President of Sri Lanka. He also holds several ministerial positions,including the Minister of Finance,Minister of Defence,Minister of Technology and Minister of Women,Child Affairs and Social Empowerment.

The Central Bank of Sri Lanka is the monetary authority of Sri Lanka. It was established in 1950 under the Monetary Law Act No.58 of 1949 (MLA) and in terms of the Central Bank of Sri Lanka Act No. 16 of 2023,the CBSL is a body corporate with perpetual succession and a common seal. The Central Bank has administrative and financial autonomy. The CBSL has two main boards in operation,namely,

Amal Uthum Herat born in Colombo,Sri Lanka was Deputy Governor of the Central Bank of Sri Lanka and Alternate Executive Director of the International Monetary Fund.

Ajith Nivard Cabraal is a Sri Lankan accountant and politician who was also the 16th Governor of the Central Bank of Sri Lanka. He is also the former State Minister of Finance,Capital Markets and State Enterprise Reforms and a national list member of parliament since 12 August 2020. He served as the Governor of the Central Bank of Sri Lanka,holding the post from 1 July 2006 until his resignation on 9 January 2015. He again became the Governor of Central Bank of Sri Lanka in September 2021,replacing W. D. Lakshman,and resigned again in April 2022.

Harsha de Silva is a Sri Lankan economist and politician. He is a Member of Parliament for the Colombo District and former Non-Cabinet Minister of Economic Reforms and Public Distribution;State Minister of National Policies and Economic Affairs;and Deputy Minister of Foreign Affairs. He is a member of Samagi Jana Balawegaya.

Corruption in Sri Lanka is considered a major problem in all levels of society,from the top echelons of political power to minor staff levels.

Ranee Jayamaha also spelt as Rani Jayamaha is a Sri Lankan economist,author and banker. She served as the chairperson of Hatton National Bank from 2011 to 2015. In addition,she is currently an advisor to the President of Sri Lanka in Banking and a former Deputy Governor of the Central Bank of Sri Lanka (2004–2009). She has also served as a member of the Insurance Board of Sri Lanka and a member of Securities and Exchange Commission.

Punchi Banda Jayasundara is a Sri Lankan economist. He was the former Secretary to the President,Gotabaya Rajapaksa and former Secretary of the Treasury on multiple occasions.

Lakshman Arjuna Mahendran is a Sri Lankan-born Singaporean economist and banker. He is a former Governor of the Central Bank of Sri Lanka (CBSL),having been appointed by President Maithripala Sirisena in January 2015 and served until the end of his term in 30 June 2016. He was the former Managing Director of HSBC Private Bank,Chief Investment Officer of Emirates NBD as well as Chairman and Director-General of the Board of Investment of Sri Lanka. Mahendran is currently residing in Singapore,which has refused to extradite him on a request from Sri Lanka routed through interpol.

The Governor of the Central Bank of Sri Lanka (CBSL) functions as the chief executive of the Sri Lankan central bank. The post is the ex-officio chairperson of the Monetary Board of Central Bank of Sri Lanka. Since its establishment in 1950,the CBSL has been headed by sixteen governors. The governor has two deputies and several assistant governors. The inaugural officeholder was the American John Exter who served the Government of Sri Lanka in helping found the central bank. The position is currently held by Nandalal Weerasinghe who was appointed to the office on 8 April 2022 following the resignation of Ajith Nivard Cabraal.

Deshamanya Weligamage Don Lakshman popularly known as Professor W. D. Lakshman is a Sri Lankan economist,professor,lecturer,academic and author who also served as the 15th Governor of the Central Bank of Sri Lanka and current chairman of the Monetary Board of the CBSL. He is regarded as one of the prominent economists of the country mainly well known for his immense contributions to policy related activities and for being specialised in the field of Economics.

Central Bank of Sri Lanka bond scandal which is also referred as CBSL bond scam was a financial laundering scam which happened on 27 February 2015 and caused losses of more than US$ 11 million to the nation. The bond scam is also regarded as the largest reported financial scam in Sri Lanka despite the country's reputation of having a solid visionary banking system over the years. This was a major blow to the Sri Lankan economy and was also major setback to the newly elected government under the leadership of Maithripala Sirisena which commenced its first term as of 8 January 2015. Arjuna Mahendran was appointed as the Governor of the Central Bank of Sri Lanka replacing Ajith Nivard Cabraal.

Edirisinghe Trust Investments Finance Limited also popularly known as ETI Finance is a Sri Lankan private limited company as well as a non banking financial institution which worked as a licensed finance company accepting deposits from general public. The company's business was primarily based on lending money on gold securities. On 13 July 2020,Central Bank of Sri Lanka decided to cancel the license of the company due to insufficient capital and financial problems regarding repaying depositors' money on demand as well as before maturity.

Mohamed Uvais Mohamed Ali Sabry,PC,MP,also known as Ali Sabry,is a Sri Lankan lawyer and politician. He is the Current Minister of External Affairs serving since 22 July 2022. He previously served as the Minister of Finance until 9 May 2022. He was a Member of Parliament,appointed from the national list of the Sri Lanka Podujana Peramuna. He also served as the Minister of Justice until 9 May 2022. He served as the defense counsel of President Gotabaya Rajapaksa,chief legal adviser and President of the Muslim Federation of the Sri Lanka Podujana Peramuna.

William Tennekoon was a Sri Lankan banker. He was the Governor of the Central Bank of Ceylon.

