Related Research Articles

The Bank of Scotland plc is a commercial and clearing bank based in Edinburgh, Scotland, and is part of the Lloyds Banking Group. The bank was established by the Parliament of Scotland in 1695 to develop Scotland's trade with other countries, and aimed to create a stable banking system in the United Kingdom. The bank is the ninth oldest bank in continuous operation.

Sir William Forbes, 6th Baronet of Monymusk and Pitsligo, usually known as William Forbes of Pitsligo (1739–1806), was a Scottish banker. He was known also as an improving landlord, philanthropist and writer.

James Fordyce, DD, was a Scottish Presbyterian minister and poet. He is best known for his collection of sermons published in 1766 as Sermons for Young Women, popularly known as Fordyce's Sermons.

The Boston Tea Party was an American political and mercantile protest on December 16, 1773, by the Sons of Liberty in Boston in colonial Massachusetts. The target was the Tea Act of May 10, 1773, which allowed the East India Company to sell tea from China in American colonies without paying taxes apart from those imposed by the Townshend Acts. The Sons of Liberty strongly opposed the taxes in the Townshend Act as a violation of their rights. In response, the Sons of Liberty, some disguised as Native Americans, destroyed an entire shipment of tea sent by the East India Company.

Hope & Co. was a Dutch bank that existed for two and a half centuries. The bank was located in Amsterdam until 1795; originally it concentrated on Great Britain. From 1750 it played a major part in the finances of the Dutch East India Company (VOC) through Thomas Hope and his brother Adrian. During the Seven Years' War (1756–1763) the Hope brothers profited from the Netherlands' neutral position and became very wealthy. The Hopes became heavily involved in the Dutch Caribbean, and Danish West Indies. They specialised in plantation loans, in which the entire produce of the plantation was remitted to the lender, who would supervise its sale in order to secure repayment. In this way, the Hopes helped the plantation economy to become integrated into a global network of financiers and consumers. The Hope family were among the richest in Europe at the time. The family business focused on financing commercial transactions and especially on issuing money loans to monarchs and governments in Denmark, Sweden, Poland, Russia, Portugal, Spain, France and America. The bank was famous for having Catherine the Great as their client and Adrian supplied her several times with diamonds.

Events from the year 1772 in Great Britain.

Sir Charles Asgill, 1st Baronet merchant banker, was the third son of Henry Asgill, silkman, of St Clement Danes, Middlesex and was educated at Westminster School.

The Hutchinson letters affair was an incident that increased tensions between the colonists of the Province of Massachusetts Bay and the British government prior to the American Revolution.

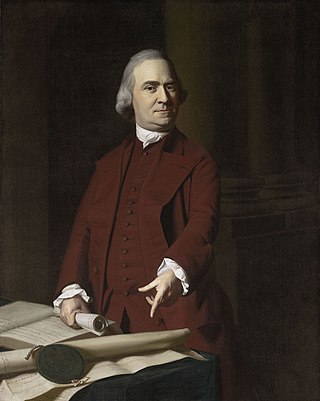

Samuel Adams was an American statesman, political philosopher, and a Founding Father of the United States. He was a politician in colonial Massachusetts, a leader of the movement that became the American Revolution, a signatory of the Declaration of Independence and other founding documents, and one of the architects of the principles of American republicanism that shaped the political culture of the United States. He was a second cousin to his fellow Founding Father, President John Adams. He founded the Sons of Liberty.

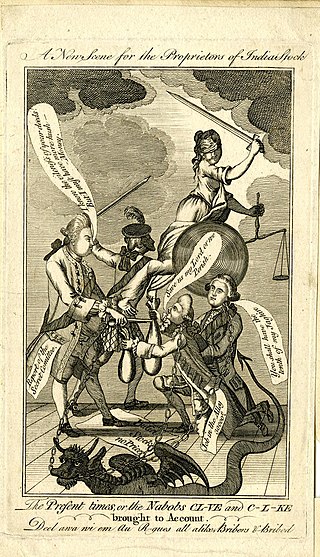

Sir George Colebrooke, 2nd Baronet was an English merchant, banker and politician who sat in the British House of Commons from 1754 to 1774, representing the constituency of Arundel. Born in Chilham, Kent, he was also a stockjobber and nabob with close ties to Robert Clive and Alexander Fordyce who thrice served as the chairman of the East India Company in 1769, 1770 and 1772 respectively. His financial activities, which included the ownership of slave plantations in the West Indies, resulted in Colebrooke coming into the possession of a large fortune; however, he went bankrupt through poor speculations during the British credit crisis of 1772–1773.

Douglas, Heron & Company, also known as the Ayr Bank, was a Scottish bank with its head office at Ayr. It opened in November 1769 and folded in 1772 during the crisis of 1772.

The British credit crisis of 1772–1773, also known as the crisis of 1772, or the panic of 1772, was a peacetime financial crisis which originated in London and then spread to Scotland and the Dutch Republic. It has been described as the first modern banking crisis faced by the Bank of England. New colonies, as Adam Smith observed, had an insatiable demand for capital. Accompanying the more tangible evidence of wealth creation was a rapid expansion of credit and banking, leading to a rash of speculation and dubious financial innovation. In today's language, they bought shares on margin.

Leendert Pieter de Neufville was a Dutch merchant and banker trading in silk, linen, and grain. His business grew quickly during the Seven Years' War. De Neufville secretly supplied the Prussian army with gunpowder. It is likely that the army's outsourcing of handling bills of exchange in commercial payment boosted his business in a sophisticated form of letters of credit, acceptance loans. His business model had similarities with the modern shadow banking system.

Alexander Fordyce was a Scottish banker, centrally involved in the bank run on Neale, James, Fordyce and Down which led to the credit crisis of 1772. He fled abroad and was declared bankrupt, but in time he used the profits from other investments to cover the losses.

The Amsterdam banking crisis of 1763 in the Netherlands followed the end of the Seven Years' War. At this time prices of grain and other commodities were falling sharply, and the supply of credit dried up due to the decreased value of collateral goods. Many of the banks based in Amsterdam were over-leveraged and were interlinked by complex financial instruments, making them vulnerable to a sudden tightening of credit availability.

Events from the year 1836 in Scotland.

Events from the year 1772 in Scotland.

John Cornelius Fordyce (1735–1809) was Member of Parliament for New Romney from 1796 to 1802, and for Berwick-Upon-Tweed from 1802 to 5 April 1803.

References

- "Memoirs" - Sir William Forbes, 6th Baronet, Memoirs of a Banking-House, 1860 (written by (?) 1803), online text, see pp. 39-44 for a detailed account