The Sri Lankan economic crisis is an ongoing crisis in Sri Lanka that started in 2019. It is the country's worst economic crisis since its independence in 1948. It has led to unprecedented levels of inflation,near-depletion of foreign exchange reserves,shortages of medical supplies,and an increase in prices of basic commodities. The crisis is said to have begun due to multiple compounding factors like tax cuts,money creation,a nationwide policy to shift to organic or biological farming,the 2019 Sri Lanka Easter bombings,and the impact of the COVID-19 pandemic in Sri Lanka. The subsequent economic hardships resulted in the 2022 Sri Lankan protests. Sri Lanka received a lifeline in the form of an Indian line of credit amounting to $4 billion. This substantial credit infusion served to cover the costs of importing essential goods and fuel. As a result,the foreign currency reserves of debt-ridden Sri Lanka experienced a notable improvement,reaching $2.69 billion.

The 2022 Sri Lankan protests,commonly known as Aragalaya,were a series of mass protests that began in March 2022 against the government of Sri Lanka. The government was heavily criticized for mismanaging the Sri Lankan economy,which led to a subsequent economic crisis involving severe inflation,daily blackouts,and a shortage of fuel,domestic gas,and other essential goods. The protesters' main demand was the resignation of President Gotabaya Rajapaksa and key officials from the Rajapaksa family. Despite the involvement of several opposition parties,most protesters considered themselves to be apolitical,with many expressing discontent with the parliamentary opposition. Protesters chanted slogans such as "Go Home Gota","Go Home Rajapaksas",and "Aragalayata Jaya Wewa". Most protests were organized by the general public,with youths playing a major part by carrying out protests at Galle Face Green.

Sri Lanka declared the country was suspending payment on most foreign debt from April 12,2022,kindling the Indian Ocean island's first sovereign default event and ending an unblemished record of repaying external debt despite experiencing milder currency crises in the past. By April Sri Lanka was suffering the worst monetary crisis in its history with a steeply falling rupee,high inflation and forex shortages which triggered shortfalls of fuel,power and medicine. Widespread public protests led to a political crisis. In March,the International Monetary Fund released a report saying publicly for the first time that the country's debt was unsustainable and required re-structuring. Authorities had advertised for financial and legal advisors to help negotiate with creditors shortly before the suspension was announced.

Bimputh Finance PLC was a Sri Lankan public limited company and functioned as a licensed finance company. It was a listed company in the Colombo Stock Exchange from 2012 to 2023. In September 2023,the Central Bank of Sri Lanka cancelled the operating license of the company due to the breach of regulatory requirements.

References

- ↑ "Dr. Nandalal Weerasinghe arrives in SL to take up CBSL Governor post - Breaking News | Daily Mirror". www.dailymirror.lk. Retrieved 2022-04-09.

- ↑ "Bloomberg - Nandalal Weerasinghe profile". www.bloomberg.com. Retrieved 2022-04-05.

- ↑ "Sri Lanka central bank to get new governor amid economic crisis". BBC News. 2022-04-05. Retrieved 2022-04-05.

- ↑ "Cabraal resigns; Weerasinghe speculated to take over - Business News | Daily Mirror". www.dailymirror.lk. Retrieved 2022-04-05.

- ↑ "Sri Lanka appoints new central bank head". www.aljazeera.com. Retrieved 2022-04-05.

- ↑ "Dr. P. Nandalal Weerasinghe - Central Bank of Ceylon".

- 1 2 "Central Bank appoints new deputy governors". www.sundaytimes.lk. Retrieved 2022-04-05.

- 1 2 3 4 "Nandalal Weerasinghe | Central Bank of Sri Lanka". www.cbsl.gov.lk. Retrieved 2022-04-05.

- ↑ "Govt. delays permanent appointment of CB Governor | Daily FT". www.ft.lk. Retrieved 2022-04-07.

- ↑ "Modernise or be disrupted | Daily FT". www.ft.lk. Retrieved 2022-04-07.

- ↑ "A glimpse into the future of banking and fintech at Banktech Asia Sri Lanka | Daily FT". www.ft.lk. Retrieved 2022-04-07.

- ↑ "CBSL Deputy Governor addresses President's recent outburst". NewsWire. 2020-06-25. Retrieved 2022-04-07.

- ↑ "Deputy Governors Weerasinghe and Karunaratne retire - Business News | Daily Mirror". www.dailymirror.lk. Retrieved 2022-04-07.

- ↑ "Controversy over CBSL's Dy Govs' pre-retirement leave approval". CeylonToday. Retrieved 2022-04-07.

- ↑ "BoP crisis might lead to banking crisis - Dr Nandalal Weerasinghe". CeylonToday. Retrieved 2022-04-05.

- ↑ "Dr. P. Nandalal Weerasinghe to deliver Olcott Oration 2017 on Saturday | Daily FT". www.ft.lk. Retrieved 2022-04-07.

- ↑ "Dr. Nandalal Weerasinghe, Dhammika Perera to get new posts?". CeylonToday. Retrieved 2022-04-05.

- ↑ "Sri Lanka Economic Crisis highlights: Ex-Sri Lanka cenbanker Weerasinghe says he accepts offer to be new governor". Deccan Herald. 2022-04-04. Retrieved 2022-04-05.

- ↑ "Nandalal Weerasinghe to be come new CBSL Governor". Sri Lanka News - Newsfirst. 2022-04-05. Retrieved 2022-04-05.

- ↑ "Sri Lanka Names Former FX In-Charge as New Central Bank Governor". Bloomberg. 4 April 2022. Retrieved 5 April 2022.

- ↑ "Nandalal's arrival from Aussie awaited for formal appointment as CBSL Chief | Daily FT". www.ft.lk. Retrieved 2022-04-07.